Palogic Value Management, L.p. - Net Worth and Insider Trading

Palogic Value Management, L.p. Net Worth

The estimated net worth of Palogic Value Management, L.p. is at least $29 Million dollars as of 2024-11-10. Palogic Value Management, L.p. is the 10% Owner of QAD Inc and owns about 335,463 shares of QAD Inc (QADA) stock worth over $29 Million. Details can be seen in Palogic Value Management, L.p.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the final shares held after open market or private purchases and sales of common stock with a transaction code of "P" or "S" on Form 4, assuming that Palogic Value Management, L.p. has not made any transactions after 2014-02-19 and currently still holds the listed stock(s). Please note that this estimate may not reflect the actual net worth.

Transaction Summary of Palogic Value Management, L.p.

Palogic Value Management, L.p. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Palogic Value Management, L.p. owns 2 companies in total, including BSQUARE Corp (BSQR) , and QAD Inc (QADA) .

Click here to see the complete history of Palogic Value Management, L.p.’s form 4 insider trades.

Insider Ownership Summary of Palogic Value Management, L.p.

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| BSQR | BSQUARE Corp | 2019-11-12 | other: Member of 10% Group |

| QADA | QAD Inc | 2015-07-14 | 10 percent owner |

Palogic Value Management, L.p. Latest Holdings Summary

Palogic Value Management, L.p. currently owns a total of 1 stock. Palogic Value Management, L.p. owns 335,463 shares of QAD Inc (QADA) as of February 19, 2014, with a value of $29 Million.

Palogic Value Management, L.p. Form 4 Trading Tracker

According to the SEC Form 4 filings, Palogic Value Management, L.p. has made a total of 0 transactions in QAD Inc (QADA) over the past 5 years. The most-recent trade in QAD Inc is the sale of 10,600 shares on February 19, 2014, which brought Palogic Value Management, L.p. around $204,050.

Insider Trading History of Palogic Value Management, L.p.

- 1

Palogic Value Management, L.p. Trading Performance

GuruFocus tracks the stock performance after each of Palogic Value Management, L.p.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Palogic Value Management, L.p. is 11.93%. GuruFocus also compares Palogic Value Management, L.p.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Palogic Value Management, L.p. within 3 months outperforms 1 times out of 1 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Palogic Value Management, L.p.'s insider trading performs compared to the benchmark.

Performance of Palogic Value Management, L.p.

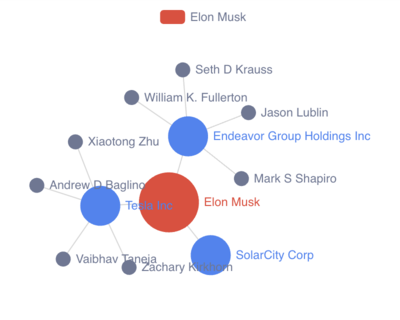

Palogic Value Management, L.p. Ownership Network

Ownership Network List of Palogic Value Management, L.p.

Ownership Network Relation of Palogic Value Management, L.p.

Palogic Value Management, L.p. Owned Company Details

What does BSQUARE Corp do?

Who are the key executives at BSQUARE Corp?

Palogic Value Management, L.p. is the other: Member of 10% Group of BSQUARE Corp. Other key executives at BSQUARE Corp include director & President and CEO Ralph C Derrickson , other: Member of 10% Group Palogic Value Fund, Lp , and Chief Financial Officer Christopher Wheaton .

BSQUARE Corp (BSQR) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of BSQUARE Corp (BSQR) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of BSQUARE Corp (BSQR) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

BSQUARE Corp (BSQR)'s detailed insider trading history can be found in Insider Trading Tracker table.

BSQUARE Corp Insider Transactions

Palogic Value Management, L.p. Mailing Address

Above is the net worth, insider trading, and ownership report for Palogic Value Management, L.p.. You might contact Palogic Value Management, L.p. via mailing address: 5310 Harvest Hill Road, Suite 110, Dallas Tx 75230.