Joel Greenblatt (Trades, Portfolio) is a legendary investor who is the founder and managing partner of Gotham Asset Management. Greenblatt is most famous for his “magic formula” investing strategy, which focuses on buying “good” and “cheap” companies as defined by specific technical criteria, which you can read about in his famous book, "The Little Book That Beats the Market."

Thus, in this post, we will take a look at two beaten-down tech stocks that Greenblatt's firm was buying in the second quarter of 2022 according to its latest 13F report. Let’s dive in.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Micron Technology

Micron Technology (MU, Financial) is the fourth-largest semiconductor company in the world. This is a stock I have covered many times before as it is very popular among great hedge fund managers.

Greenblatt's firm added a substantial 39% to its position in Micron in the second quarter of 2022. During the quarter, shares traded at an average price of $68 apiece, which is 18% more expensive than where the stock trades at the time of writing.

In addition, other great investors such as Li Lu (Trades, Portfolio), who is a friend of Charlie Munger (Trades, Portfolio), and Mohnish Pabrai (Trades, Portfolio) have also been buying Micron recently.

Micron is the third-largest supplier of DRAM (dynamic random access memory). If you have ever upgraded your laptop RAM, you may have seen the brand Crucial, which is also owned by Micron. The company makes 71% of its revenue from DRAM and 26% from NAND (flash memory). Growth in this industry is forecasted to be driven by the growth in computing, data centers and even 5G. For example, 5G smartphones have 50% more DRAM and 100% more NAND that 4G cell phones. Given 5G smartphones are increasing in penetration and expected to make up 69% of total shipments by 2023, the company has an immense tailwind.

Micron generated strong financial results for its third quarter of fiscal 2022. Revenue popped to $8.64 billion, up 16% year over year, which was slightly below analyst estimates but still strong overall.

The company also generated strong operating income of $3.1 billion, which popped by 33% over the same period last year. Non-GAAP earnings per share was $2.49, which surpassed analyst expectations by $0.15.

Micron issued a poor outlook in the short term for semiconductor chips. This was due to a major boom in chips during the pandemic, where we actually saw chip shortages across many sectors such as automotive. However, now the industry is correcting due to weakness in consumer markets such as smartphone and PC. Now although this isn’t great for Micron in the short term, I believe in the long term, the industry trend will be up.

Micron trades at a forward price-earnings ration of 6.58, which is 40% cheaper than its five-year average. Therefore it's no surprise this stock is very popular among value investors.

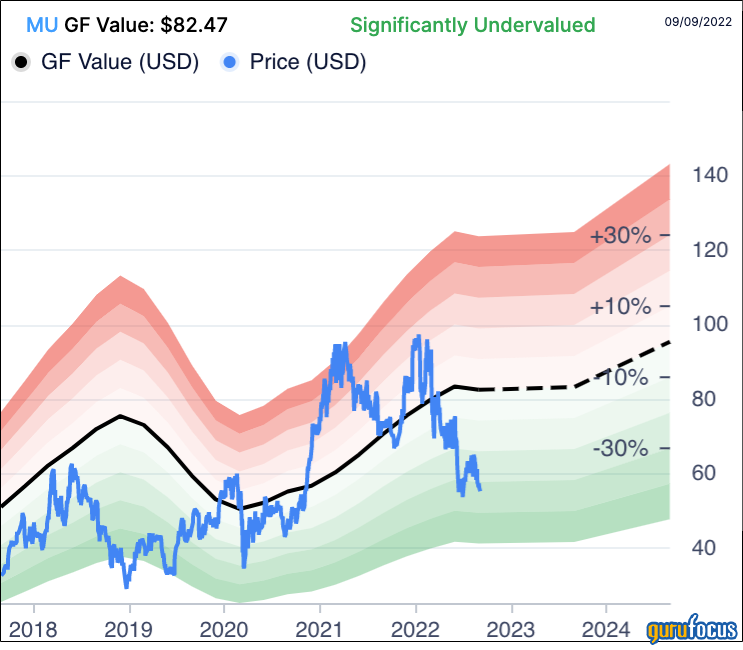

The GF Value line indicates a fair value of $82 per share for the stock, making it significantly undervalued at the time of writing.

