Investors looking to identify high-quality companies should consider those names that have consistently shown to generate a strong return on invested capital. This shows that these companies are successfully using capital to generate profits.

At the same time, investors should make sure the return is higher than the company’s weighted average cost of capital. If it is not, this means the company’s invested capital is not being used effectively to generate profits.

Names with high ROIC that are also undervalued by at least 10% relative to their intrinsic value can mean even greater returns in the future as the market is likely not pricing their ability to generate profits correctly.

As of Sept. 21, the All-in-One Screener identified several names that had a ROIC that was at least 20% ahead of its WACC and were trading at a discount to its intrinsic value, including Domino’s Pizza Inc. (DPZ, Financial), Texas Instruments Inc. (TXN, Financial), Ulta Beauty Inc. (ULTA, Financial) and Yum Brands Inc. (YUM, Financial).

Domino’s

First up is Domino’s (DPZ, Financial), which is the largest pizza company in the world based on revenue. The company has nearly 20,000 locations in close to 100 counties around the world. It has a market capitalization of $13.5 billion and has generated revenue of $5.5 billion over the last year.

Domino’s has been very active in building its digital network over the years. The company was one of the first restaurant chains to institute curbside pickup, something that is now offered by nearly every major restaurant. Domino’s also has hotspot delivery, which means customers can have their food delivered to outdoor locations such as beaches, parks and stadiums.

This heavy investment has resulted in an extremely high ROIC of 50.5%. This is almost unheard of in the quick-service restaurant industry. The WACC is just 9.1%, meaning Domino’s is one of the best in the marketplace at successfully using capital to produce profits.

A GF Score of 94 out of 100 indicates the company has the potential for outperformance due to its high ratings for profitability, momentum and growth. Financial strength and value are more middling, however.

The stock’s GF Value Line shows Domino’s is modestly undervalued using its historical ratios, past financial performance and projections for future earnings. With a price-to-GF Value ratio of 0.86, investors could see a return of more than 16% if the stock were to reach its GF Value. This projection does not include the current yield of 1.3%, so total returns could be even greater.

Texas Instruments

The second name for consideration is Texas Instruments (TXN, Financial), a leading designer, manufacturer and marketer of semiconductors. The company operates two business segments, including Analog and Embedded Processing. Texas Instruments is valued at $147 billion and has gained sales of almost $19 billion over the last year.

Texas Instruments is the lone technology name that met the criteria of a having high ROIC and low WACC, while trading at a steep discount to fair value. This is impressive as there are many technology companies that can deliver a strong ROIC, but are not as effective in deploying capital to do so. Texas Instruments has a ROIC of 46.2%, which compares very favorably to a WACC of 9.5%.

The company also has a GF Score of 94 out of 100, implying the potential for outperformance. This ranking is powered by a perfect score for growth, a near-perfect showing for profitability and moderate scores for financial strength, momentum and value.

The stock’s GF Value shows Texas Instruments to be modestly undervalued. If the stock were to reach its GF Value of $185.96, then shareholders would see a 14.7% return from the current price. The stock also has one of the higher yields in the technology sector at 3.1%, which could push total returns into the high-teens range.

Ulta Beauty

Next up is Ulta Beauty (ULTA, Financial), a specialty beauty retailer. The company sells beauty products such as cosmetics, haircare, skin care, fragrances and other related products. It has a market capitalization of just over $20 billion and recorded almost $11 billion of sales in the last year.

Ulta Beauty has a vast array 25,000 products that it can sell across its nearly 1,400 stores in the U.S. The company also has an extensive e-commerce business where customers can purchase their favorite products.

The company has a ROIC of 33% against a WACC of 9.6%. This is the lowest ROIC minus WACC of the names discussed, but it is still one of the highest in the company’s industry.

The GF Score of 97 of 100, which is one of the highest scores in the entire market, suggests Ulta Beauty could see very high returns. The company has perfect scores for growth and profitability, a high score for value and moderate showings for financial strength and momentum.

The GF Value Line also believes returns could be excellent. With a price-to-GF Value ratio of 0.74, investors could see a return of 35% from the most recent closing price.

Yum Brands

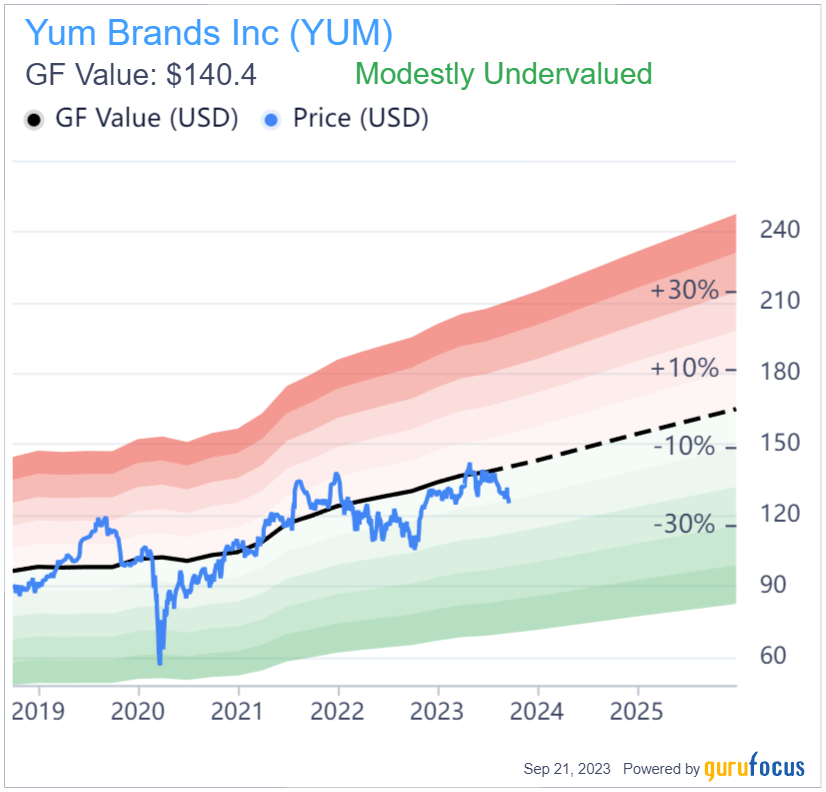

Rounding out the list is Yum Brands (YUM, Financial), which owns fast-food chains KFC, Pizza Hut and Taco Bell. The company is valued at $35 billion and has generated $7 billion of revenue within the last 12 months.

Yum Brands spun off its China operations in late-2016 into Yum China Holdings Inc. (YUMC, Financial), but the company still has a massive global footprint, with more than 54,000 locations spread across 155 countries around the world. Nearly 60% of stores are in international markets, with most locations franchised.

The company has a ROIC of 39% compared to its WACC of 8.3%. Like Domino’s, this ranks as one of the best ROICs in the restaurant industry.

Yum Brands has a GF Score of 84 out of 100, implying modest return potential going forward. Top scores in momentum and profitability are offset by middling results for financial strength, growth and value.

Still, the GF Value suggests the stock is modestly undervalued. Reaching its GF Value would result in a 12% return. Shares yield 1.9%.

Final thoughts

Measuring return on invested capital versus weighted average cost of capital is an excellent way for investors to see how successful companies are at generating profits. Companies that have an ROIC well above their WACC are among the best at doing so.

Domino’s, Texas Instruments, Ulta Beauty and Yum Brands are four companies that are the best within their industry at producing extremely high ROIC while also posting low WACC. All four stocks are also trading at a double-digit discount to their fair value, according to GuruFocus. This could mean that growth and value investors alike might find these four stocks attractive.