On December 30, 2022, Bank of Nova Scotia marked a significant portfolio addition by acquiring 4,204,481 shares of Skeena Resources Ltd (SKE, Financial), a prominent player in the Metals & Mining industry. This transaction, executed at a price of $5.32 per share, not only reflects a strategic investment but also highlights the firm's confidence in Skeena Resources. The acquisition resulted in a new holding for the bank, establishing a 0.07% impact on its portfolio, with the firm now holding a 5.40% stake in Skeena Resources.

Bank of Nova Scotia: A Profile of Strategic Investments

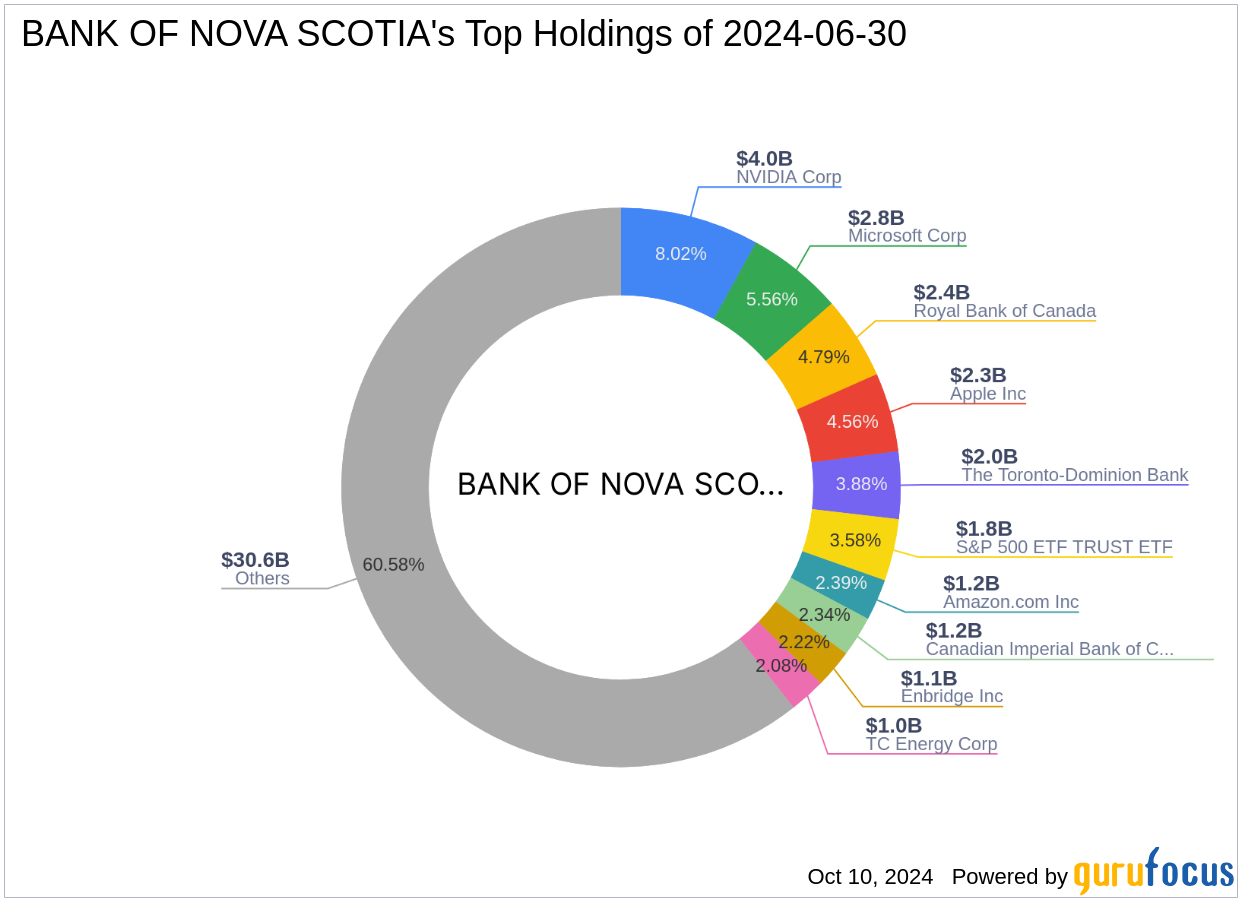

Bank of Nova Scotia, headquartered at 44 King Street West, Toronto, is a globally recognized financial institution known for its robust investment strategies. With top holdings in major corporations like Apple Inc (AAPL, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial), the firm manages an equity portfolio worth approximately $50.51 billion. The firm's investment philosophy emphasizes diversification and strategic stakeholding, particularly in the Technology and Financial Services sectors, which are its top sectors of focus.

Exploring Skeena Resources Ltd

Skeena Resources Ltd, based in Canada, is a mining exploration company dedicated to the development of precious and base metal properties in British Columbia's Golden Triangle. Since acquiring the past-producing Eskay Creek mine, the company has focused on revitalizing this historically rich mining area. Despite its ambitious projects, Skeena's market capitalization stands at $921.835 million, with a current stock price of $8.586869, reflecting a significant 61.41% gain since the Bank of Nova Scotia's investment.

Financial and Market Performance Analysis

Skeena Resources exhibits a complex financial landscape. With a Profitability Rank of 1/10 and a Growth Rank of 0/10, the company faces significant challenges. However, its balance sheet remains relatively strong with a rank of 7/10. The GF Score of 39/100 indicates potential concerns about its future performance, although its stock has shown considerable momentum with a 6-month index of 58.87.

Impact on Bank of Nova Scotia’s Portfolio

The acquisition of Skeena Resources shares has modestly diversified Bank of Nova Scotia's investment portfolio, which is heavily skewed towards technology and financial services. This move into the metals and mining sector could hedge against volatility in its traditional sectors. The 0.07% portfolio impact suggests a cautious but strategic entry into this new industry for the firm.

Industry and Future Outlook

The Metals & Mining industry, where Skeena operates, is known for its high volatility and potential for significant returns. The future performance of Skeena Resources will largely depend on commodity prices and the company's ability to manage its projects efficiently. Given the current market dynamics and Skeena's ongoing development efforts, investors should closely monitor these factors.

Comparative and Future Performance Insights

Compared to industry standards, Skeena's performance has been mixed. While the stock has outperformed since the Bank of Nova Scotia's acquisition, its long-term metrics, such as ROE and ROA, remain concerning. The company's future trajectory will be crucial for investors, especially those looking for growth in the volatile mining sector.

This strategic acquisition by Bank of Nova Scotia not only diversifies its portfolio but also positions it within an industry poised for potential resurgence. Investors and market watchers will undoubtedly keep a close eye on how this investment plays out in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.