What dynamics do you think contributed to the market’s rally in 4Q22?

Chuck Royce (Trades, Portfolio): I think it was a combination of factors—seller exhaustion, short covering, the idea that inflation has peaked, etc. Of course, none of these elements proved strong enough to keep the rally going, as we saw in a pretty dismal December for most stocks. I thought it was interesting that this was a near-global move as well, with non-U.S. stocks similarly strong into the end of November before they also experienced a pullback in December. I’m not sure what it all means, of course, beyond the fact that near-term visibility remains very cloudy—and when that’s the case, we’ll see this kind of volatility.

Francis Gannon: Picking up on Chuck’s point, we saw a similar pattern in 2022’s third quarter: A strong upward move in July and early August, which was followed by a loss in momentum as the quarter wore on. But there was an interesting difference in that the 3Q22 rally was dominated by lower-quality small caps—those without earnings and dividends, for example—while in the fourth-quarter small caps with higher returns on invested capital—our primary quality marker—led the way. This similar performance pattern in consecutive quarters, each with very different leadership, only serves to underscore how uncertain investors feel—and how eager we all are for a more consistent sense of direction for equities. You can get an additional sense of how uncertain investors have been feeling by the volatility in the 10-year Treasury yield. After starting 2022 at 1.6%, the yield mostly rose through the first 10 months of the year before peaking at 4.2% in late October. It then went to 3.4% in early December before closing out the year just shy of 4.0%.

Is it rare for stocks and bonds to both perform poorly in the same year, as was the case in 2022?

CR: It’s exceedingly rare. In fact, it’s happened only about a dozen times since the Great Depression. More importantly, 2022 was one of the worst years for that staple of diversified portfolios, the 60/40 mix of stocks and bonds. With large-cap indexes down close to 20% and the Bloomberg Barclays US Aggregate Bond Index down 13.0%, it was the worst year for stocks and bonds since 2008. And the 60/40 split has only had double-digit calendar year losses six times since the 1930s. So, there was nowhere to hide in 2022.

FG: It was also the third worst year for both the small-cap Russell 2000 Index, which fell 20.4%, and the Russell 1000 Index, which declined 19.1%, since each index’s inception at the end of 1978. Only two years had lower returns—and it was the same two years for both indexes—2008 during the Financial Crisis and 2002 through the worst year of the Internet Bubble. That certainly puts the challenges investors faced last year in context.

A Historically Rough Year for Stocks

Lowest Calendar Year Returns for the Russell 2000 and Russell 1000 Indexes Since Inception (12/31/78)

Past performance is no guarantee of future results

Do you think we have hit peak inflation in the U.S.?

CR: Most of the data is certainly pointing that way—and we’re in line with the consensus that the worst is probably behind us. Wage inflation is proving a lot stickier—and will remain so, of course, for as long as the job market is as strong as it’s been over the last couple of years. More important is the fact that the market still seems uncertain about the overall state of the economy, as the last two quarters’ reversals have shown. In other words, I suspect it will take more than pretty compelling evidence that inflation has peaked for investors to feel sanguine about the economy or the market.

FG: We’ve seen a lot of sharp deflation lately, too. The Baltic Dry Index—which measures the cost of shipping goods worldwide—fell more than 70% from its high in May through the end of December. Lumber, steel, and copper prices also slipped precipitously in 2022. Many investors are understandably focused on the levelling off of the Consumer Price Index, but we’re seeing costs falling even more dramatically in other areas, even as wage inflation stays high. We expect a similar dynamic going forward, in which wage inflation continues to be sticky, but the steepest increases in goods inflation remain behind us.

Why might ongoing inflation be an advantage for small-cap stocks?

FG: Small-cap has beaten inflation in every decade going back to the 1930s—and is the only equity class to have done so. We learned this by comparing the average annual U.S. consumer price index (CPI) to returns for the Center for Research in Security Prices (CRSP) 6-10 Index—which is a proxy that we use for small caps when we want to reach farther back in history than the Russell 2000 goes. Moreover, the CRSP 6-10 has posted positive annualized three-year returns 88% of the time on a rolling monthly basis since 1945, with an average return in the low double digits.

