Overview of Recent Transaction

On September 30, 2024, State Street Corp executed a significant transaction by reducing its holdings in Prosperity Bancshares Inc (PB, Financial) by 280,414 shares. This move adjusted the firm's total shares in PB to 4,937,688, reflecting a minor yet strategic portfolio adjustment with a trade impact of 0.02%. The shares were traded at a price of $72.07 each.

Profile of State Street Corp

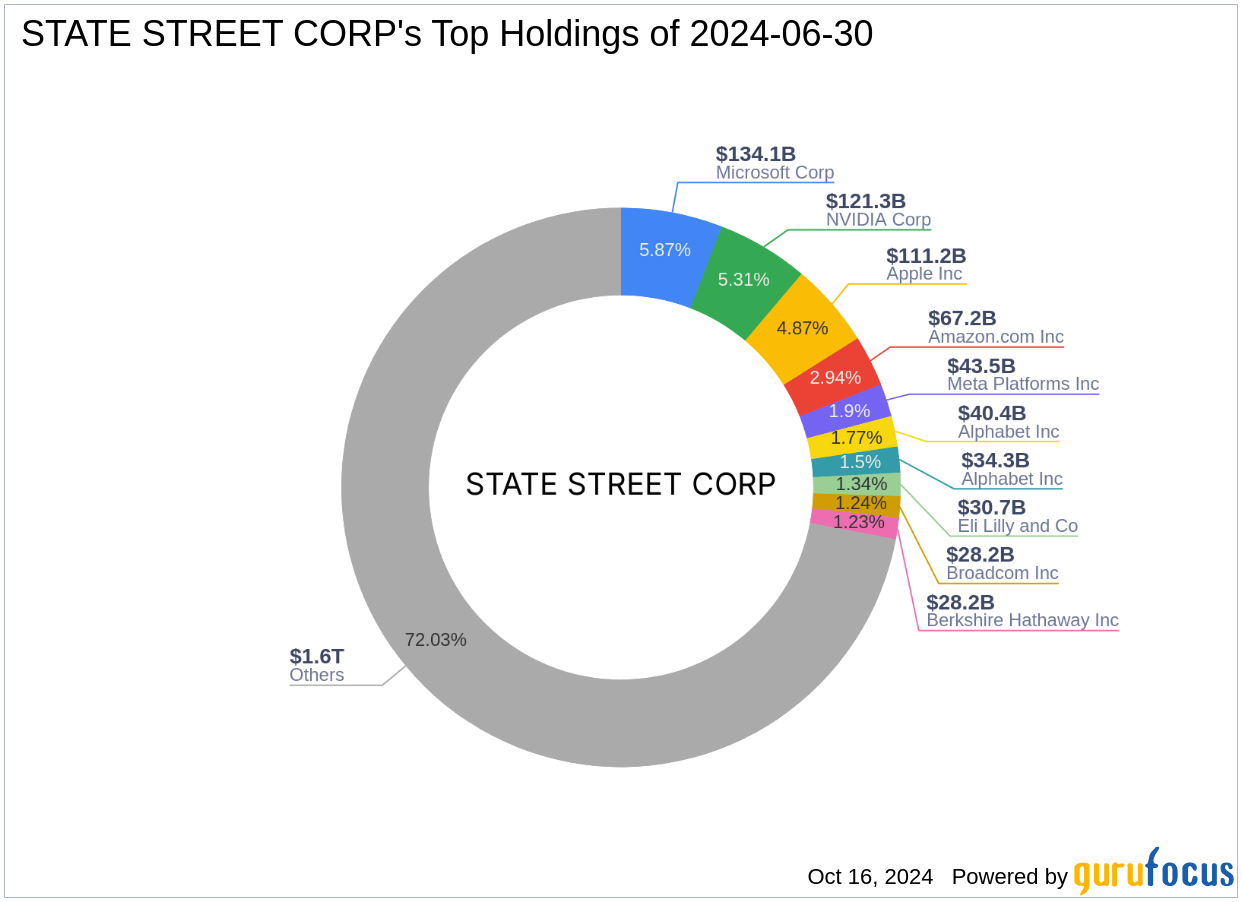

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial services provider known for its robust investment strategies primarily focusing on technology and financial services sectors. The firm manages a vast equity portfolio totaling approximately $2,285.63 trillion, with top holdings including giants like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial). State Street Corp's investment philosophy emphasizes long-term growth and stability, leveraging its extensive market experience.

Insight into Prosperity Bancshares Inc

Prosperity Bancshares Inc, trading under the symbol PB, operates as a retail and commercial banking service provider across Texas and Oklahoma. Since its IPO on November 12, 1998, PB has shown substantial market growth. The company is currently valued at $7.1 billion with a PE ratio of 16.31, indicating profitability. The stock is fairly valued at a GF Value of $68.82, with a current price of $74.52, suggesting a slight premium.

Transaction Impact Analysis

The recent reduction by State Street Corp marks a decrease in their holding percentage in PB by 5.20%, aligning with their strategic portfolio realignment. This adjustment reflects the firm's ongoing portfolio optimization efforts in response to shifting market dynamics and internal investment criteria.

Market Performance and Valuation of PB

Prosperity Bancshares has experienced a year-to-date stock price increase of 9.04%, with a significant rise of 1098.07% since its IPO. The stock's current market performance, coupled with a GF Score of 75/100, indicates a strong potential for future performance, despite some volatility in financial metrics.

Comparative Analysis with Other Investors

Notable investors like Ken Fisher (Trades, Portfolio) and Robert Olstein (Trades, Portfolio) also hold stakes in Prosperity Bancshares, highlighting the stock's appeal in the financial sector. Third Avenue Management (Trades, Portfolio) remains the largest shareholder, underscoring the stock's significance in substantial investment portfolios.

Financial Health and Future Outlook

Prosperity Bancshares maintains a Profitability Rank of 5/10 and a Growth Rank of 6/10. However, its Financial Strength could be a concern with a balance sheet rank of 3/10. The future performance potential, as indicated by the GF Score, suggests an average to above-average outcome, contingent on broader market conditions and internal management strategies.

Sector and Industry Context

State Street Corp's interest in the banking sector, particularly in firms like Prosperity Bancshares, aligns with its focus on financial services, a sector known for its resilience and steady growth. The banking industry faces ongoing challenges such as interest rate changes and regulatory developments, which require continuous strategic adjustments from investment firms like State Street Corp.

This transaction not only reflects State Street Corp's strategic financial maneuvers but also highlights the dynamic nature of investment decisions in the fluctuating banking sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.