DaVita Inc (DVA, Financial) has recently seen a daily gain of 2.16%, and a 3-month gain of 5.17%. With an Earnings Per Share (EPS) (EPS) of 5.03, the question arises: is the stock modestly undervalued? This article provides an in-depth valuation analysis of DaVita (DVA), encouraging readers to delve into the financial intricacies of the company.

Company Introduction

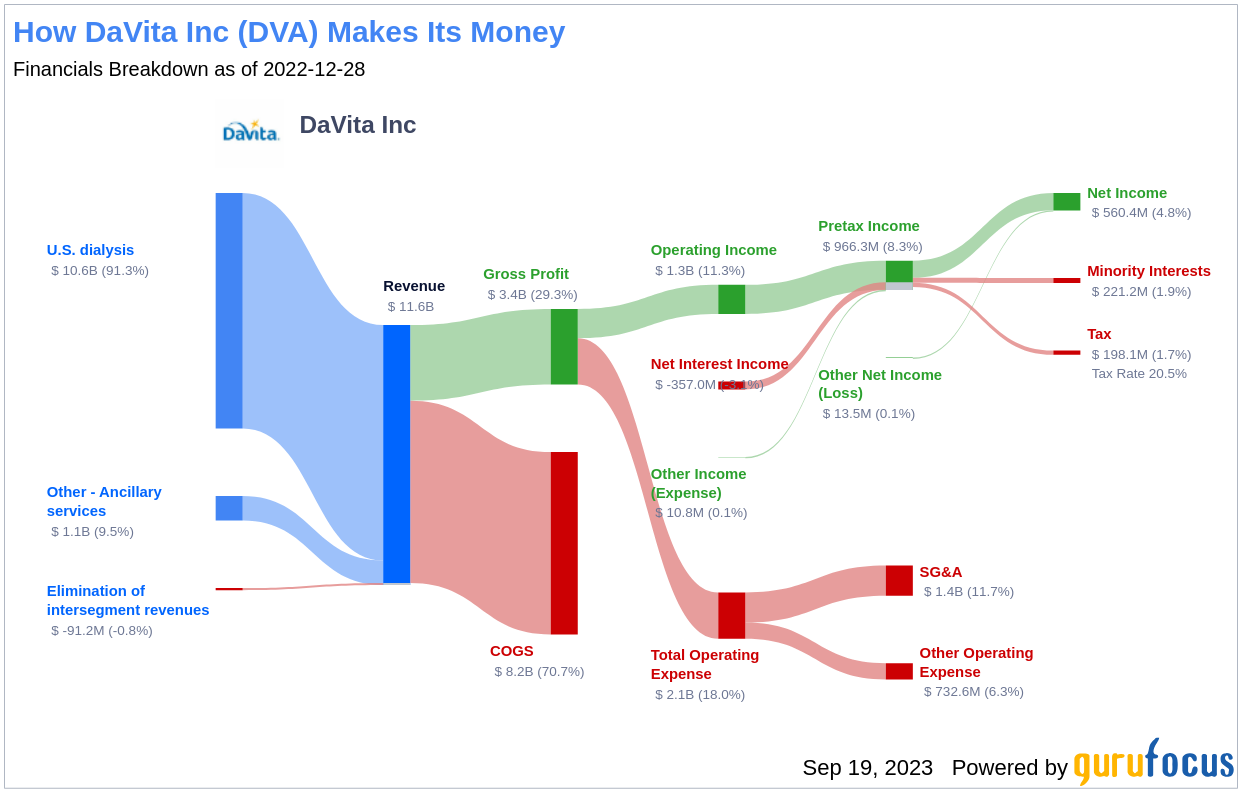

DaVita Inc is the leading provider of dialysis services in the United States, with a market share exceeding 35% by both patients and clinics. The company operates over 3,000 facilities worldwide, treating over 240,000 patients globally each year. The majority of DaVita's sales are at government reimbursement rates, primarily Medicare, while the remainder comes from commercial insurers. Despite commercial insurers representing only about 10% of the U.S. patients treated, they generate nearly all of the profits for DaVita's U.S. dialysis business.

