On September 20, 2023, Robert Genter, the Sector President of Science Applications International Corp (SAIC, Financial), sold 3,557 shares of the company. This move is part of a series of insider sell transactions that have been taking place over the past year.

Robert Genter is a key figure in the Science Applications International Corp, a leading technology integrator providing full life cycle services and solutions in the technical, engineering, intelligence, and enterprise information technology markets. The company primarily serves the U.S. federal government, but also has commercial customers in selected markets.

Over the past year, the insider has sold a total of 16,241 shares and has not made any purchases. This trend is reflected in the company's overall insider transaction history, which shows zero insider buys and six insider sells over the same timeframe.

The relationship between insider sell transactions and the stock price is often closely watched by investors. In the case of SAIC, the stock was trading at $109.79 per share on the day of the insider's recent sell, giving the company a market cap of $5.796 billion.

The company's price-earnings ratio stands at 11.98, which is lower than both the industry median of 27.27 and the company’s historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical performance.

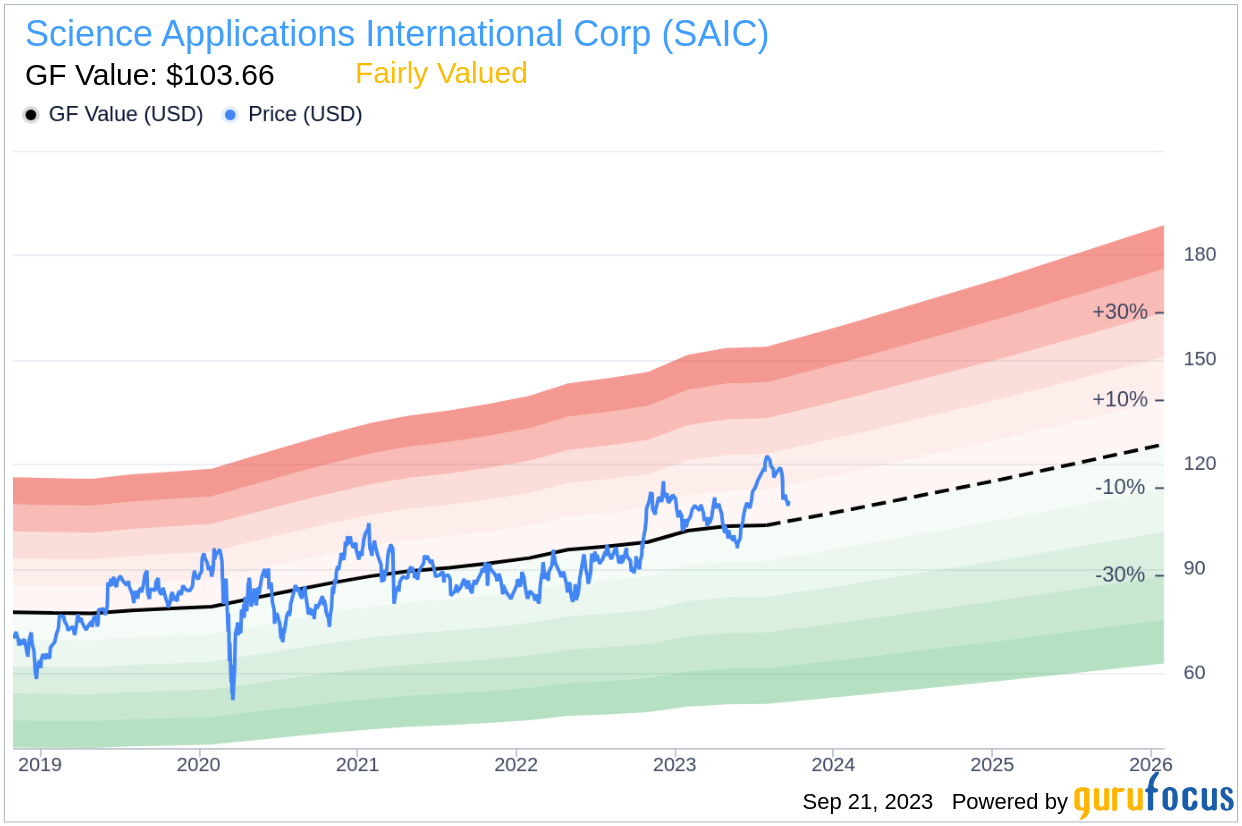

However, when considering the GuruFocus Value of $103.66, the price-to-GF-Value ratio is 1.06, indicating that the stock is fairly valued. The GF Value is a proprietary estimate of intrinsic value developed by GuruFocus, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, the recent sell transaction by Robert Genter, along with the overall trend of insider sells at SAIC, may raise questions among investors. However, the company's valuation metrics suggest that the stock is fairly valued at its current price. As always, investors should consider a range of factors and conduct their own due diligence when making investment decisions.