Overview of the Recent Transaction

On September 30, 2024, Chuck Royce (Trades, Portfolio), through Royce & Associates, made a notable addition to its investment portfolio by acquiring 1,154,000 shares of Gencor Industries Inc. (GENC, Financial). This transaction, executed at a price of $20.86 per share, represents a significant move, enhancing the firm's stake in the company. The addition has increased the firm's total holdings in Gencor Industries, reflecting a strategic investment decision in the farm and heavy construction machinery sector.

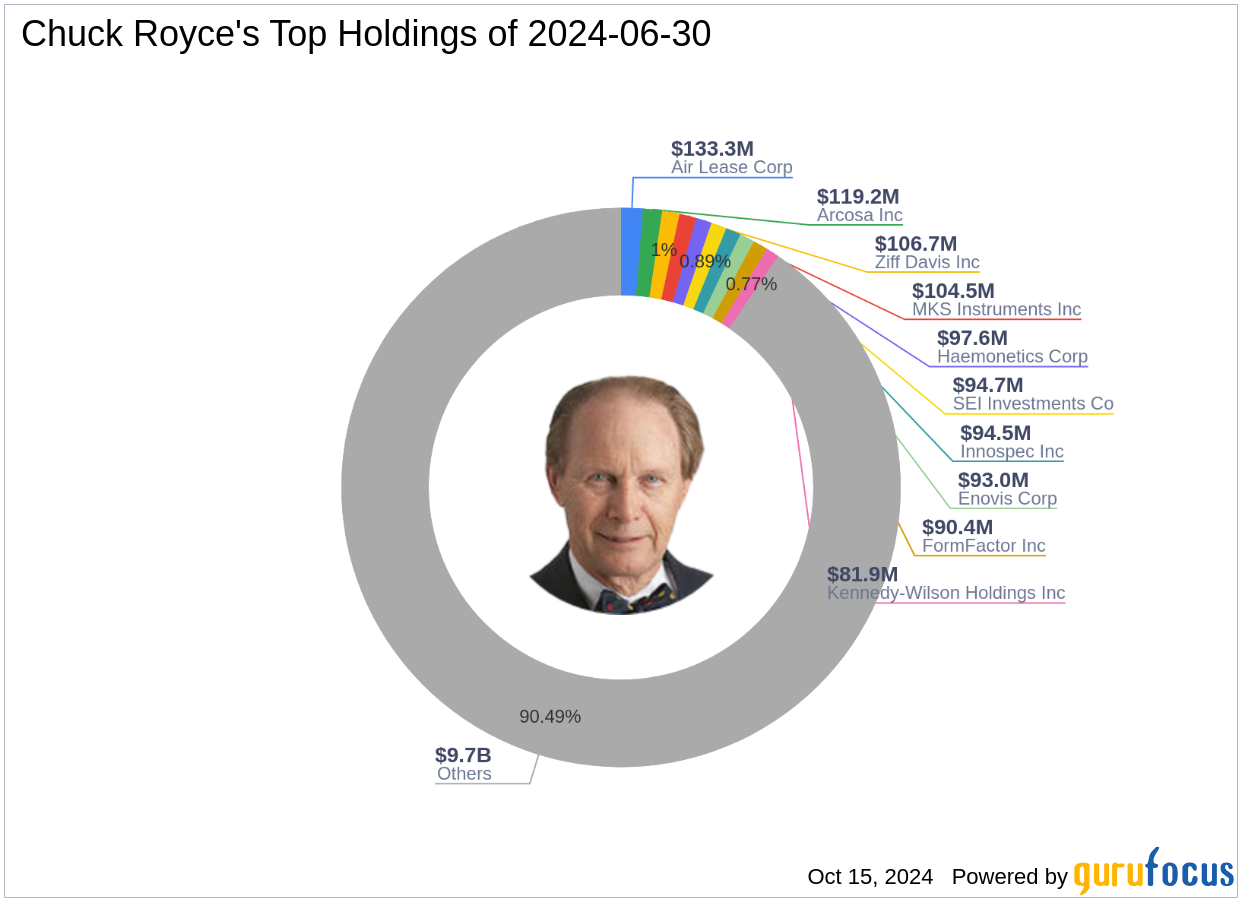

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a distinguished figure in the investment community, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a robust educational background from Brown University and an MBA from Columbia University, Royce has carved a niche in small-cap investing. The firm's investment philosophy focuses on identifying undervalued small to mid-sized companies with strong financials and potential for future profitability. This approach has consistently guided the firm's investment decisions, aiming to secure stocks at prices less than their estimated enterprise value.

Insight into Gencor Industries Inc.

Gencor Industries Inc., based in the USA, operates within the heavy machinery sector, specializing in equipment for highway construction. Since its IPO on July 15, 2003, the company has focused on manufacturing essential construction materials and environmental control equipment. With a market capitalization of approximately $292.35 million and a PE ratio of 18.13, Gencor stands as a significant player in its industry. Despite being currently assessed as modestly overvalued with a GF Value of $15.55, the company maintains a solid financial foundation and operational success.

Analysis of the Trade's Impact

The recent acquisition by Chuck Royce (Trades, Portfolio) represents a 0.23% increase in the firm's portfolio, with Gencor Industries now constituting 9.35% of the firm's total holdings. This strategic decision likely stems from Gencor's strong Financial Strength and consistent performance in the heavy machinery sector. The firm's commitment to investing in companies with robust financial health and growth potential is evident in this transaction.

Comparative Analysis with Other Major Investors

While Chuck Royce (Trades, Portfolio) holds a significant position in Gencor Industries, other notable investors like GAMCO Investors and First Eagle Investment (Trades, Portfolio) also maintain stakes in the company. This shared interest by multiple renowned investors underscores the perceived value and potential of Gencor Industries within the investment community.

Sector and Industry Trends

The farm and heavy construction machinery industry is pivotal in supporting infrastructure development and construction activities globally. Gencor Industries, with its specialized product line and strategic market position, is well-poised to capitalize on industry growth driven by increasing construction demands and technological advancements in machinery.

Conclusion

Chuck Royce (Trades, Portfolio)'s recent investment in Gencor Industries highlights a strategic move aligned with the firm's philosophy of value investing in financially sound and potentially profitable companies. This acquisition not only diversifies the firm's portfolio but also positions it to benefit from the growth trajectories in the heavy machinery sector. For value investors, this development offers a noteworthy insight into potential market opportunities and investment strategies in similar industrial domains.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.