Overview of the Recent Transaction

On October 4, 2024, Deep Track Capital, LP (Trades, Portfolio) marked a significant portfolio addition by acquiring 68,415.6 shares of Reneo Pharmaceuticals Inc (RPHM, Financial). This transaction, categorized as a new holding, was executed at a price of $18.20 per share. The acquisition not only diversifies Deep Track Capital’s investment portfolio but also underscores its strategic interest in the biotechnology sector, particularly in companies involved in rare genetic mitochondrial diseases.

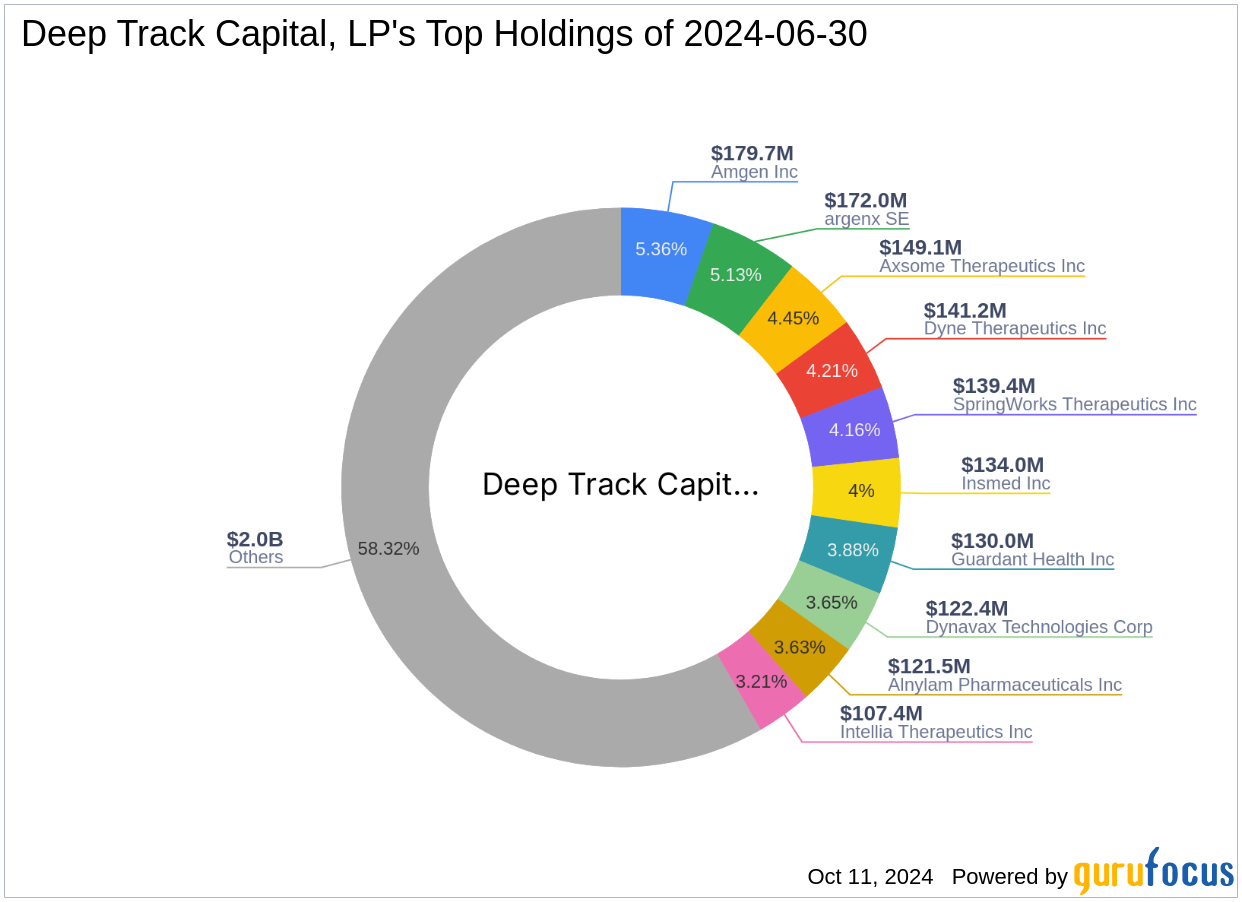

Insight into Deep Track Capital, LP (Trades, Portfolio)

Deep Track Capital, LP (Trades, Portfolio), headquartered at 200 Greenwich Avenue, Greenwich, CT, is a prominent investment firm managing an equity portfolio worth approximately $3.35 billion. The firm is known for its keen focus on the healthcare sector, particularly biotechnology and pharmaceuticals. With 68 stocks in its portfolio, Deep Track Capital maintains a strategic position in companies like Amgen Inc (AMGN, Financial), Axsome Therapeutics Inc (AXSM, Financial), and several others that underscore its investment philosophy centered on high-growth potential in biotech innovations.

About Reneo Pharmaceuticals Inc

Reneo Pharmaceuticals, based in the USA, is a clinical-stage pharmaceutical company that debuted on the stock market on April 9, 2021. With a current market capitalization of $60.84 million, Reneo is dedicated to developing therapies for rare genetic mitochondrial diseases. These diseases typically involve mitochondrial dysfunction, leading to inadequate ATP production, essential for energy in cellular processes. Reneo’s leading product, REN001, aims to modulate genes crucial to metabolism and ATP generation.

Financial Metrics and Stock Performance

As of the latest data, Reneo Pharmaceuticals is trading at $18.20, reflecting a year-to-date increase of 9.64%. However, since its IPO, the stock has seen a significant decline of 88.1%. The company currently does not have a PE Ratio, indicating it is not generating profits. The GF Score of 36/100 suggests poor future performance potential, with specific weaknesses in profitability and growth metrics.

Impact of the Trade on Deep Track Capital’s Portfolio

The recent acquisition of Reneo Pharmaceuticals shares represents a 0.04% position in Deep Track Capital’s portfolio, indicating a moderate but strategic investment. This move aligns with the firm’s broader strategy of investing in high-potential biotechnology firms, despite the current financial metrics of Reneo.

Market Analysis and Future Outlook

Reneo Pharmaceuticals operates in the competitive biotechnology industry, focusing on niche markets like rare mitochondrial diseases. The future growth prospects of Reneo depend heavily on the clinical success of its therapies, which could lead to substantial rewards for investors like Deep Track Capital. However, the path is fraught with clinical and regulatory challenges.

Comparative and Future Valuation Analysis

When compared to industry standards, Reneo Pharmaceuticals shows potential in innovation but lags in financial health, as evidenced by its low profitability and growth ranks. The stock’s valuation metrics and investment ranks, such as GF Value Rank and Momentum Rank, are currently not favorable, which could be a concern for potential investors.

Conclusion

Deep Track Capital’s recent investment in Reneo Pharmaceuticals highlights a calculated move to capitalize on future advancements in mitochondrial disease treatments. While the current financial health of Reneo poses risks, the potential for significant clinical breakthroughs could justify this investment. Investors should watch closely as Reneo progresses through its clinical trials, which will be pivotal in determining the stock's future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.