Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 901,780 shares of REX American Resources Corp (REX, Financial). This transaction, executed at a price of $46.29 per share, reflects a strategic move by the firm to bolster its holdings in the energy sector. The addition of these shares has increased State Street Corp's total ownership in REX to a substantial 5.10% of the company's outstanding shares.

Profile of State Street Corp

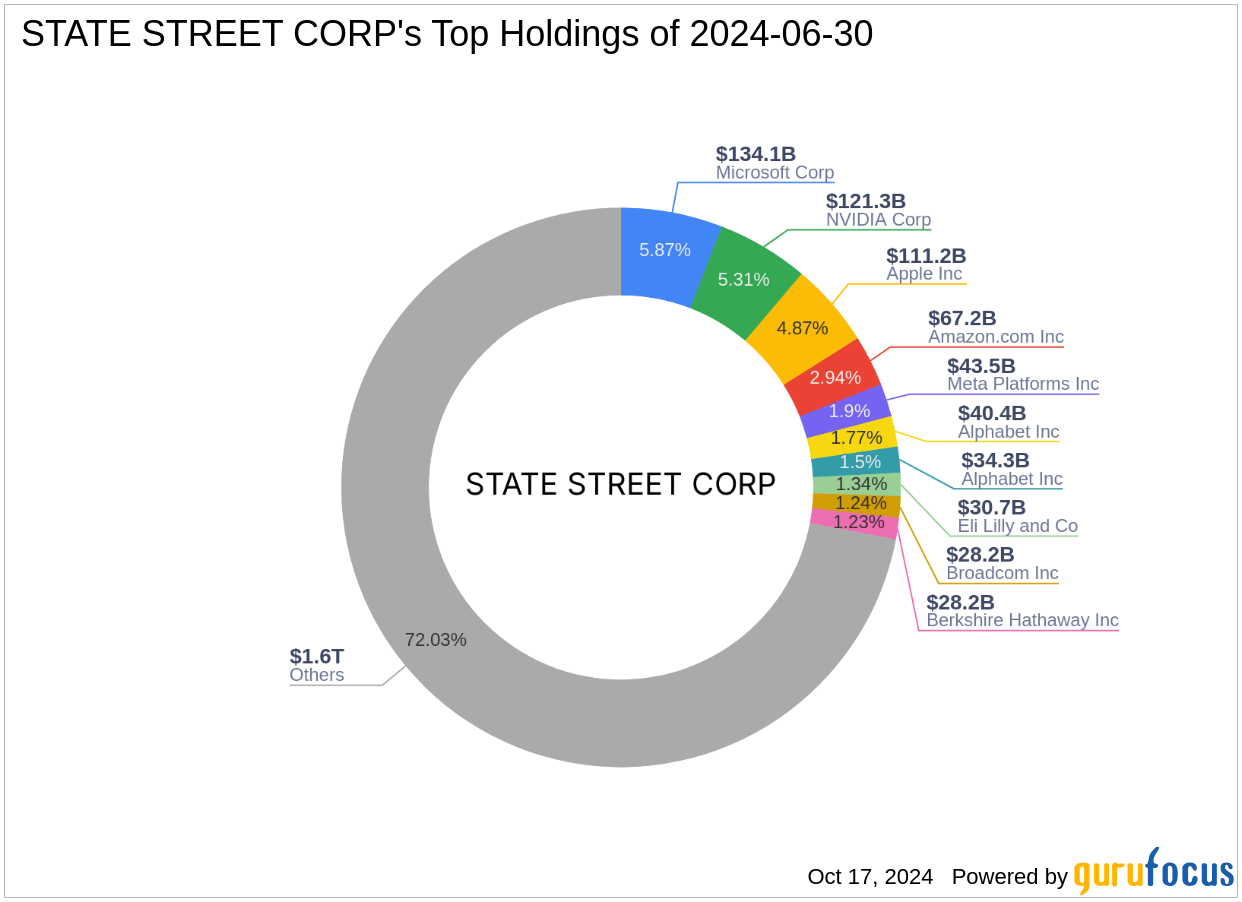

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a global leader in financial services, providing a broad range of investment management, research, and trading services. With a portfolio that includes top holdings such as Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial), the firm is heavily invested in the technology and financial services sectors. The firm manages an equity portfolio worth approximately $2,285.63 trillion, showcasing its significant influence in the investment world.

Introduction to REX American Resources Corp

REX American Resources Corp, based in the USA, operates as a holding company with a focus on alternative energy and ethanol production. The company's diverse product range includes ethanol, dried distillers grains, and non-food grade corn oil, catering to various market segments. Since its IPO in 1992, REX has shown substantial growth, with its stock price appreciating by over 6,204.58%.

Financial and Market Analysis of REX

Currently, REX American Resources Corp holds a market capitalization of approximately $809.318 million, with a stock price of $46.07. Despite being significantly overvalued with a GF Value of $29.30, the company maintains a PE Ratio of 11.72. REX's financial strength and profitability are underscored by its high Financial Strength and Profitability Rank, both rated at 8/10.

Impact of the Trade on State Street Corp’s Portfolio

The recent acquisition of REX shares by State Street Corp, although not significantly altering the firm's massive portfolio, strategically increases its exposure to the renewable energy sector. This move aligns with broader market trends favoring sustainable and alternative energy sources.

Sector and Market Considerations

State Street Corp's investment in REX American Resources Corp reflects a calculated approach to diversify into the energy sector, particularly renewable resources. This sector is gaining momentum as global energy policies shift towards sustainability, positioning REX as a potentially valuable asset in State Street's portfolio.

Comparative Analysis with Other Gurus

While State Street Corp holds a significant stake in REX, it is noteworthy that Hotchkis & Wiley Capital Management LLC remains the largest shareholder. This comparison highlights State Street's competitive positioning among major investors in the renewable energy sector.

Future Outlook and Analyst Insights

Analysts are cautiously optimistic about the future prospects of REX American Resources Corp, considering the growing demand for renewable energy. However, the company's current overvaluation and market performance metrics suggest a need for careful monitoring. State Street Corp's investment could be seen as a long-term strategic play, anticipating future growth in the renewable energy market.

This strategic acquisition by State Street Corp not only diversifies its portfolio but also aligns with global trends towards sustainable energy, potentially setting the stage for future growth in this sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.