Overview of the Recent Transaction

On September 30, 2024, JPMorgan Chase & Co executed a significant transaction involving the sale of 1,091,698 shares of Axalta Coating Systems Ltd (AXTA, Financial), a leading manufacturer in the coatings industry. This move reduced the firm's holdings in Axalta, reflecting a strategic adjustment in its investment portfolio. The shares were traded at a price of $36.19, adjusting the firm's total holdings to 11,200,451 shares, which now represents a 5.10% stake in the company.

Insight into JPMorgan Chase & Co

JPMorgan Chase & Co, founded in 1799, has evolved into one of the world's most prominent financial institutions, with a presence in over 60 countries. The firm operates across six major business segments, including investment banking, retail financial services, and asset management, managing a total asset value of $2.6 trillion. Its diverse financial services cover everything from commercial banking to treasury services, catering to a broad client base ranging from individuals to large corporations and governments.

Understanding Axalta Coating Systems Ltd

Axalta Coating Systems Ltd specializes in the development and distribution of innovative coatings for various automotive and industrial applications. The company is segmented into Mobility Coatings and Performance Coatings, serving a global market that includes regions like North America, EMEA, and Asia-Pacific. With a market capitalization of $7.98 billion and a PE ratio of 26.96, