On August 6, 2023, Amgen Inc (AMGN, Financial) observed a promising daily gain of 5.45%, with an Earnings Per Share (EPS) standing at 14.83. But is this biotech giant's stock fairly valued? This article aims to answer this question through an in-depth valuation analysis. Let's delve into the financial details and future prospects of Amgen (AMGN).

Introduction to Amgen Inc

Amgen is a pioneer in biotechnology-based human therapeutics, known for its expertise in renal disease and cancer supportive-care products. Its flagship drugs include Epogen, Aranesp, Neupogen, Neulasta, Enbrel, and Otezla. With the acquisition of Onyx, Amgen bolstered its therapeutic oncology portfolio with Kyprolis. The company's recent launches include Repatha, Aimovig, Lumakras, and Tezspire. Amgen's biosimilar portfolio includes Mvasi, Kanjinti, and Amjevita.

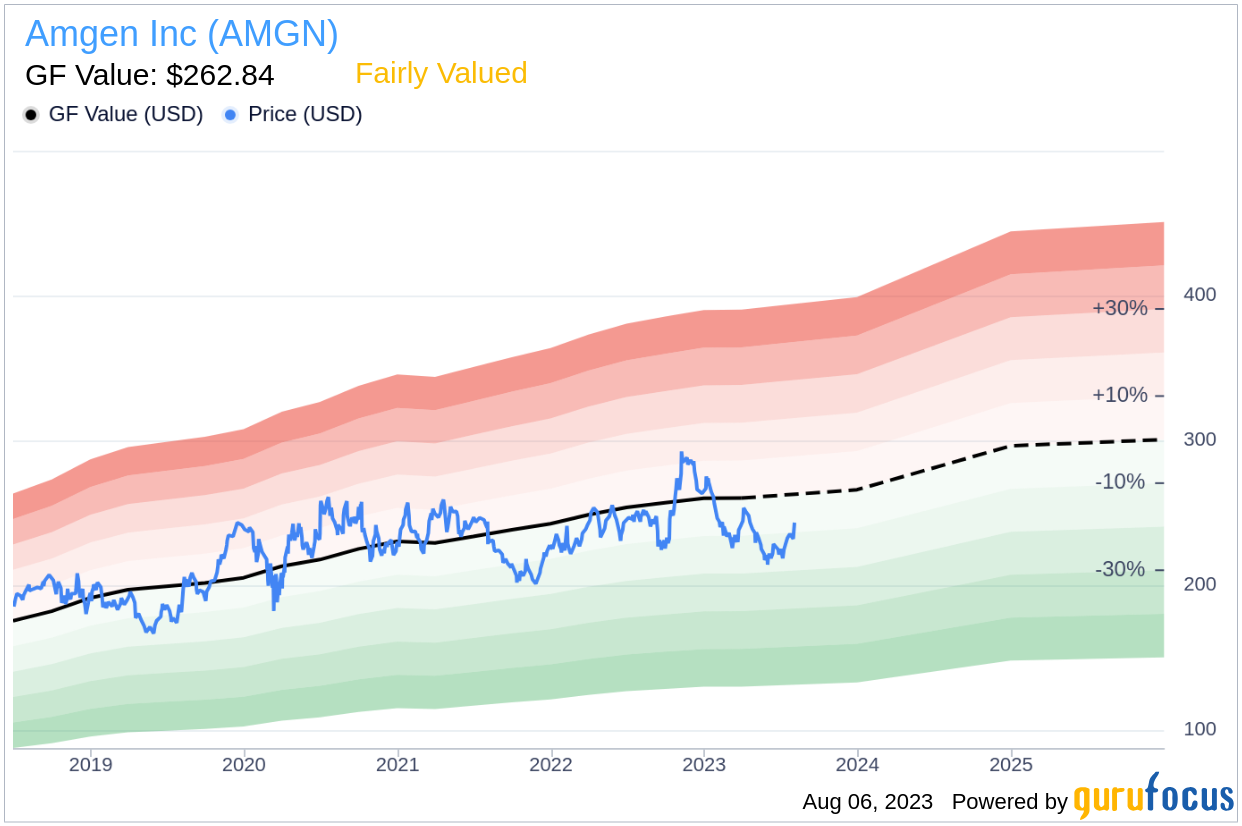

As of August 6, 2023, Amgen's stock price is $243.28, while its fair value according to the GF Value is $262.84, suggesting that the stock is fairly valued. The following analysis will provide a deeper insight into the company's valuation.

Understanding the GF Value of Amgen (AMGN, Financial)

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor derived from past performance and growth, and future business performance estimates. The GF Value Line represents the fair trading value of the stock.

For Amgen, the GF Value suggests that the stock is fairly valued. This estimation is based on historical multiples, the company's past business growth, and analyst estimates of future business performance. If the stock price is significantly above the GF Value Line, it implies overvaluation and potentially poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it indicates undervaluation and potentially higher future returns.