Small-Caps Have Beaten Inflation in Every Decade Since the 1930’s

Average Annual Consumer Price Index (CPI) vs. Average Annual CRSP 6-10 Index Performance from 12/31/1930- 12/31/2020

Past performance is no guarantee of future results

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

We think that ongoing inflation, rising rates, and the uncertain economic environment of 2022 together signal an opportunity for investors to increase their exposure to small caps, specifically small-cap value. In addition to their long-term historical edge during inflationary periods, small caps tend to be nimbler than large caps, which allows them to potentially act more quickly in a climate of contracting liquidity and Fed tightening.

Do you see any parallels between the Nifty Fifty market of the 1970s and 2022’s market for mega-cap stocks?

CR: There is a similarity in the broader economic and market environment: Both took place during uncertain periods in which inflation and recession were the major concerns. I also see two more specific parallels. The Nifty Fifty was a group of large-cap, mostly multinational companies (and there’s still some disagreement as to which 50 companies comprised it all these years later) that were viewed as a steady, sure, and safe road to growth until the bear market of 1973-74 saw them get at least as badly hurt, if not worse, than the average stock. A similar perception of safety was reserved for an even smaller number of mega-cap stocks, the “FAAMG” group of Facebook, Apple, Amazon, Microsoft, and Google, prior to 2022. It’s also interesting that those five stocks accounted for an outsized share of the U.S. market’s total capitalization—which was also the case for AT&T, Eastman Kodak, Exxon, GM, and IBM before the big correction in the 1970s.

Do you remain confident in the long-term prospects for small-cap value over small-cap growth?

FG: Yes, we do. First, 2022’s performance pattern was very much what we would expect in a bearish year. The Russell 2000 Value Index more than doubled the performance of Russell 2000 Growth Index, up 8.4% in 4Q22 versus 4.1%. This marked the eighth quarter out of the last nine in which small-cap value beat growth, including a run of seven consecutive quarters prior to 3Q22. For 2022, the Russell 2000 Value lost a lot less than the Russell 2000 Growth, -14.5% versus -26.4%. Of course, we’ve been saying that small-cap value would recapture its long-term historical advantage over small-cap growth for a couple of years now.

What other factors can you cite that underlie your case for small-cap value?

FG Over the last few years, we’ve seen a deep and far-reaching re-rating of growth stocks. This development was unsurprising after the end of more than a decade’s worth of zero interest rates and easy access to capital, along with the knock-on effect of much higher inflation. To be sure, we saw this most clearly at two ends of the equity market last year: in the deeper correction for small-cap growth stocks and in the steep declines for many mega-cap companies. As Chuck mentioned, the latter group had formerly been something of a haven for investors who saw few, if any, alternatives in an environment that offered so little in the form of yields. But those days are behind us. Rising rates and inflation have ushered in a major regime change, a period of multiple compression that we expect to reorient investors’ attention—to some extent, at least—away from the admittedly crowded and uncertain macro scene and onto corporate fundamentals, which we view as an advantage for the kind of conservatively capitalized, free cash flow generating companies that most of our major strategies hold.

Do you have a similar level of confidence in the prospects for quality small caps?

CR: Absolutely. First, high-quality small-cap companies—that is, those in the highest quintile of return on invested capital (“ROIC”) within the Russell 2000—had the highest returns in 4Q22, while those in the lowest ROIC quintile had the lowest after falling behind in the third quarter. And because small caps with both higher ROIC and earnings also led in 2022’s first half, they held up better as a group in 2022 versus their lower-quality, non-earning siblings. Our quality companies generally possess strong long-term growth prospects, low debt, positive free cash flows, high ROIC, and/or proven management expertise. Overall, I think they’re very well positioned to benefit from a market that’s more focused on fundamentals and/or from a reaccelerating economy. Of course, we’re all concerned about a recession, but none of us knows how long it will last or how deep it will go. What we do know, however, is that any recession—like any bear market—is ultimately finite and will be followed by a recovery. It’s worth keeping in mind that history also shows that small caps will likely begin an upward move before many of us know for sure that the economy is rebounding in earnest. For this and other reasons, any amount of increased scrutiny of company fundamentals should help boost quality small caps.

What factors can you cite to substantiate the idea that small cap is well positioned for strong absolute and relative long-term performance?

