Overview of the Recent Trade by WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)

On September 30, 2024, WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) executed a significant transaction involving the shares of Fortune Rise Acquisition Corp (FRLA, Financial). The firm decided to reduce its holdings by 1,595 shares, resulting in a new total of 342,518 shares valued at $11.38 each. This move reflects a strategic adjustment in the firm's portfolio, where FRLA now represents a 0.08% position, indicating a substantial engagement by the firm in this entity.

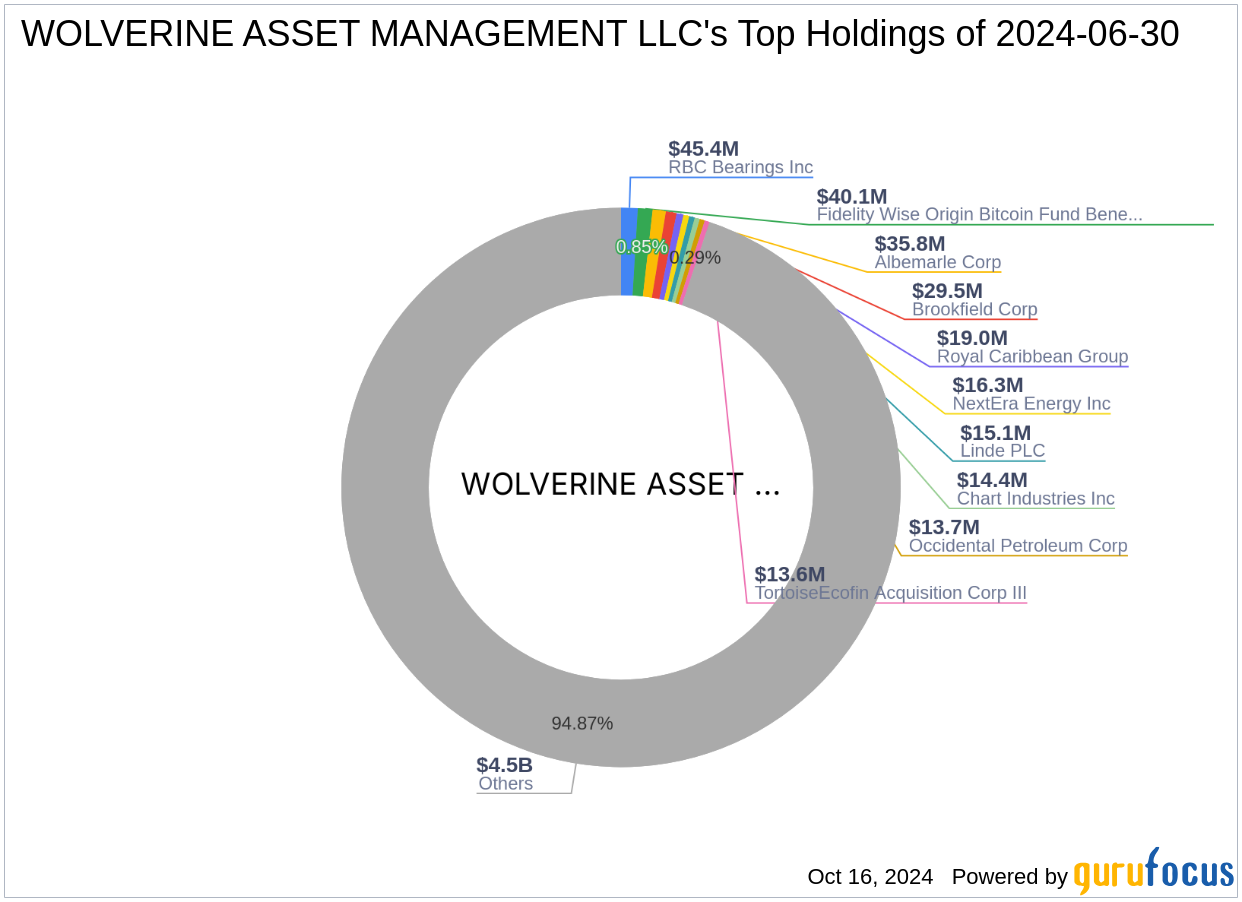

Profile of WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)

Located at 175 West Jackson, Chicago, IL, WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) is a prominent investment firm managing an equity portfolio worth approximately $4.73 billion. The firm holds a diverse array of 1,547 stocks, with top holdings including RBC Bearings Inc (RBC, Financial) and Brookfield Corp (BN, Financial). The firm's investment philosophy focuses on leveraging market dynamics to optimize portfolio returns, primarily concentrating on the Financial Services and Industrials sectors.

Introduction to Fortune Rise Acquisition Corp (FRLA, Financial)

Fortune Rise Acquisition Corp, based in the USA, operates as a blank check company. Since its IPO on December 27, 2021, the company has aimed to execute a merger, capital stock exchange, asset acquisition, or similar business combination. Currently, FRLA has a market capitalization of $71.309 million, with a stock price of $11.37, reflecting a 14.85% increase since its IPO and a 3.74% rise year-to-date.

Financial and Market Performance of FRLA

Despite its operational model, FRLA's financial metrics such as ROE and ROA are in the negative, standing at -5.06% and -3.81% respectively. The firm's interest coverage ratio is exceptionally high, indicating minimal debt-related risk. However, the company's GF Score of 25 suggests limited potential for future performance, with specific weaknesses in growth and profitability as indicated by its ranks.

Impact of the Trade on WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)’s Portfolio

The recent reduction in FRLA shares by WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) slightly alters the composition of the firm's portfolio. Holding 0.08% of the portfolio in FRLA, the firm maintains a significant interest in the company, reflecting a strategic stance on its potential or aligning with broader portfolio adjustments.

Sector and Market Analysis

WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)'s focus on Financial Services and Industrials is evident from its top holdings. The firm's strategy in these sectors may provide a backdrop to the recent transaction with FRLA, a company within the Diversified Financial Services industry, suggesting a tactical move aligned with broader market trends and internal portfolio benchmarks.

Future Outlook and Performance Indicators

Considering FRLA's current market performance and financial metrics, the outlook remains cautiously optimistic. The company's market position and the strategic reduction by WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) could be indicative of anticipated sector movements or portfolio realignment strategies by the firm.

Conclusion

The recent transaction by WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) involving Fortune Rise Acquisition Corp shares marks a notable adjustment in its investment strategy. This move, reflective of the firm's analytical approach to portfolio management, underscores the dynamic nature of asset management and the continuous assessment required to optimize investment outcomes in a fluctuating financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.