Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 250,487 shares of Biogen Inc (BIIB, Financial), a prominent player in the biotechnology industry. This transaction increased State Street Corp's total holdings in Biogen to 7,346,505 shares, reflecting a trade price of $193.84 per share. This move not only underscores the firm's strategic investment approach but also highlights its confidence in Biogen's future prospects.

Profile of State Street Corp

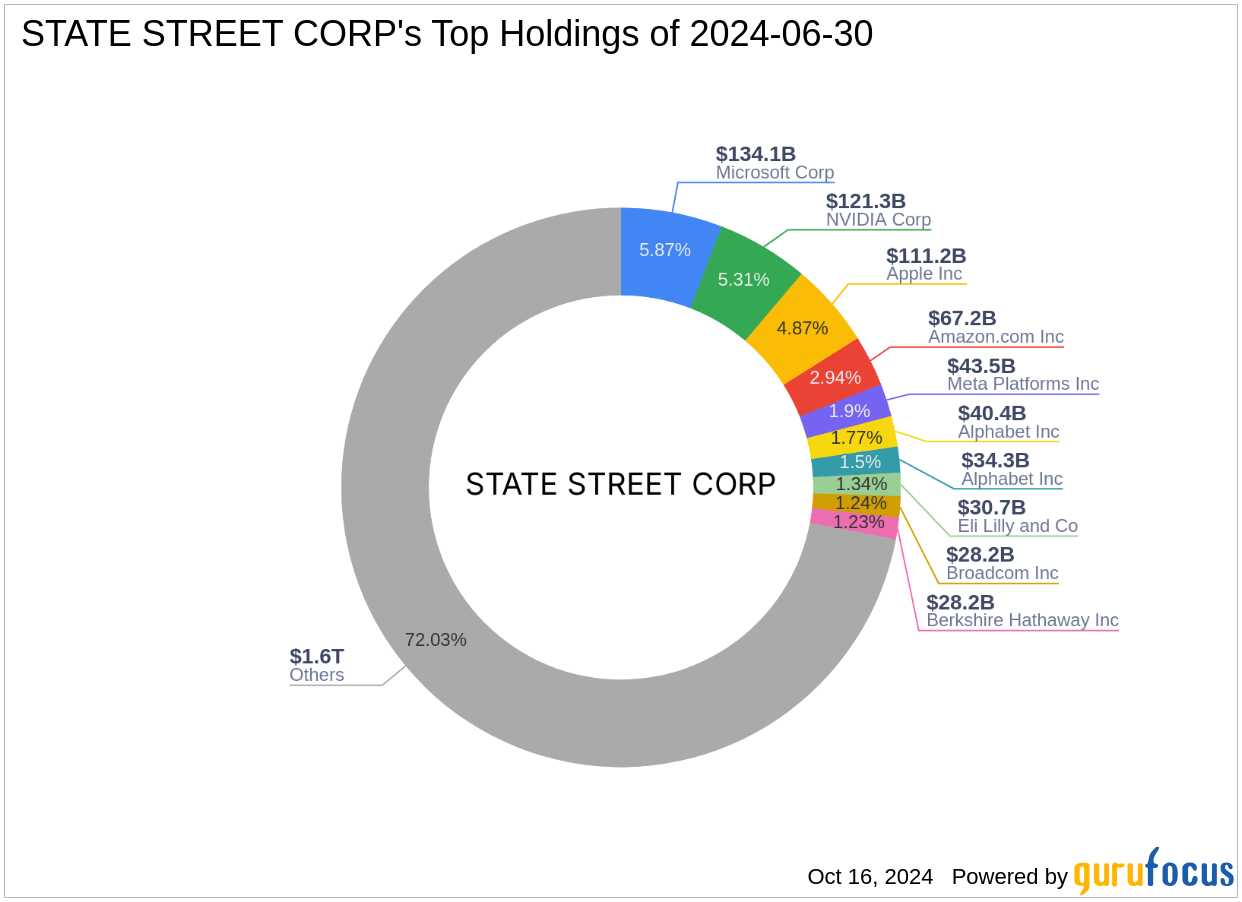

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a global leader in asset management. With a diverse portfolio of 4,172 stocks, the firm is known for its keen focus on technology and financial services sectors. Its top holdings include giants like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial), showcasing a strong inclination towards high-performing tech companies. The firm manages an impressive equity portfolio valued at approximately $2,285.63 trillion.

Insight into Biogen Inc

Founded from the merger of Biogen and Idec in 2003, Biogen Inc has been at the forefront of the biotechnology industry, particularly known for its multiple sclerosis and oncology treatments. The company's product line includes well-known drugs such as Avonex, Tysabri, and the recently launched Alzheimer's treatment, Leqembi. With a market capitalization of $27.71 billion, Biogen continues to be a key player in drug manufacturing, focusing on neurology, immunology, and rare diseases.

Financial Health and Stock Performance

Biogen's current PE ratio stands at 23.96, indicating a profitable operation, albeit with a stock price that has seen a year-to-date decline of 28.93%. The company is rated as modestly undervalued with a GF Value of $231.88, suggesting a potential upside in its stock price. Despite challenges in growth, as evidenced by a growth rank of 2/10, Biogen maintains a strong profitability rank of 8/10 and a GF Value rank of 10/10, reflecting solid long-term value potential.

Impact of the Trade on State Street Corp's Portfolio

The recent acquisition of Biogen shares represents a modest 0.06% of State Street Corp's total portfolio, yet it signifies a strategic positioning with a 5.00% stake in the company. This move could be seen as a calculated bet on Biogen's pipeline and market position, potentially offering substantial returns as the biotech sector continues to evolve.

Market Reaction and Comparative Analysis

Following the transaction, Biogen's stock experienced a slight decline of 1.85%. However, when compared to other major holders like Vanguard Health Care Fund (Trades, Portfolio), State Street Corp's investment strategy appears aligned with those of leading institutional investors, suggesting a consensus on Biogen's valuation and future market performance.

Conclusion

State Street Corp's recent investment in Biogen Inc aligns with its history of strategic portfolio management and its belief in the biotech sector's growth potential. Despite current market volatilities and Biogen's mixed financial metrics, the firm's significant stake positions it well to capitalize on future gains, driven by Biogen's innovative drug pipeline and robust market presence.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.