Overview of the Recent Transaction

On September 30, 2024, State Street Corp executed a significant transaction involving the sale of 70,573 shares in Assurant Inc (AIZ, Financial), a prominent player in the insurance sector. This move reduced their holdings by 2.89%, bringing the total shares held to 2,372,237. The shares were traded at a price of $198.86 each. Despite this reduction, State Street Corp maintains a substantial position in Assurant, reflecting a 4.60% ownership in the company and a minor 0.02% portfolio position.

Profile of State Street Corp

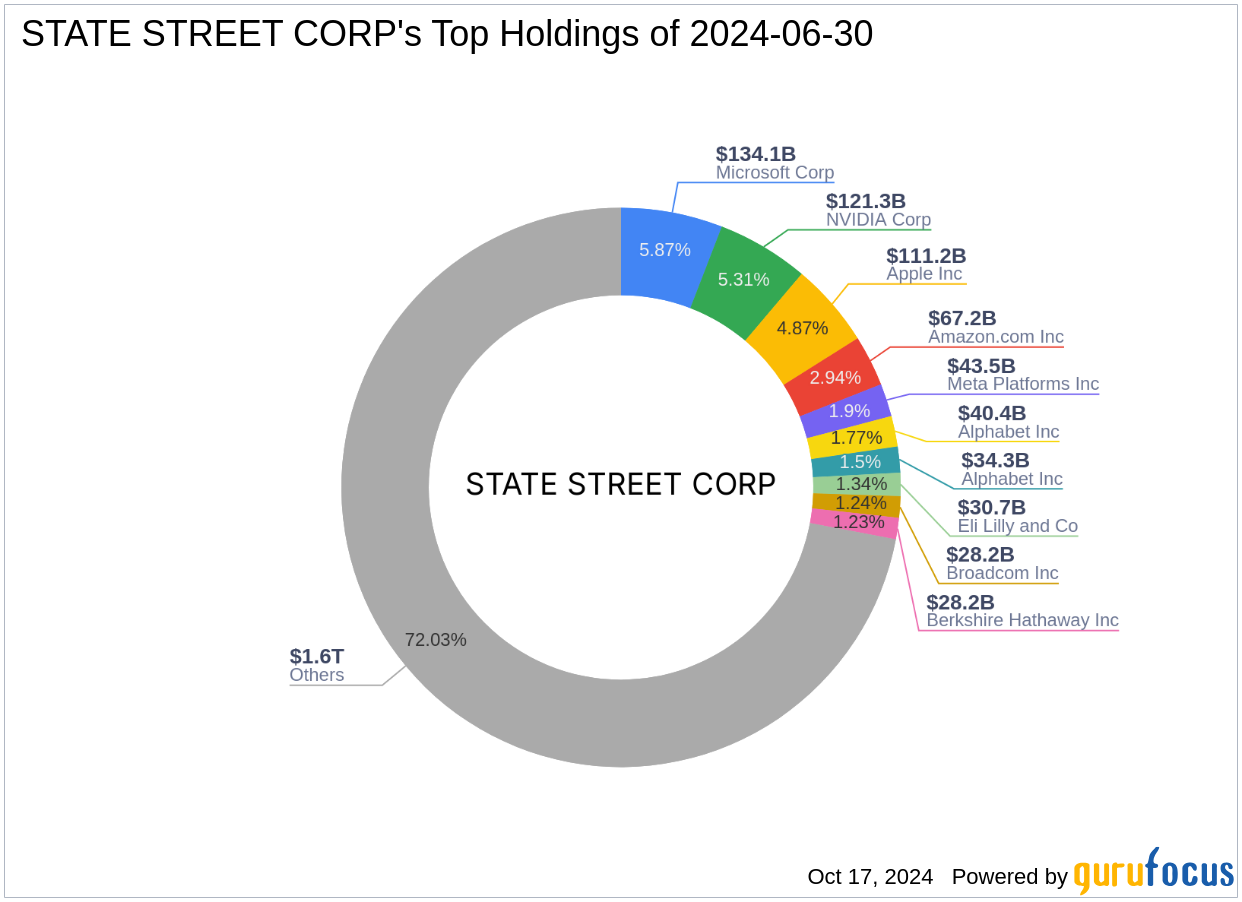

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a globally recognized investment firm. With a vast portfolio of 4,172 stocks, the firm is a major player in the financial services and technology sectors. Their top holdings include giants like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). State Street Corp's investment philosophy focuses on leveraging market trends and technological advancements to maximize returns. The firm's equity holdings amount to a staggering $2,285.63 trillion, underscoring its influential presence in the investment world.

Assurant Inc at a Glance

Assurant Inc, with its diverse range of insurance products, operates primarily through its Global Housing and Global Lifestyle segments. The company, which went public on February 5, 2004, has a market capitalization of $10.26 billion and a stock price of $198.09. Assurant is currently rated as "Fairly Valued" with a GF Value of $183.95 and a price to GF Value ratio of 1.08. The company's profitability and growth metrics are robust, with a GF Score of 85/100, indicating a strong potential for future performance.

Impact of the Trade on State Street Corp's Portfolio

The recent sale of Assurant shares by State Street Corp, although minor in terms of their overall portfolio, reflects a strategic adjustment. This reduction might be indicative of risk management or portfolio rebalancing efforts, especially considering the firm's significant exposure to technology and financial services sectors.

Assurant's Market Performance and Financial Health

Assurant has shown a commendable year-to-date stock price increase of 16.62% and an impressive 734.06% gain since its IPO. The company's financial health is solid, with a cash to debt ratio of 0.82 and an interest coverage of 10.14. These figures reflect Assurant's ability to cover its financial obligations while continuing to grow revenue and earnings, evidenced by a three-year revenue growth rate of 10.80%.

Comparative Analysis with Other Major Investors

Other significant investors in Assurant include Gotham Asset Management, LLC, and Jefferies Group (Trades, Portfolio). State Street Corp's strategy in managing its Assurant holdings differs from these firms, which may be adopting a more bullish stance given the insurance industry's current dynamics.

Sector and Market Considerations

State Street Corp's investment strategy is heavily influenced by its dominant sectors: technology and financial services. The insurance industry, where Assurant operates, is undergoing significant transformations with technological integration and regulatory changes. State Street Corp's adjustment in its Assurant position might be a strategic move to align with broader market trends and optimize its portfolio performance in light of these industry shifts.

This transaction underscores State Street Corp's active management approach, aiming to capitalize on market movements and sectoral shifts to deliver optimal investment returns.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.