Overview of Chuck Royce (Trades, Portfolio)'s Recent Trade

On September 30, 2024, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a significant transaction involving the shares of Amtech Systems Inc (ASYS, Financial), a key player in the semiconductor industry. The firm reduced its holdings by 25,496 shares at a trading price of $5.80 per share. Following this transaction, the firm's total holding in Amtech Systems Inc stands at 1,711,172 shares, representing a 12.03% ownership in the company and accounting for 0.09% of the firm's portfolio.

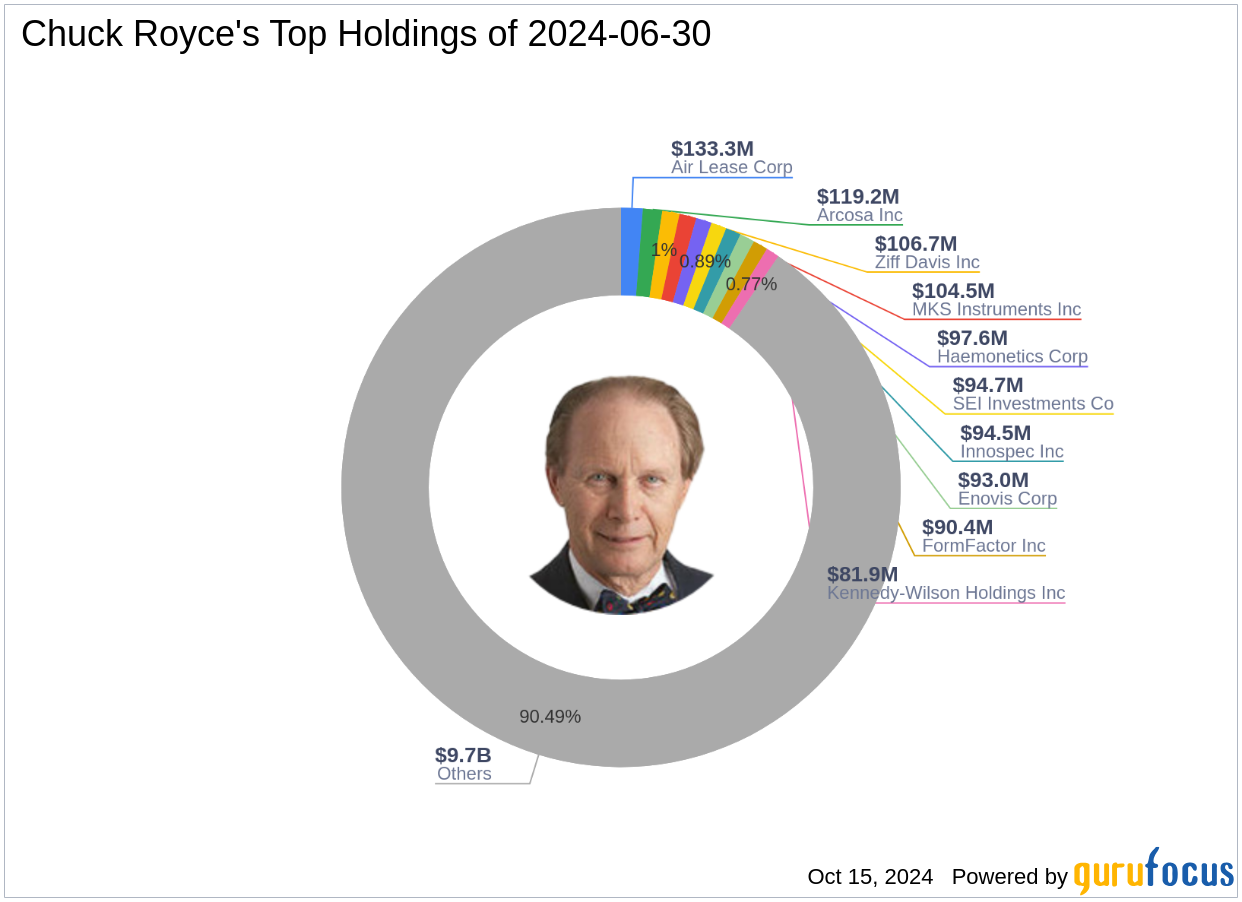

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap investments, the firm targets companies with market capitalizations up to $10 billion, seeking stocks that trade below their estimated enterprise value. This approach emphasizes a strong balance sheet, a successful business track record, and potential for future profitability. Chuck Royce (Trades, Portfolio)'s educational background includes a bachelor's degree from Brown University and an MBA from Columbia University.

Introduction to Amtech Systems Inc

Amtech Systems Inc, listed under the ticker ASYS, operates within the semiconductor sector. Founded on September 7, 1984, the company specializes in manufacturing capital equipment essential for the production of semiconductor devices, LEDs, and electronic assemblies. Amtech's offerings include thermal processing equipment and wafer polishing products, catering to semiconductor manufacturers and various industries under its Semiconductor and Material and Substrate segments.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent reduction in Amtech Systems Inc shares by Chuck Royce (Trades, Portfolio)'s firm has slightly altered its investment landscape. Holding 1,711,172 shares, the firm maintains a significant position in the company, reflecting a strategic adjustment rather than a complete exit. This move aligns with the firm's investment philosophy of adjusting positions based on perceived enterprise value and market conditions.

Current Market Context and Amtech's Position

The semiconductor industry, where Amtech Systems Inc operates, is currently experiencing dynamic shifts influenced by global supply chain adjustments and technological advancements. Despite a challenging market environment, Amtech has maintained a competitive stance within its niche, supported by its specialized product offerings.

Financial Health and Stock Valuation

Amtech Systems Inc's financial health shows mixed signals; it holds a Financial Strength rank of 6/10. However, its profitability and growth metrics suggest areas of concern, with a Profitability Rank of 5/10 and a Growth Rank of 3/10. The stock is currently trading below its GF Value, indicating it may be undervalued, which aligns with Chuck Royce (Trades, Portfolio)'s value investing strategy.

Comparative Insights and Market Sentiment

Comparatively, First Eagle Investment (Trades, Portfolio) Management, LLC holds a larger share in Amtech, suggesting a strong interest from institutional investors. The market sentiment towards Amtech Systems Inc appears cautiously optimistic, given its potential undervaluation and strategic market position.

Conclusion

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm in Amtech Systems Inc reflects a strategic portfolio adjustment in line with its value investing philosophy. While the firm reduced its stake, it still maintains a significant position, indicating a sustained belief in the company's value proposition. Investors should consider both the firm's strategic moves and Amtech's current market valuation in their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.