With a daily loss of -2.75%, a 3-month loss of -1.62%, and an Earnings Per Share (EPS) of 1.45, Freeport-McMoRan Inc. (FCX, Financial) presents an intriguing case for valuation. Is the stock fairly valued? This comprehensive analysis seeks to answer this question, delving into the company's financials, growth prospects, and intrinsic value. Stay tuned for an enlightening journey into Freeport-McMoRan's valuation.

Company Overview

Freeport-McMoRan Inc. (FCX, Financial) is an international mining company with diverse assets and proven mineral reserves of copper, gold, and molybdenum. The company operates in various regions, including the Grasberg minerals district in Indonesia, the Morenci minerals district in Arizona, and the Cerro Verde operation in Peru. Its primary revenue comes from copper sales. Freeport-McMoRan boasts a market cap of $56 billion and a stock price of $39.09 per share, aligning closely with its GF Value of $40.56, indicating a fair valuation.

Understanding GF Value

The GF Value is a proprietary valuation method that estimates a stock's intrinsic value. It factors in historical trading multiples, a GuruFocus adjustment based on past performance and growth, and future business performance estimates. The GF Value Line provides a visual representation of a stock's fair trading value. If a stock's price significantly deviates from the GF Value Line, it may be over or undervalued, impacting future returns.

For Freeport-McMoRan, the GF Value suggests a fair valuation. This means the long-term return of its stock is likely to align with its business growth rate.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

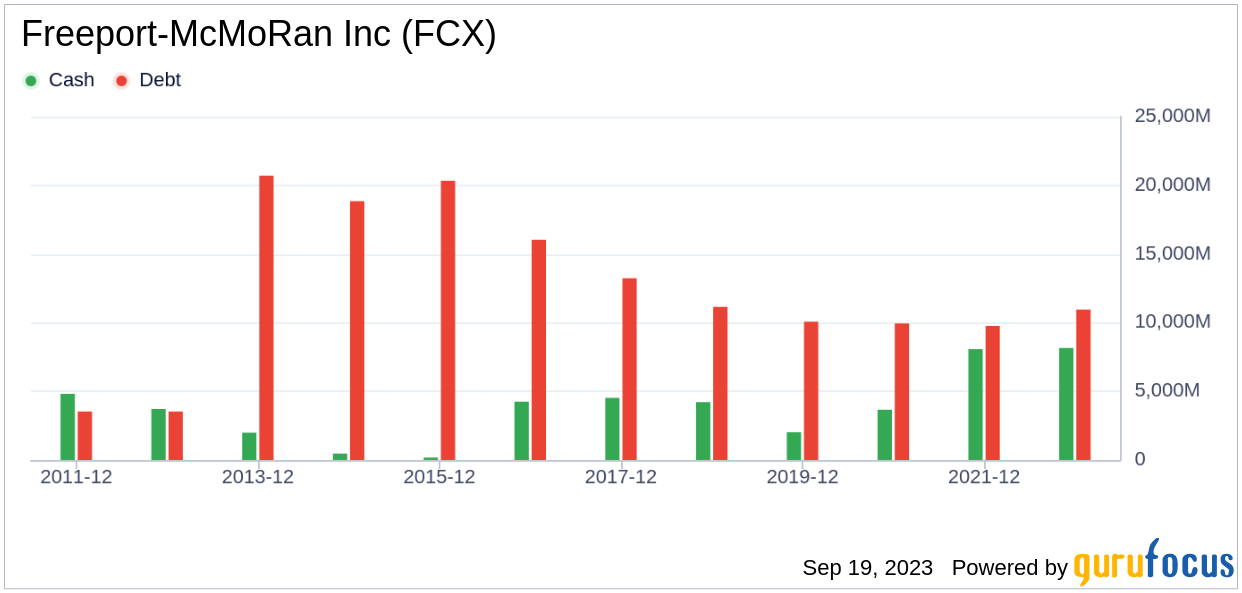

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, assessing a company's financial strength is crucial before investing. Key indicators such as the cash-to-debt ratio and interest coverage offer insight into a company's financial health. Freeport-McMoRan's cash-to-debt ratio of 0.7 ranks lower than 75.46% of companies in the Metals & Mining industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies typically carries less risk, especially if the company demonstrates consistent profitability over the long term. Companies with high profit margins often offer better performance potential. Freeport-McMoRan has been profitable for 6 out of the past 10 years, with revenues of $21.90 billion and Earnings Per Share (EPS) of $1.45 in the past 12 months. Its operating margin of 25.14% ranks better than 86.42% of companies in the Metals & Mining industry, indicating fair profitability.

Growth is a crucial factor in a company's valuation. Faster-growing companies create more value for shareholders, especially when the growth is profitable. Freeport-McMoRan's 3-year average annual revenue growth of 16.5% ranks better than 62.05% of companies in the Metals & Mining industry. Its 3-year average EBITDA growth rate of 58.4% ranks better than 93.06% of companies in the industry, indicating impressive growth.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to finance its assets. If ROIC exceeds WACC, the company is likely creating value for its shareholders. In the case of Freeport-McMoRan, its ROIC of 9.17 is less than its WACC of 13.7.

Conclusion

In conclusion, Freeport-McMoRan's stock shows signs of being fairly valued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 93.06% of companies in the Metals & Mining industry. For more details about Freeport-McMoRan's stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.