FG: Let’s start with valuation. Even following 2022’s correction, small-cap valuations remained near their lowest rate in 20 years compared to large-cap’s, based on our preferred valuation metric of the median last 12 months’ enterprise value to earnings before taxes (LTM EV/EBIT). In addition, persistent inflation, the ongoing war in Ukraine, the seemingly endless effects of Covid, and a broadly predicted global recession hit many stocks hard throughout the year. Many small-cap stocks, however, were hit independent of their financial fundamentals and/or operational expertise. We have often been struck by the contrast between the more confident—albeit cautious—outlooks from the many management teams we’ve met with and the fatalistic headlines we see almost every day.

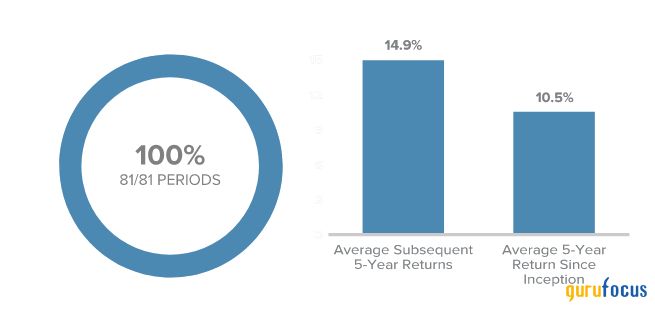

Related to this is the fact that small-cap’s historical performance patterns show that below-average longer-term return periods have been followed by those with above-average longer-term returns—and the subsequent periods have enjoyed positive returns most of the time. Subsequent annualized three-year returns from three-year entry points of less than 5% have been positive 99% of the time—that is, in 75 out of 76 three-year annualized periods—averaging 16.1% since the Russell 2000’s 12/31/78 inception. The Russell 2000 also had positive annualized five-year returns 100% of the time—that is, in all 81 five-year periods—and averaged an impressive 14.9% following five-year periods with annualized returns of 5% or less. We think this is especially relevant now because the respective three- and five-year annualized returns for the Russell 2000 as of 12/31/22 were 3.1% and 4.1%.

A High Probability of Positive Small-Cap Performance Ahead?

Average Subsequent Five-Year Annualized Performance for the Russell 2000 in Trailing Five-Year Return Ranges of less than 5% from 12/31/83 through 12/31/22

What would you say to investors fearful of entering or staying in the market at such an uncertain time?

CR: The patterns that Frank discussed not only suggest a low probability of poor small-cap performance over periods of three years or longer, but they also indicate that the cost of waiting or trying to time a bottom—whether for the market or the economy—can be high. We know better than to try predicting outcomes for the markets or the economy, but we routinely examine past performance patterns to help us make sense of the present as we prepare for the uncertain days ahead.

The Russell 2000 fell 31.9% from 11/8/21 through the current bottom on 6/16/22, which places it precisely at the average of Russell 2000 downturns of 15% or more since the index’s inception. Over that 44-year span, only three bear markets went markedly deeper than this one by falling at least another 10%. Each of these downturns was exacerbated by a monumental negative event: the Great Financial Crisis led to small-cap losses of 58.9% from 7/13/07-3/9/09; the bursting Internet Bubble saw the Russell 2000 down 44.1% from 3/9/00-10/9/02; and in the Covid pandemic the small-cap index declined 41.8% from 8/31/18-3/18/20. As difficult as these markets were, each presented investors with an important opportunity to build their small-cap allocation because in each case the subsequent recovery was robust—but it was much more rewarding for those who stayed invested. Regardless of what happens in the near term, then, we see the current period of uncertainty as a highly opportune time to actively invest in select small caps for the long run.

Missing the Rally’s Earliest Stage Has Been Costly

Average Returns for the Russell 2000 During the First 12 Months of a Recovery Depending on Entry Point from 12/31/78-12/31/22

Mr. Royce’s and Mr. Gannon’s thoughts concerning recent market movements and future prospects for small-company stocks are solely those of Royce Investment Partners, and, of course, there can be no assurances with respect to future small-cap market performance. The performance data and trends outlined in this presentation are presented for illustrative purposes only. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.