Following the release of PayPal Holdings Inc.'s (PYPL, Financial) second-quarter financial results after the closing bell on Wednesday, its shares fell 12%.

While the company posted revenue that exceeded expectations, it recorded a decrease in customers for the second consecutive quarter, a sequential decline in its operating margin and lower free cash flow. However, the drop has sufficiently priced in the risks, offering investors an attractive entry point.

Earnings update

PayPal reported $7.29 billion in revenue for the second quarter, an increase of 7% year over year and exceeding analysts' estimates by $30 million. As a result, adjusted earnings per share grew 24% to $1.16. The $377 billion total payment volume, which increased 11% annually, was also a major contributor to the results. Growth for Venmo was a little slower than average with $67 billion in TPV, gaining 8%.

Additionally, operating cash flow was -$200 million, down from $1.25 billion in the prior-year quarter. However, operating cash flow was $1.70 billion when adjusting for changes in working capital, the origination of loans that are being held for sale and profits from repayments of these loans receivable.

The sharp increase in PayPal's low-margin business goods is what caused its operating margin to fall. The company's margins have been under pressure for several quarter despite the success of these items, which have lesser profitability. Simultaneously, due in part to rising competition from rivals like Apple (AAPL, Financial), growth in its higher-margin products has slowed. Specifically, PayPal's adjusted operating margin for the quarter was 21.4%, which fell short of the company's own forecast of 22% and was down from 22.7% in the first quarter. This shortfall disappointed investors and analysts who were expecting better results.

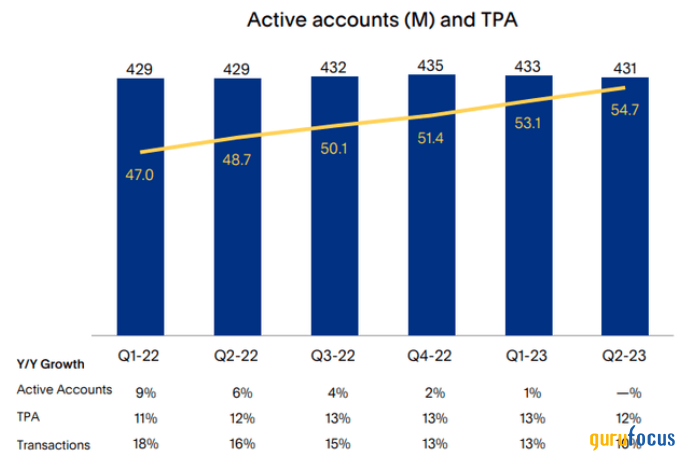

The San Jose, California-based fintech company also recorded a sequential decline in its user base. With 431 million users on its platform at the end of the second quarter, PayPal recorded a 2 million reduction from the end of the first quarter. This also marked the second straight quarter of decreases. However, the number of transactions per account increased to 54.7, up 12% from the previous year, offsetting the slight drop in the number of active accounts.

Source: PayPal

Finally, according to management, the company's strategic investment portfolio had a 34-cent impact on the preceding year. Without that effect, analysts anticipate a 43% increase in earnings per share. PayPal has been affected by the macroeconomic environment and adverse currency exchange rates, so investors were hoping that its growth would pick up again.

What to expect in the third quarter

PayPal anticipates net revenue of $7.4 billion for the third quarter, up about 8% year over year, translating to non-GAAP earnings of $1.23 per share, up almost 14%.

Despite the drop in margins, acting Chief Financial Officer Gabrielle Rabinovitch said during the earnings call that PayPal expects an improvement in margin performance toward the end of the year. This projection might be based on factors like expected changes in business strategies, cost management and the anticipated rebound in e-commerce growth as inflation cools down.

Valuation

As a result of its recent performance, the stock remains undervalued. The company is currently trading at just 2 times next year's sales, which is close to its lowest valuation ever.

Further, the GF Value Line suggests the stock is significanlty undervalued currently based on its historical ratios, past financial performance and analysts' future earnings projections.

The shares have not gained nearly as much from the recent market rally as some of its fintech peers, but it is still well below its pandemic-era highs. As a result, PayPal might be a great option for investors looking for a long-term play, even though it may no longer be the exciting growth story it once was.

Takeaway

Despite PayPal's challenges, the stock remains undervalued and presents an attractive entry point for investors. From a technical standpoint, it makes sense to anticipate a modest rebound given the steep share price decrease following the second-quarter results. Trading at just 2 times next year's sale the company's potential for a comeback makes it an appealing option for patient investors.

As its products improve, more businesses are likely to start using PayPal as a payment option, which will significantly boost total payment volume and income as the economy strengthens. The company will also likely profit from the rising transition to electronic payment methods as its network effect will attract additional users and merchants, further solidifying its market position.