Control Empresarial De Capitales S.a. De C.v. - Net Worth and Insider Trading

Control Empresarial De Capitales S.a. De C.v. Net Worth

The estimated net worth of Control Empresarial De Capitales S.a. De C.v. is at least $1.9 Billion dollars as of 2024-11-05. Control Empresarial De Capitales S.a. De C.v. is the 10% Owner of PBF Energy Inc and owns about 25,962,498 shares of PBF Energy Inc (PBF) stock worth over $736 Million. Control Empresarial De Capitales S.a. De C.v. is the 10% Owner of Talos Energy Inc and owns about 43,545,604 shares of Talos Energy Inc (TALO) stock worth over $455 Million. Control Empresarial De Capitales S.a. De C.v. is also the Add'l Rep. Persons-see Ex.99-1 of New York Times Co and owns about 8,247,175 shares of New York Times Co (NYT) stock worth over $433 Million. Besides these, Control Empresarial De Capitales S.a. De C.v. also holds PBF Logistics LP (PBFX) , ProKidney Corp (PROK) . Details can be seen in Control Empresarial De Capitales S.a. De C.v.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the final shares held after open market or private purchases and sales of common stock with a transaction code of "P" or "S" on Form 4, assuming that Control Empresarial De Capitales S.a. De C.v. has not made any transactions after 2024-10-31 and currently still holds the listed stock(s). Please note that this estimate may not reflect the actual net worth.

Transaction Summary of Control Empresarial De Capitales S.a. De C.v.

Control Empresarial De Capitales S.a. De C.v. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Control Empresarial De Capitales S.a. De C.v. owns 6 companies in total, including New York Times Co (NYT) , PBF Energy Inc (PBF) , and PBF Logistics LP (PBFX) among others .

Insider Ownership Summary of Control Empresarial De Capitales S.a. De C.v.

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| NYT | New York Times Co | 2018-09-20 | 10 percent owner & other: Affiliates - see Exhibit 99-1 |

| PBF | PBF Energy Inc | 2024-10-31 | 10 percent owner & other: Add'l Rep. Persons-see Ex.99-1 |

| PBFX | PBF Logistics LP | 2022-10-20 | 10 percent owner & other: Add'l Rep Persons-see Ex. 99.1 |

| 2022-07-11 | 10 percent owner | ||

| 2024-06-11 | 10 percent owner | ||

| 2024-09-27 | 10 percent owner & other: Add'l Rep. Persons-see Ex.99-1 |

Control Empresarial De Capitales S.a. De C.v. Latest Holdings Summary

Control Empresarial De Capitales S.a. De C.v. currently owns a total of 5 stocks. Among these stocks, Control Empresarial De Capitales S.a. De C.v. owns 25,962,498 shares of PBF Energy Inc (PBF) as of October 31, 2024, with a value of $736 Million and a weighting of 39.24%. Control Empresarial De Capitales S.a. De C.v. owns 43,545,604 shares of Talos Energy Inc (TALO) as of September 27, 2024, with a value of $455 Million and a weighting of 24.28%. Control Empresarial De Capitales S.a. De C.v. also owns 8,247,175 shares of New York Times Co (NYT) as of September 20, 2018, with a value of $433 Million and a weighting of 23.06%. The other 2 stocks PBF Logistics LP (PBFX) , ProKidney Corp (PROK) have a combined weighting of 13.42% among all his current holdings.

Latest Holdings of Control Empresarial De Capitales S.a. De C.v.

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| PBF | PBF Energy Inc | 2024-10-31 | 25,962,498 | 28.35 | 736,036,818 |

| TALO | Talos Energy Inc | 2024-09-27 | 43,545,604 | 10.46 | 455,487,018 |

| NYT | New York Times Co | 2018-09-20 | 8,247,175 | 52.45 | 432,564,329 |

| PBFX | PBF Logistics LP | 2022-10-20 | 7,042,592 | 19.90 | 140,147,581 |

| PROK | ProKidney Corp | 2024-06-11 | 71,560,107 | 1.56 | 111,633,767 |

Holding Weightings of Control Empresarial De Capitales S.a. De C.v.

