Tech giant Apple Inc. (AAPL, Financial) has been facing significant challenges recently as China announced bans on government employees using iPhones at work. This development has potentially dire consequences as nearly 20% of Apple's annual revenues could be affected, leading to a significant drop in its market capitalization.

While the company has performed strongly in the past, it is also carrying a relatively high debt load and trading at a premium valuation. The recent restrictions in China add another layer of uncertainty. It remains a pivotal market for Apple, not only for iPhone sales, but also for its broader ecosystem of products and services.

Diversified revenue stream

Apple has a diversified revenue stream, with services, wearables and Macs contributing significantly to its top line. This diversification helps to offset the impact of slowing iPhone sales, but it may not be enough to completely mitigate the effects of the restrictions imposed by the Chinese government.

This discussion aims to provide a financial health check of Apple, utilizing the All-in-One Screener tool from GuruFocus, after it lost about $200 billion in market capitalization due to reports of iPhone restrictions in China.

China's restrictions on Apple

Recently, Beijing ordered officials working for central government agencies to refrain from using iPhones or other "foreign-branded devices" for work or even bringing these devices into the office. The precise scope and goal of these new regulations remain unclear. However, the effect is evident: Investors are spooked, and Apple's stock has taken a hit.

Specifically, shares dropped by 5.1% following the announcement. This is particularly concerning as China is Apple's third-largest market, representing 18% of its total revenue last year.

Implications of the iPhone ban

The ban on iPhones and other foreign-branded devices by Chinese government officials could have broader implications. It signals a further deterioration of relations between China and the U.S. and may lead to a more significant backlash against American companies operating in China. This could impact not only Apple, but also its suppliers and other U.S.-based tech companies.

Additionally, there is a risk that the restrictions could extend beyond government employees, affecting the broader consumer base in China.

Apple's mitigation strategies

Apple has been making efforts to localize its supply chain and reduce its dependence on China. This includes shifting some production to other countries, such as India and Vietnam. Further, the brand remains strong as its ecosystem of products and services continues to attract loyal customers worldwide.

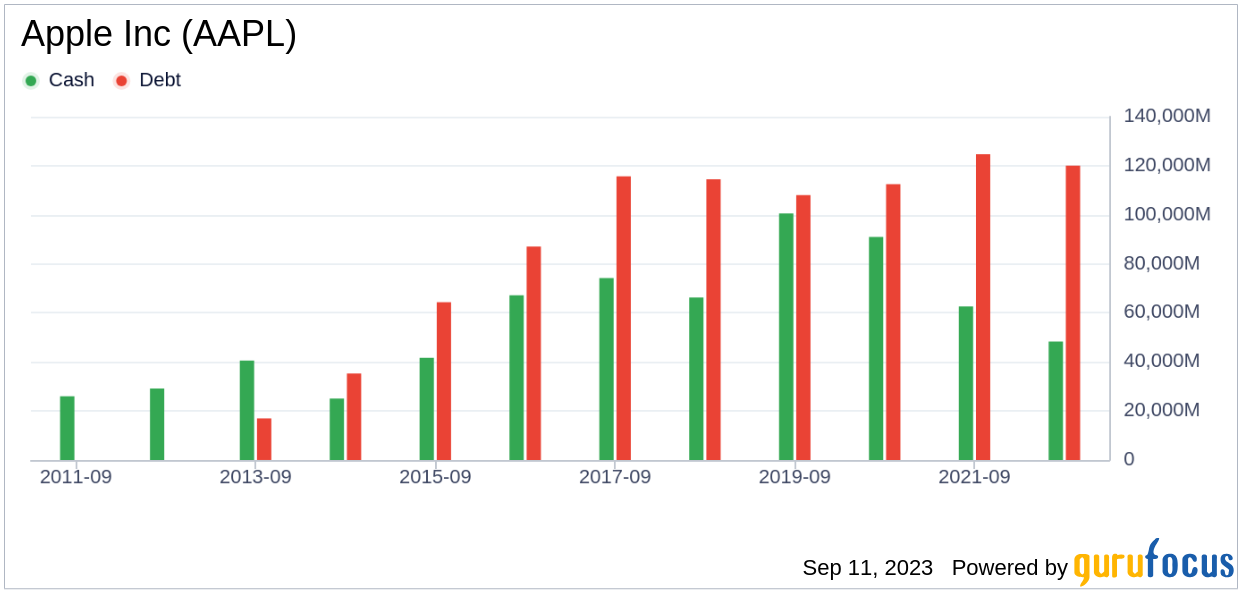

The company also has a robust balance sheet, with a significant cash pile that it can use to invest in new growth areas, buy back shares or pay down debt.

Financial overview

Despite this recent setback, Apple has demonstrated strong financial performance in the past few years. Its three-year revenue growth rate per share is 20%, which ranks better than 85.91% of companies in the hardware industry. Additionally, its three-year Ebitda growth rate per share is 22.8%, ranking better than 69.35% of competitors.

Moreover, its three-year free cash flow growth rate per share is 29.2%, ranking better than 75.71% of companies.

However, there are some areas of concern. Apple's debt-to-equity ratio is 1.81, which is worse than 94.49% of industry peers. Further, its forward price-earnings ratio of 26.81 is worse than 87.39% of companies in the same industry. Also, its current ratio is 0.98, ranking worse than 90.96% of companies in the hardware industry.

Apple is also is bracing for a deceleration in its total revenue growth over the next three to five years. Forecasts indicate a modest growth rate of 3.14%, positioning it behind 66.80% of 253 companies in the hardware sector. This suggests a period of headwinds for Apple as it contends with rising competition and a saturated market.

Investor outlook

Investors need to be realistic about their outlook on Apple. While it has been one of the best investments in the past three years, with the stock climbing by 46%, its massive size means future growth will likely be slower.

Moreover, Apple's current high valuation reduces the chance of achieving market-beating returns. Its trailing price-earnings ratio is 29.8, which is significantly higher than its average multiple of 20.2 over the past decade.

Investors should consider the potential risks associated with Apple's exposure to China and its high valuation. Diversifying their portfolio by investing in other tech companies or sectors with less exposure to China may help reduce risk. Additionally, investors should closely monitor developments in U.S.-China relations and assess the potential impact on Apple and other U.S.-based tech companies.

Takeaway

The recent iPhone restrictions in China pose a significant challenge for Apple as it derives a substantial portion of its revenue from the region. While the company has demonstrated strong financial performance in recent years, its high valuation and debt load are areas of concern.

Investors should be cautious and realistic about their outlook on Apple, considering the potential impact of these developments on its future growth and stock performance. Diversifying investments and closely monitoring developments in international relations can help manage risks associated with Apple's exposure to the region.