Since Amgen is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth. For companies that may deliver higher future returns at reduced risk, check out these high-quality companies.

Amgen's Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to review a company's financial strength before purchasing shares. The cash-to-debt ratio and interest coverage are great indicators of financial strength. Amgen's cash-to-debt ratio is 0.51, ranking worse than 60.48% of companies in the Drug Manufacturers industry. The overall financial strength of Amgen is 4 out of 10, which indicates poor financial strength.

Profitability and Growth of Amgen Inc

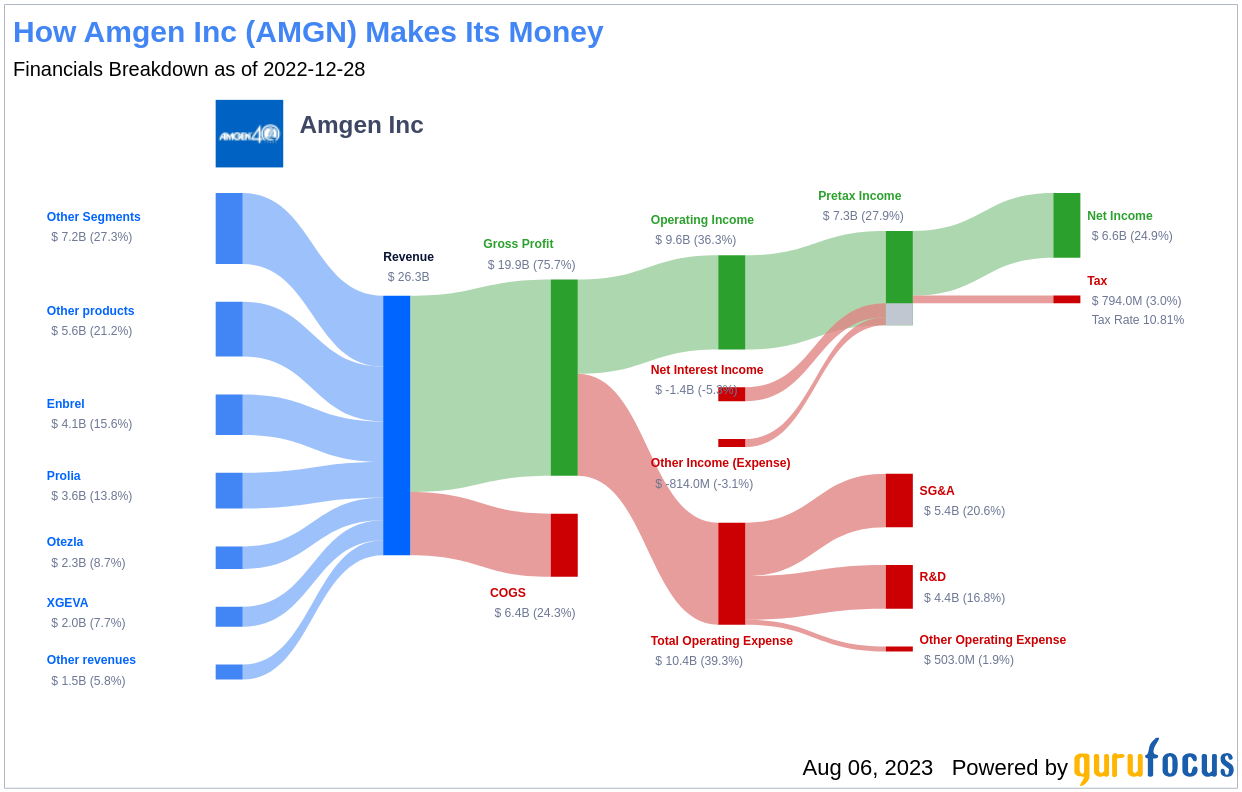

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. Amgen has been profitable 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $26.6 billion and Earnings Per Share (EPS) of $14.83. Its operating margin is 34.31%, ranking better than 96.72% of companies in the Drug Manufacturers industry. Overall, GuruFocus ranks Amgen's profitability at 9 out of 10, indicating strong profitability.

Growth is a vital factor in a company's valuation. Amgen's 3-year average revenue growth rate is better than 57.31% of companies in the Drug Manufacturers industry. However, its 3-year average EBITDA growth rate is 2.7%, ranking worse than 62.46% of companies in the industry. Thus, Amgen's growth ranks poorly compared to its industry peers.

Amgen's ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates the company is creating value for shareholders. Over the past 12 months, Amgen's ROIC was 18.2, while its WACC came in at 6.98, suggesting a positive value creation.

Conclusion

In conclusion, Amgen's stock appears to be fairly valued. Although the company's financial condition is poor, its profitability is strong. However, its growth ranks lower than 62.46% of companies in the Drug Manufacturers industry. For more information about Amgen stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please visit the GuruFocus High Quality Low Capex Screener.