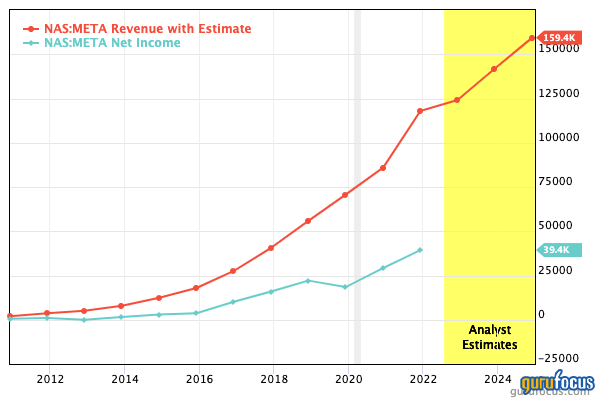

Meta Platforms (META, Financial), formerly known as Facebook, is a global social media giant which owns Facebook, Instagram and WhatsApp. The company’s stock price has dropped by over 57% from its all-time highs after reporting slower user and revenue growth, facing ad revenue issues in light of Apple (AAPL, Financial) privacy updates, suffering from a whisteblower report about the company's lack of care for users of its social media platforms and its bold plans to transform its business for the so-called 3D version of the internet, the Metaverse.

In the second quarter of 2022, Meta reported revenue of $28.8 billion, which was a down 1% year over year and the first ever revenue decline historically. This was mainly driven by a decline in the average price per advert by 14% year over year. This was partially a result of Facebook's focus on Reels in an effort to compete with TikTok, as well as ad buyers pulling spending due to economic uncertainty and recession fears. The good news is total ad impressions actually increased by 15% year over year. In addition, Facebook Monthly Active Users (MAUs) totaled 2.94 billion, which was 1% higher than the prior quarter.

Meta saw a major hit in its operating income, which declined by 34% year over year to $8.4 billion. This was due to a substantial increase in operating expenses, which popped by 22% year over year to $21 billion.

Founder and CEO Mark Zuckerberg announced strong cost-cutting measures and told employees to “do more with less."

Earnings per share plummeted 32% year over year to $2.46. The good news is management bought back $5 billion worth of shares while also authorizing an extra $24.3 billion in repurchases for the future.

Meta has a fortress-like balance sheet with cash, cash equivalents and short-term investments of $40 billion. Meanwhile, total debt is $16 billion, although a portion of this includes operating liabilities.

Zuckerberg plans to invest a portion of this large cash balance into the Metaverse. The Metaverse has alot of potential but is still an unproven concept, but as evidenced by its name change, this is what Meta is staking its future on.

The stock is trading at a price-earnings ratio of 16.4, which is 32% cheaper than its historic five-year average. In addition, its forward price-to-free-cash-flow ratio is 9.1, which is 58% cheaper than its five-year average.

Greenblatt's increased its position in Meta by 29% in the second quarter at an average price of $193 per share. At the time of writing, the stock price is 16% cheaper than the average second-quarter price point.

The GF Value line indicates a fair value for Meta stock of $397 per share, making the stock significantly undervalued.

A risk with Meta is it could be a “value trap” due to declining business fundamentals such as slow user growth. For example, management is expecting revenue of between $26 billion and $28.5 billion in the third quarter. This would be well below analyst consensus estimates of $30.7 billion, and down 10% from the prior year.

Final thoughts

Joel Greenblatt (Trades, Portfolio) is a great value investor who focuses on undervalued companies with strong earnings yields and returns on capital. Both Micron and Meta have seen their stocks post substantial declines, putting them on the radar for many value investors.

I personally believe Micron offers better upside potential than Meta. This is because we know the semiconductor industry is cyclical and it will have a downturn within the next year, but after the secular trend will eventually go up again. Meta is more difficult to analyze as slowing user growth could be a permanent part of the business given increased competition from competitors like TikTok and the uncertainty of future adoption of the Metaverse.