Building off the popular Peter Lynch chart, GuruFocus’ GF Value chart seeks to take more than price alone into account when attempting to determine the fair value of a stock. This unique tool from GuruFocus considers the following three categories of information:

- Historical price-earnings, price-book, price-sales and price-to-free cash flow ratios.

- A GuruFocus adjustment factor based on the company’s past returns and growth.

- Future estimates of the business’ performance.

Of course, just like with any valuation estimate, trading below GF Value is by no means a guarantee that a stock will rise in the future. In many cases, undervaluation is the market’s response to underlying issues in a company that may turn out to be permanent. Even a solid large-cap company with a successful track record can end up undervalued if it enters a period of stagnation or decline.

The challenge of telling a value stock from a value trap is part of what makes insider buying such a popular reference point for investors. If the insiders who know their company best are buying shares of an undervalued stock, it could mean they expect shares to rise in the future.

According to the GuruFocus All-in-One Screener, a Premium feature, three stocks that are trading below GF Value and have been bought by insiders recently include Enterprise Products Partners LP (EPD, Financial), VF Corp. (VFC, Financial) and Align Technology Inc. (ALGN, Financial).

Enterprise Products Partners

Enterprise Products Partners(EPD, Financial), a natural gas pipeline company, traded around $26.33 per share on Tuesday compared to its GF Value of $40.72, making it significantly undervalued based on the GF value chart.

Over the past three months, there have been three insiders buying the stock. Co-CEO AJ Teague was buying on Dec. 20 and Dec. 27 of 2022, while director John Rutherford was buying on Nov. 23 and director Carin Marcy Barth was buying on Dec. 27. As shown in the chart below, insiders often buy the stock on the open market and rarely sell.

While most parts of the oil and gas industry tend to be more cyclical, that is often not the case for midstream companies like Enterprise, as long-term contracts and the built-in monopolies of pipelines help ensure predictable and profitable cash flows. Enterprise has not actually paid off much in terms of capital gains over its history, but it does have a forward dividend yield of 7.46% thanks to its stalwart business.

VF

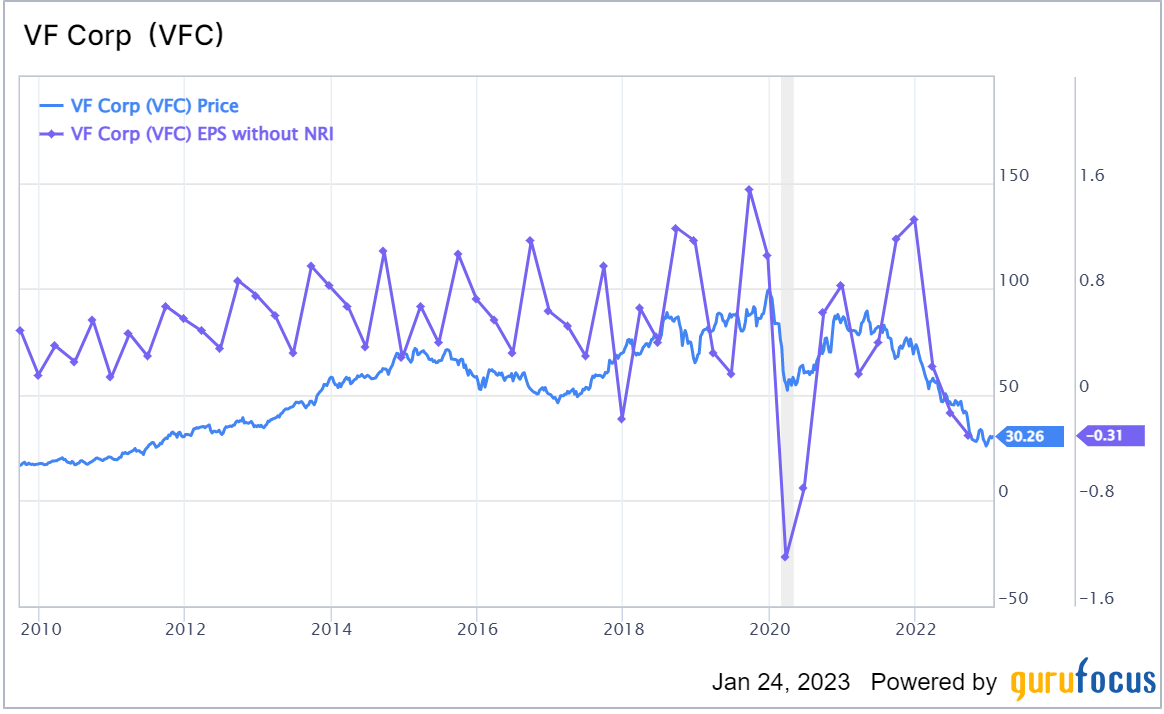

Apparel company VF (VFC, Financial), which owns iconic brands such as Vans and The North Face, traded around $30.31 per share on Jan. 24, which is much lower than its GF Value chart of $83.33. The GF Value chart rates the stock as a potential value trap due to a sharp bottom-line decline.

Despite the company’s earnings troubles, three insiders have been buying shares over the past three months. Directors Mark Samuel Hoplamazian and Clarence Otis Jr. were buying on Dec. 9, while interim President and CEO Benno O’Dorer was buying on Dec. 13. The chart below shows that this represents an increase in insider buys following years of insiders mostly selling shares.

In 2018, VF sought to revamp its business amid declining earnings, so it separated into two different companies by spinning off its jean brands. This worked initially, but shares began to plunge in late 2021 amid continued erratic earnings and the broad bear market that was taking hold. The current weakness in the retail market could keep VF down for the near term and might even result in a cut to its forward dividend yield of 6.73%. In the long run, it can hopefully keep up a decent dividend and see earnings improve during an economic recovery.

Align Technology

Align Technology (ALGN, Financial), an orthodontics company that makes the Invisalign aligners, changed hands around $252.63 per share on Tuesday, which is much lower than the GF Value estimate of $492.43, making the stock significantly undervalued based on the GF Value chart.

The price of this stock has been through a dramatic rise and fall from 2020 to the present, with shares more than tripling before falling to pre-pandemic levels, but insiders have finally begun buying again for the first time since August of 2019. President Joseph Hogan and directors Anne Myong and Warren Thaler were all buying shares on Nov. 11.

While Align also manufactures 3D digital scanners for the dental industry, its premier offering is the Invisalign clear aligners which catapulted it to fame. Invisalign provides an alternative to traditional metal braces that is more comfortable, much less visible and does not make it hard to keep up good oral health like metal braces do. The company has begun to see a tiny slowdown in its revenue and earnings in recent quarters, but most of the stock price decline can be attributed to the correction of the Covid market bubble. Align still has a solid core business offering, though its lack of a dividend is a downside.