Summarizing GF Value

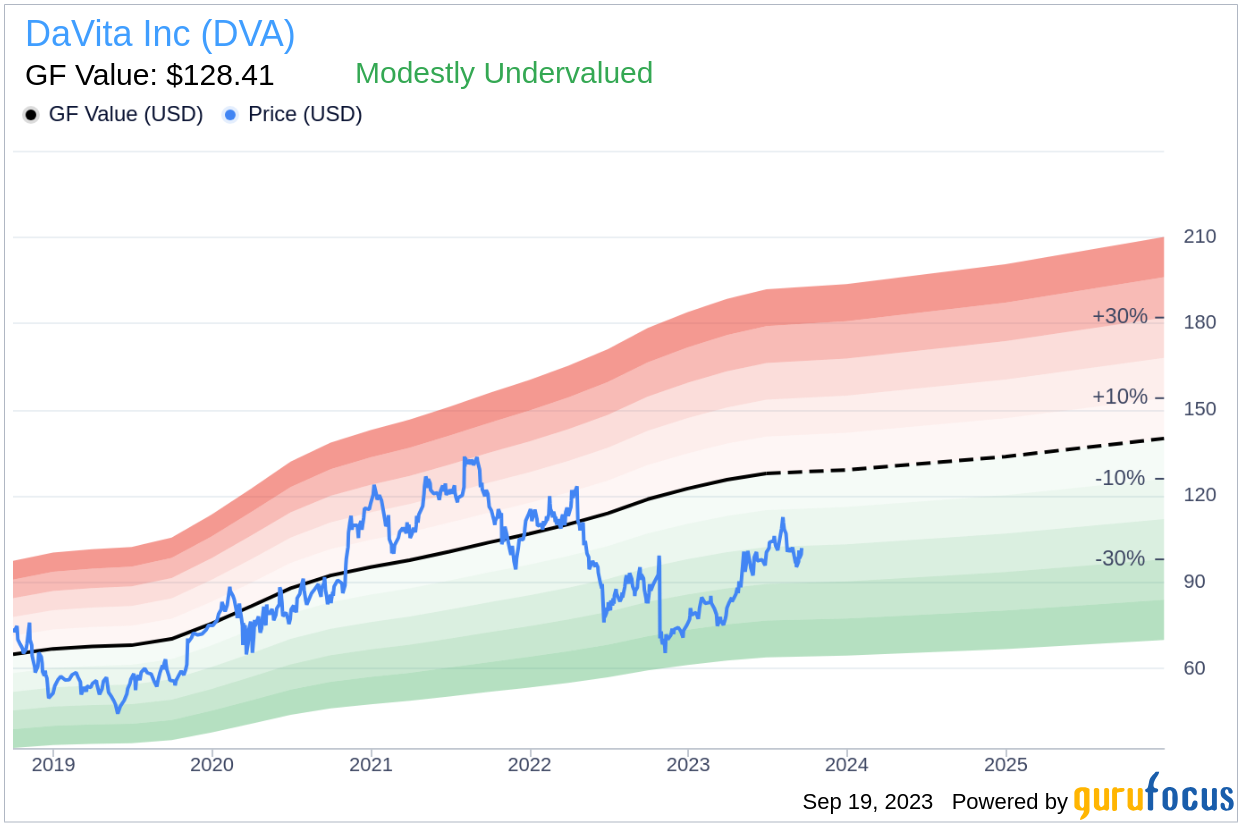

The GF Value represents the intrinsic value of a stock, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If a stock's price is significantly above the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

DaVita's stock is estimated to be modestly undervalued, according to GuruFocus Value calculation. At its current price of $101.93 per share and a market cap of $9.30 billion, the stock is likely to yield a higher long-term return than its business growth due to its relative undervaluation.

Financial Strength

Assessing the financial strength of a company is crucial before investing in its stock. Investing in companies with poor financial strength poses a higher risk of permanent loss. DaVita's cash-to-debt ratio of 0.03 is weaker than 92.84% of 656 companies in the Healthcare Providers & Services industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent long-term profitability, poses less risk. DaVita has been profitable for 10 out of the past 10 years, with an operating margin of 10.73%, ranking better than 73.44% of 655 companies in the Healthcare Providers & Services industry.

One of the most crucial factors in the valuation of a company is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. DaVita's average annual revenue growth is 17.8%, ranking better than 72.08% of 573 companies in the Healthcare Providers & Services industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another method of determining its profitability. A higher ROIC than WACC implies that the company is creating value for shareholders. For the past 12 months, DaVita's ROIC has been 6.3, and its cost of capital has been 5.31.

Conclusion

In conclusion, the stock of DaVita is estimated to be modestly undervalued. The company's financial condition is poor, but its profitability is strong. Its growth ranks better than 56.02% of 523 companies in the Healthcare Providers & Services industry. To learn more about DaVita stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.