Merck & Co Inc (MRK, Financial) recently recorded a daily gain of 4.19%, despite a 3-month loss of -5.72%. The company's Earnings Per Share (EPS) stands at a decent 1.22. But, is the stock fairly valued? This comprehensive analysis explores Merck's valuation and financial strength to answer that question. Read on to understand the intrinsic value of Merck (MRK).

Company Overview

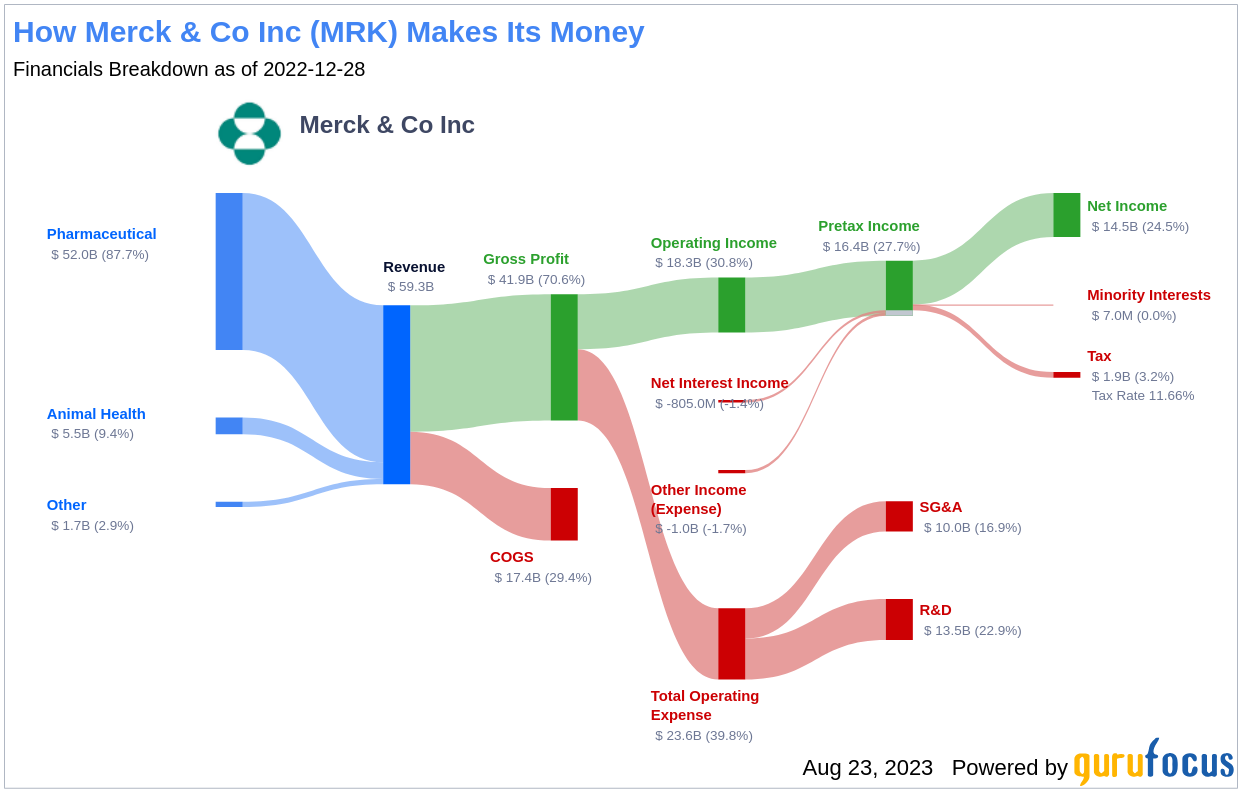

Merck & Co Inc (MRK, Financial), a leading pharmaceutical company, develops products to treat various conditions across therapeutic areas, including cardiometabolic disease, cancer, and infections. The company's immuno-oncology platform contributes significantly to its overall sales. Merck also has a robust vaccine business, with treatments for hepatitis B, pediatric diseases, HPV, and shingles. The company sells animal health-related drugs as well. Geographically, the United States generates just under half of Merck's sales.

At present, Merck's stock price sits at $111.72, slightly above its GF Value of $105.46. This comparison between the stock price and the GF Value offers an initial insight into the company's fair value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value. It's calculated based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it indicates overvaluation and potentially poor future returns. Conversely, if it's significantly below the GF Value Line, the stock may be undervalued and likely to deliver higher future returns.

Considering these factors, Merck appears to be fairly valued. Its long-term stock return is expected to align closely with its business growth rate.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with low financial strength could lead to permanent capital loss. Thus, it's crucial to review a company's financial strength before purchasing its shares. Merck's cash-to-debt ratio is 0.17, ranking worse than 77.26% of 1007 companies in the Drug Manufacturers industry. GuruFocus ranks Merck's financial strength as 5 out of 10, indicating a fair balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk, especially those demonstrating consistent profitability over the long term. Merck has been profitable for 10 out of the past 10 years, with revenues of $58.30 billion and Earnings Per Share (EPS) of $1.22 in the past 12 months. Its operating margin of 10.95% is better than 63.48% of 1035 companies in the Drug Manufacturers industry. GuruFocus ranks Merck's profitability as strong.

Growth is a crucial factor in the valuation of a company. Merck's growth ranks better than 77.41% of 912 companies in the Drug Manufacturers industry, with a 3-year average annual revenue growth of 15.4% and a 3-year average EBITDA growth rate of 23.9%.

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to assess its profitability. When the ROIC is higher than the WACC, the company is creating value for shareholders. For the past 12 months, Merck's ROIC is 4.81, and its WACC is 6.34.

Conclusion

In summary, Merck (MRK, Financial) appears to be fairly valued. The company has a fair financial condition and strong profitability. Its growth ranks better than 71.9% of 886 companies in the Drug Manufacturers industry. For more details on Merck stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.