Overview of the Recent Transaction

On September 30, 2024, State Street Corp significantly increased its stake in ADMA Biologics Inc, a key player in the biopharmaceutical industry. The firm added 4,945,063 shares to its holdings, bringing its total ownership to 13,004,993 shares. This transaction, executed at a price of $19.99 per share, reflects a strategic move by State Street Corp to bolster its portfolio in the biotechnology sector.Profile of State Street Corp

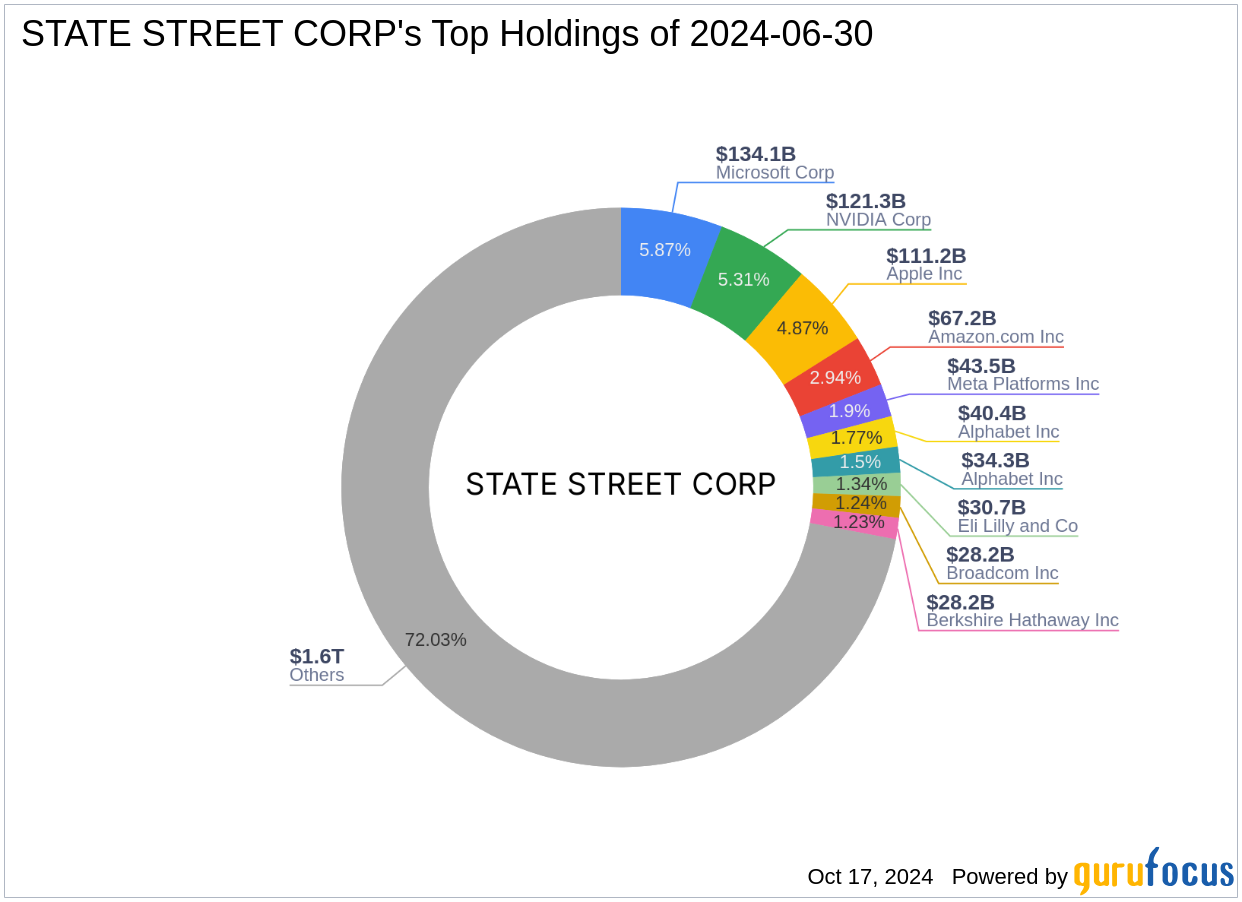

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a major institutional investor known for its broad investment portfolio spanning various sectors, with a strong emphasis on technology and financial services. The firm manages an equity portfolio worth approximately $2,285.63 trillion, featuring top holdings in giants like Apple Inc, Amazon.com Inc, and Microsoft Corp. This transaction in ADMA Biologics underscores State Street Corp's strategic investment approach, focusing on high-potential biotechnology assets.

Introduction to ADMA Biologics Inc

ADMA Biologics Inc, trading under the symbol ADMA, operates primarily within the biotechnology industry in the United States. Since its IPO on October 17, 2013, the company has been dedicated to the development and commercialization of plasma-derived biologics for immune-deficient patients. ADMA's business is segmented into BioManufacturing, Plasma Collection Centers, and a corporate segment, with the majority of its revenue generated from the United States.Financial and Market Analysis of ADMA Biologics Inc

As of the latest data, ADMA Biologics Inc boasts a market capitalization of $3.83 billion, with a current stock price of $16.43. Despite being significantly overvalued with a GF Value of $6.43, the company shows a PE Ratio of 117.36, indicating profitability concerns. However, ADMA has demonstrated substantial year-to-date growth of 261.1%, showcasing its volatile yet potentially rewarding nature in the biotech sector.Impact of the Trade on State Street Corp's Portfolio

The recent acquisition of ADMA shares represents a minor yet strategic addition to State Street Corp's vast portfolio, accounting for a 0.01% position. This move aligns with the firm's ongoing strategy to diversify into high-growth biotechnology, potentially leveraging ADMA's strong market performance and future growth prospects.Sector and Market Considerations

The biotechnology sector is currently experiencing dynamic shifts, with significant innovations and regulatory changes shaping the market landscape. State Street Corp's investment in ADMA Biologics positions it well within this volatile yet promising sector, potentially capitalizing on upcoming biotechnological advancements and increased healthcare demands.Comparative Analysis with Other Market Players

Other notable investors in ADMA Biologics include Leucadia National and Joel Greenblatt (Trades, Portfolio), highlighting the stock's appeal to diverse institutional portfolios. State Street Corp's stake is comparatively significant, underscoring its commitment to investing in high-potential biotech firms.Conclusion

State Street Corp's recent acquisition of ADMA Biologics shares marks a calculated enhancement to its investment portfolio, reflecting confidence in the biotechnology sector's growth potential. This strategic move not only diversifies State Street Corp's holdings but also positions it to potentially reap substantial rewards from ADMA's future successes in the biopharmaceutical field.This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.