Sands Capital Management recently disclosed its 13F portfolio updates for the first quarter of 2023, which ended on March 31.

Founded in 1992 by Frank M. Sands Sr., Sands Capital Management is an independent investment management firm that invests in high-quality growth business. Frank Sands (Trades, Portfolio) Jr. joined the firm in 2000 and currently serves as CEO and chief investment officer. The Arlington, Virginia-based firm has two main concentrated growth strategies: Select Growth, which chooses innovative businesses, and Global Growth, which diversifies holdings in countries outside of the U.S. Sands Capital focuses on six investment criteria: sustainable above-average earnings growth, leadership position in a promising business space, a clear mission with a focus on value, good financial strength, rational valuation and significant competitive advantages.

According to the firm’s latest 13F portfolio, its top buys for the first quarter were additions to Microsoft Inc. (MSFT, Financial) and Entegris Inc. (ENTG, Financial) and a new stake in Axon Enterprise Inc. (AXON, Financial).

Investors should be aware 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Microsoft

The firm upped its stake in Microsoft (MSFT, Financial) by 226.14% for a total holding of 1,648,482 shares. The trade added 1.09% to the equity portfolio at the quarter’s average share price of $255.08.

Microsoft is an American tech giant that is famous for its Windows operating systems, Microsoft Office suite and web browsers. It also has gaming operations through Xbox and has tapped cloud computing, internet of things and artificial intelligence for growth avenues.

Microsoft’s cloud business, which is the company’s main growth engine currently, has seen its growth rate slow down, and its planned $68.7 billion acquisition of Activision Blizzard (ATVI, Financial) is in regulatory danger. Nevertheless, investors are hyped about the potential of Microsoft’s AI efforts, which include a partnership with OpenAI to re-vamp its Bing search engine.

Despite its huge market cap of $2.48 trillion, Microsoft has still been posting impressive growth with a three-year revenue per share growth rate of 17.4% and a three-year earnings per share growth rate of 24%. This growth is anticipated to continue, which is one of the reasons why the GF Value chart rates the stock as fairly valued despite the price-earnings ratio of 36.08.

Entegris

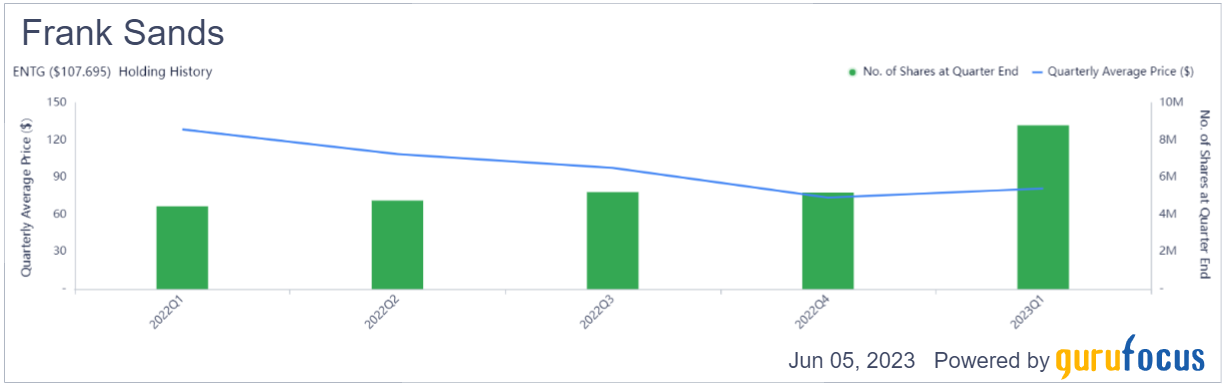

Sands’ firm also increased its Entegris Inc. (ENTG, Financial) holding by 69.56% for a total of 8,792,591 shares, adding 0.98% to the equity portfolio. During the quarter, shares traded for an average price of $81.03.

Entegris is an advanced materials and process solutions company serving the semiconductor, life sciences and other technology industries. Its products include catalysts, post etch cleaning solutions, electronic chemicals and more.

As a leading provider of materials and processes that are necessary for the development and production of semiconductors and other high-tech products, Entegris is poised to benefit from the growth of several technology industries as a “pick and shovel” play.

Entegris has a three-year revenue per share growth rate of 23.70%, but earnings per share have declined an average of 7.90% per year over the same period. The GF Value chart rates the stock as a possible value trap as the share price decline has coincided with declining profitability, though a return to bottom-line growth could place it in undervalued territory.

Axon Enterprise

The firm’s top new buy of the quarter was Axon Enterprise (AXON, Financial). It acquired 988,570 shares, giving the company a 0.73% weight in the equity portfolio at the quarter’s average share price of $198.81.

Axon Enterprise is a manufacturer of weapons and technology for the military, law enforcement and civilians. Its cutting-edge “public safety technology” includes smart weapons and utilizes connected technology to improve accountability and reduce the use of lethal force.

Not only does Axon have strong and growing relationships with law enforcement agencies worldwide, it is also growing its subscription revenue with its evidence collection and tracking platforms.

With a three-year revenue per share growth rate of 22.9%, a three-year earnings per share growth rate of 487.7% and a price-earnings ratio of 102.16%, Axon falls into the “high growth at a premium valuation” category. The GF Value chart rates the stock as fairly valued.

See also

Sands Capital Management’s notable sells for the quarter included reductions to Visa Inc. (V, Financial), DexCom Inc. (DXCM, Financial) and Sarepta Therapeutics Inc. (SRPT, Financial). Turnover for the period was 4%.

At the end of the quarter, the firm had holdings in 66 stocks in a 13F equity portfolio valued at $30.36 billion. The top holdings were Visa with 6.69% of the equity portfolio, DexCom with 5.26% and Amazon.com Inc. (AMZN, Financial) with 5.18%.

In terms of sector weighting, the firm was most invested in technology, consumer cyclical and health care stocks.