Overview of the Recent Transaction

On September 30, 2024, Wolverine Asset Management LLC made a significant addition to its investment portfolio by acquiring 374,414 shares of Chenghe Acquisition I Co (LATG, Financial). This transaction, executed at a price of $11.585 per share, marks a notable increase in the firm's stake in the company, bringing its total holdings to 374,414 shares. This move has a modest impact on the firm's portfolio, increasing its position by 0.09% and representing 7.49% of the traded stock's available shares.

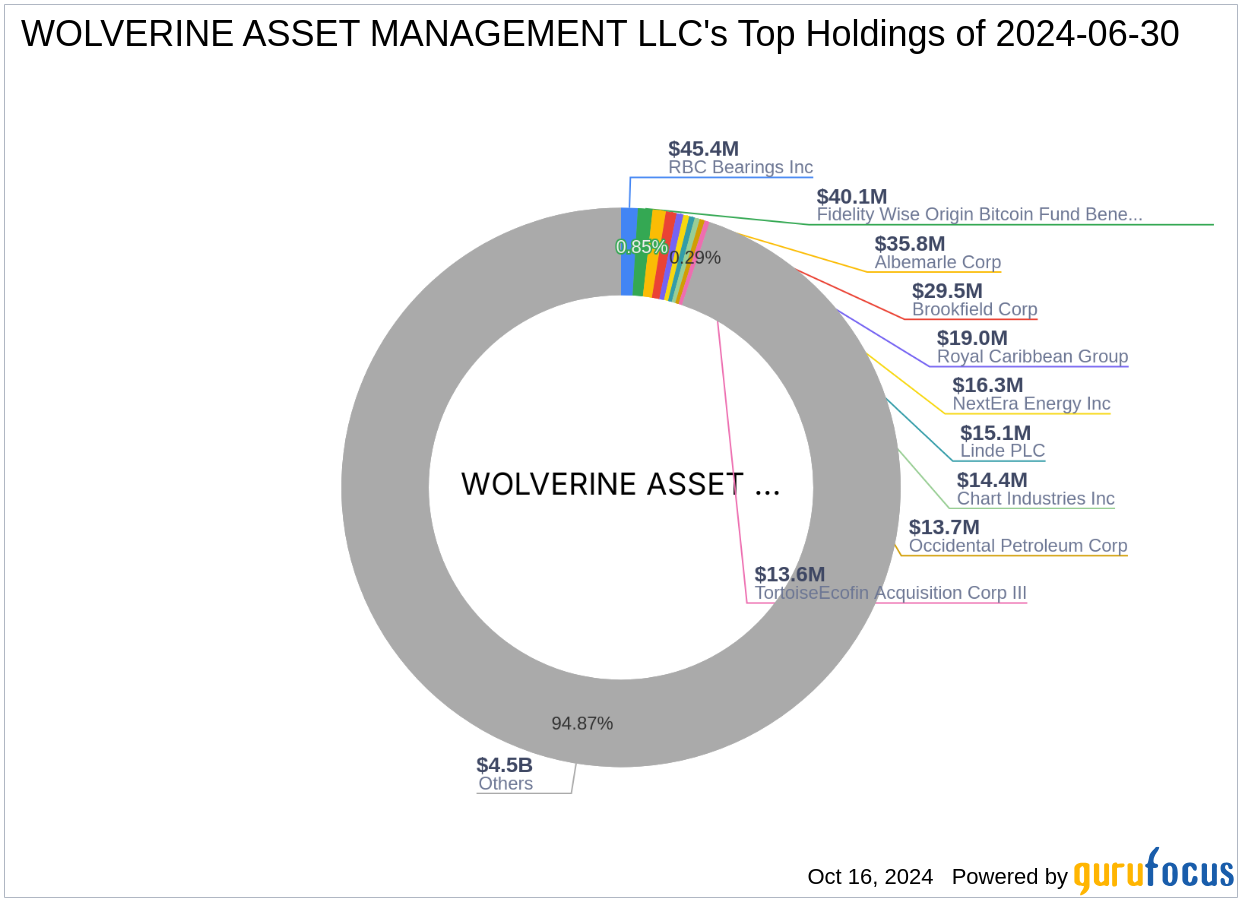

Profile of Wolverine Asset Management LLC

Located at 175 West Jackson, Chicago, IL, Wolverine Asset Management LLC is a prominent investment firm known for its strategic market interventions. With a diverse portfolio of 1,547 stocks and a total equity of $4.73 billion, the firm focuses heavily on Financial Services and Industrials. Its top holdings include notable entities such as RBC Bearings Inc (RBC, Financial), Brookfield Corp (BN, Financial), and Royal Caribbean Group (RCL, Financial). The firm's investment philosophy emphasizes a mix of growth and value, aiming to achieve substantial returns through meticulous market analysis and asset selection.

Introduction to Chenghe Acquisition I Co

Chenghe Acquisition I Co, based in Singapore, operates as a blank check company primarily engaged in merger and acquisition services. Since its IPO on March 17, 2022, the company has focused on identifying and merging with businesses across various sectors. With a current market capitalization of $83.57 million, Chenghe Acquisition I Co plays a pivotal role in facilitating corporate mergers and acquisitions, leveraging its strategic position within the diversified financial services industry.

Analysis of the Trade's Impact

The recent acquisition by Wolverine Asset Management LLC not only increases its influence over Chenghe Acquisition I Co but also aligns with its strategic investment objectives. Holding 7.49% of the company's shares positions Wolverine as a significant stakeholder with potential sway over corporate decisions, reflecting a deep commitment to this particular investment as part of its broader portfolio strategy.

Financial and Market Performance of Chenghe Acquisition I Co

Despite a challenging market, Chenghe Acquisition I Co's stock price has seen a modest year-to-date increase of 5.35%, with a notable rise of 17.61% since its IPO. Currently priced at $11.62, the stock has outperformed initial expectations, although it operates at a loss, as indicated by a PE ratio of 0.00. This performance suggests a cautious but optimistic market outlook for the company's future.

Investment Valuation and Metrics

Chenghe Acquisition I Co's financial health and growth metrics present a mixed picture. With a Financial Strength rank of 7/10 and a Profitability Rank of 3/10, the company shows reasonable financial stability but limited profitability. The GF Score of 25/100 indicates potential challenges in achieving future performance gains.

Market Sentiment and Future Outlook

The market sentiment towards Chenghe Acquisition I Co is cautiously optimistic, reflected by high RSI values indicating potential overbought conditions. However, the company's low GF Score suggests that investors should maintain vigilance, considering both the opportunities and risks associated with this investment.

Conclusion

Wolverine Asset Management LLC's recent acquisition of Chenghe Acquisition I Co shares is a strategic move that enhances its portfolio's diversity and potential for influence within the company. While the financial and market performance of Chenghe Acquisition I Co shows promise, the mixed financial metrics and cautious market sentiment suggest a balanced approach to future investments in this entity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.