Control Empresarial De Capitales S.a. De C.v. Form 4 Trading Tracker

According to the SEC Form 4 filings, Control Empresarial De Capitales S.a. De C.v. has made a total of 64 transactions in PBF Energy Inc (PBF) over the past 5 years, including 50 buys and 14 sells. The most-recent trade in PBF Energy Inc is the acquisition of 622,000 shares on October 31, 2024, which cost Control Empresarial De Capitales S.a. De C.v. around $18 Million.

According to the SEC Form 4 filings, Control Empresarial De Capitales S.a. De C.v. has made a total of 15 transactions in Talos Energy Inc (TALO) over the past 5 years, including 15 buys and 0 sells. The most-recent trade in Talos Energy Inc is the acquisition of 100,000 shares on September 27, 2024, which cost Control Empresarial De Capitales S.a. De C.v. around $1 Million.

According to the SEC Form 4 filings, Control Empresarial De Capitales S.a. De C.v. has made a total of 0 transactions in New York Times Co (NYT) over the past 5 years. The most-recent trade in New York Times Co is the sale of 90,000 shares on September 20, 2018, which brought Control Empresarial De Capitales S.a. De C.v. around $2 Million.

More details on Control Empresarial De Capitales S.a. De C.v.'s insider transactions can be found in the Insider Trading History of Control Empresarial De Capitales S.a. De C.v. table.Insider Trading History of Control Empresarial De Capitales S.a. De C.v.

- 1

Control Empresarial De Capitales S.a. De C.v. Trading Performance

GuruFocus tracks the stock performance after each of Control Empresarial De Capitales S.a. De C.v.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Control Empresarial De Capitales S.a. De C.v. is 5.84%. GuruFocus also compares Control Empresarial De Capitales S.a. De C.v.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Control Empresarial De Capitales S.a. De C.v. within 3 months outperforms 35 times out of 81 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Control Empresarial De Capitales S.a. De C.v.'s insider trading performs compared to the benchmark.

Performance of Control Empresarial De Capitales S.a. De C.v.

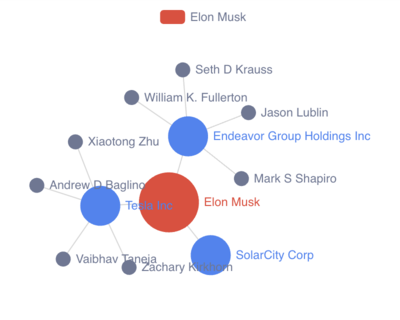

Control Empresarial De Capitales S.a. De C.v. Ownership Network

Ownership Network List of Control Empresarial De Capitales S.a. De C.v.

Ownership Network Relation of Control Empresarial De Capitales S.a. De C.v.

Control Empresarial De Capitales S.a. De C.v. Owned Company Details

What does New York Times Co do?

Who are the key executives at New York Times Co?

Control Empresarial De Capitales S.a. De C.v. is the 10 percent owner & other: Affiliates - see Exhibit 99-1 of New York Times Co. Other key executives at New York Times Co include EVP & Chief Operating Officer Kopit Levien Meredith A. , Chief Financial Officer William Bardeen , and SVP & Treasurer & Controller R Anthony Benten .

New York Times Co (NYT) Insider Trades Summary

Over the past 18 months, Control Empresarial De Capitales S.a. De C.v. made no insider transaction in New York Times Co (NYT). Other recent insider transactions involving New York Times Co (NYT) include a net sale of 67,179 shares made by Kopit Levien Meredith A. , a net sale of 18,000 shares made by Diane Brayton , and a net sale of 13,572 shares made by R Anthony Benten .

In summary, during the past 3 months, insiders sold 20,300 shares of New York Times Co (NYT) in total and bought 0 shares, with a net sale of 20,300 shares. During the past 18 months, 112,265 shares of New York Times Co (NYT) were sold and 0 shares were bought by its insiders, resulting in a net sale of 112,265 shares.

New York Times Co (NYT)'s detailed insider trading history can be found in Insider Trading Tracker table.

New York Times Co Insider Transactions

Control Empresarial De Capitales S.a. De C.v. Mailing Address

Above is the net worth, insider trading, and ownership report for Control Empresarial De Capitales S.a. De C.v.. You might contact Control Empresarial De Capitales S.a. De C.v. via mailing address: Insurgentes Sur #3500, Pb, Col. Pena Pobre, Delegacion Tlalpan, Cp, Mexico D.f. O5 14060.