Surge Components

Hi all, I'm just putting this here for some feedback on the analysis. I didn't end up buying this since management makes me a bit uncomfortable.

Background:

- The company was founded in 1981, listed on the stock market in 1996 and delisted in 2003. The company relisted in 2009

- The company primarily sells capacitors (30%) and discrete components (70%) (e.g. diodes, transistors, rectifiers, etc.) for any electronic circuitry uses

- They purchase most of their products from Taiwan, Hong Kong, and other parts of Asia and distribute to end manufacturers

- The business is effectively a distributor – purchasing from a supplier and shipping it to an end user – not really a high value business in the grand scheme of things

- Surge primarily targets SMB in North America ($35M) and China ($8.3M) with some small operations in Europe ($2.1M) and other Asian countries ($2.6M)

- Surge sells to OEM and through distributors (e.g. Avnet, Digikey, Future Electronics)

- ~1/5 of revenues is sold to distributors – distributors provide access to the small to medium size businesses.

- Large OEMs typically have relationships with individual suppliers and would unlikely use a distributor > seems like even if distributors get involved, OEMS work with their own terms and contracts

Thesis:

- Trades at a $16M market cap with $0 debt and $11M in cash > the returns have been dragged down by an excess of cash earning close to 0%

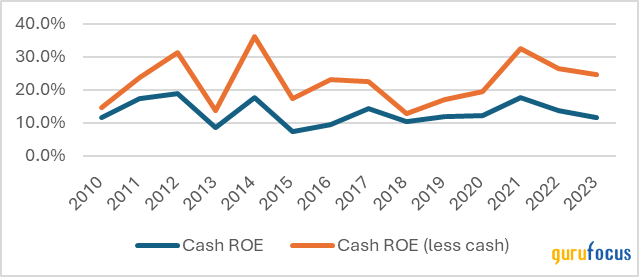

- The company has been able to generate above average cash returns on equity (7.4% to 19% in the past 14 years)

- The business has historically always produced a decent return on equity with minimal balance sheet risk due to all the cash available

- The industry has also suffered a year’s worth of declines given inventory oversupply and a mismatch in demand

Competitors:

- The company operates in the same world as parts manufacturers (e.g. Vishay, OnSemi, Microchip, Diodes, and Littelfuse)

- Although it effectively operates like a distributor (such as Avnet and Arrow), it generates better results as it is able to sell at a much higher margin than comparable distributors

- It is probably among the weakest operators (unsure whether their product, along with Vishay’s, would be a bit more of a commoditized product compared to others - although, I’d categorize all of it as generally commodity-like component products)

- Surge has a significantly higher cost structure than most of its peers

- A large portion of this is due to the exorbitant salaries management takes + the director fees that get paid out

- As well, the company’s gross profits is materially less than the majority of other manufacturers

Operations & industry:

- Capital light business and has been able to grow revenue at 6.5% CAGR for the past 20 years with ~$2.5M of fixed assets > COGS also grew at a similar rate – e.g. most of this was volume growth or at least price growth was matched with increased input costs

- Gross margins are generally stable – the variation is relatively low with annual results ranging from 24.5% to 28.5% in the past 14 years

- Relatively cyclical –dependent on customer inventory levels and demand (returns range from 7.5% to 19% with median of ~12%) – see above

- Inventory availability is incredibly important – need to have SKUs and 1 to 2 months worth of inventory available at all times

- Company generally converts ~80% of net income to free cash flow conversion > driven by needing to build up inventory and some PP&E replacements

- Surge sells under the name Lelon Electronics for a material portion of their business (75% of their capacitor business (which makes up ~30% of the overall business) and 33% of their discrete component business) > the inventory seems to generally have cleared up and the industry seems to have picked back up:

- Similarly, sales at YAGEO, a chip resister manufacturer has also started to show signs of recover through the beginning of 2024

- Most recent commentary: “We know that our distribution partners’ inventories of our products have reduced significantly compared to the previous year’s levels and we are seeing signs of them beginning to order some of those products again. We remain confident that the work we accomplished and sustained in 2023 helped maintain our best-in-class industry lead times despite the challenging industry environment and will continue to keep Surge competitive, and we look forward to launching new products at some point in the second half of 2024. While we do not expect the industry’s headwinds to dissipate in the near-term, the company hopes to start seeing a slow improvement in at least some of our market segments sometime in the second half of 2024. We remain positive on our business’ outlook and the strong operational foundation that we have laid in 2023 as we continued to invest in the company and solidify our relationships with our customers and strategic partners as we look forward to a coming rebound." – Ira Levy

- Normalized earnings: assuming the company returns to $35M to $40M of revenues with net margins of 4% to 5% and an 80% free cash flow conversion, you get returns ranging from 7% to 10%. Given the seeming recovery of the market, you are also more likely to end up on the higher end of the range over the next 2 years (inventory will need to be built back up)

Capital allocation:

- Historically hoarded significant cash – has used the cash to pay down debt, acquire equipment, and inventory

- In 2017, they did a large share buy-back which was driven by 2 activist investors – the 2 investors are no longer a part of the company

- It is highly unlikely that management will distribute the cash it has built up anytime soon > since the last activist, Ira and Steven have built up significant ownership alongside the rest of the BoD. It is near impossible to force the team to payout any excess cash.

Ownership & governance:

- Ira Levy and Steven Lubman own collectively ~41% of the company; when including the remaining board of directors, insiders own ~53% of the company

- Generally, corporate governance is generally negative. Management takes an extraordinary large salary relative to the free cash flow and market cap. It eats away at probably a third to a half of potential net income if operated otherwise

- Ira and Steven both earn an inordinate compensation relative to the size of the company

- Ira Levy: 2022: $300,000 salary + $271,575 bonus + $61,473 other = $633,048

- 2021: $291,827 salary + $240,000 bonus + $60,000 stock awards + $57,283 other = $649,110

- Steven Lubman: 2022: $250,000 salary + $183,261 bonus + $48,308 other = $481,569

- 2021: $241,827 salary + $170,889 bonus + $37,500 stock awards + $39,627 other = $489,843

- The company also rents a facilities which are ½ owned by Ira and Steven for ~$200k a year

- Ira Levy: 2022: $300,000 salary + $271,575 bonus + $61,473 other = $633,048

- Directors are also paid $200k for sitting on the board which is effectively owned by Ira and Steven

- Management seems somewhat capable. They’ve been able to generate decent returns since the company relisted in 2009. Cash returns ranged from 5.7% to 19% since 2010

The company generates a solid cash free cash flow return – expect high single digits. We are currently at the bottom of a cycle and starting to recover in a relatively cyclical industry. If you get back to 2022 levels (which it likely will over time), you are looking closer to mid-teen free cash flow returns. Surge’s operations are solid at best – an underperformer relative to competitors hemorrhaging cash in its overhead costs. That said, the business itself is generally quite stable with changes dependent on supply and demand of end user inventory. The company is sitting on a large pile of cash (~$11M of their $16M market cap) that continues to build up. If paid out, cash returns on equity would easily be well into the 20% to 30% range. However, management has entrenched itself with significant ownership with no indication that they would do a share buyback or special dividend. In actuality, management seems to take significant opportunities to enrich themselves with abnormally bloated salaries, significant bonuses, and rental agreements with properties they own.