On October 2, 2023, renowned investor Warren Buffett (Trades, Portfolio) reduced his stake in HP Inc (HPQ, Financial), a leading player in the PC and printing markets. This article provides an in-depth analysis of the transaction, Buffett's investment philosophy, and the current state of HP Inc.

Details of the Transaction

The transaction saw Buffett reduce his holdings in HP Inc by 5,125,638 shares, representing a -4.83% change. The shares were traded at a price of $25.76 each. Following the transaction, Buffett's total holdings in HP Inc stand at 100,922,113 shares, accounting for 0.75% of his portfolio. This reduction has a minor impact of -0.04% on Buffett's portfolio. Notably, Buffett's holdings represent 10.21% of HP Inc's total shares.

Profile of Warren Buffett (Trades, Portfolio)

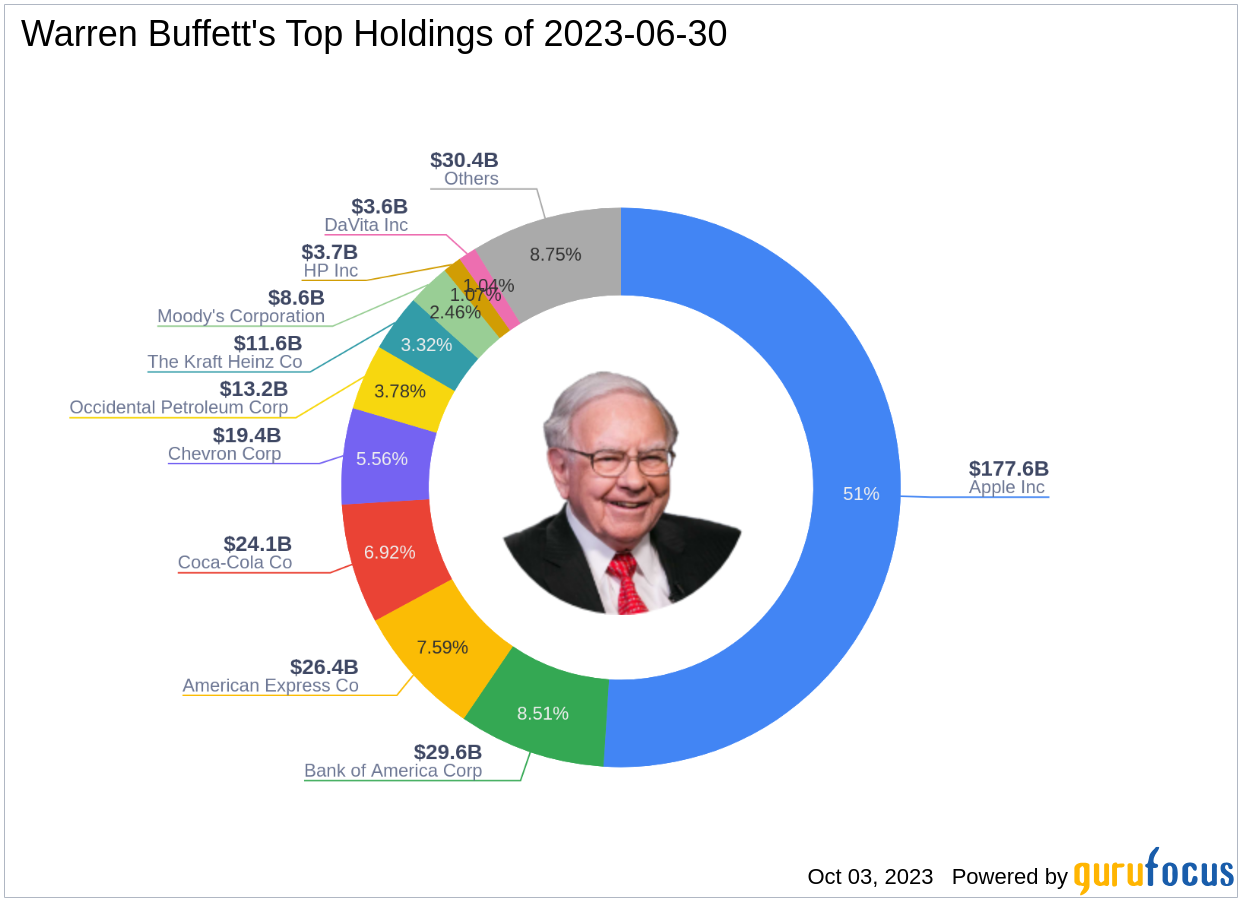

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is one of the most successful and respected investors in history. He studied under the legendary Benjamin Graham at Columbia University, who had a significant influence on Buffett's investment strategies. Buffett is the Chairman of Berkshire Hathaway, which he transformed from a textile company into a major insurance conglomerate. His investment philosophy is rooted in value investing, an adaptation of Benjamin Graham's approach. Buffett seeks to acquire great companies trading at a discount to their intrinsic value and hold them for a long time. He currently holds 49 stocks in his portfolio, with a total equity of $348.19 billion. His top holdings include Apple Inc (AAPL, Financial), American Express Co (AXP, Financial), Bank of America Corp (BAC, Financial), Chevron Corp (CVX, Financial), and Coca-Cola Co (KO, Financial). The technology and financial services sectors dominate his portfolio.

Overview of HP Inc

HP Inc, formerly known as Hewlett-Packard, is a titan in the PC and printing markets. The company has focused on these markets since it exited IT infrastructure in 2015 with the split from Hewlett Packard Enterprise. HP Inc has a broad and global customer base, with only one-third of sales coming from the U.S. The company's market capitalization stands at $25.37 billion, with a current stock price of $25.67. According to GuruFocus, HP Inc's stock is modestly undervalued, with a GF Value of $31.86. The company's GF Score stands at 88/100, indicating good outperformance potential.

Analysis of HP Inc's Stock

HP Inc's stock has a PE Percentage of 11.07, indicating that the company is profitable. The company's Financial Strength is ranked 5/10, while its Profitability Rank and Growth Rank are both 8/10. The GF Value Rank is 7/10, and the Momentum Rank is 10/10. The company's Piotroski F-Score is 6, and its Altman Z score is 1.92. HP Inc's interest coverage is 9.44, indicating that the company can comfortably meet its interest expenses.

Other Gurus' Investments in HP Inc

Other notable gurus who hold HP Inc stock include Dodge & Cox, Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). Berkshire Hathaway Inc, led by Warren Buffett (Trades, Portfolio), holds the most shares of HP Inc.

Conclusion

In conclusion, Warren Buffett (Trades, Portfolio)'s recent reduction in his stake in HP Inc is a significant move that reflects his investment strategy. Despite the reduction, HP Inc remains a substantial part of Buffett's portfolio. The company's strong financial performance, as indicated by its profitability and growth ranks, suggests that it remains a valuable investment. However, investors should always conduct their own due diligence before making investment decisions.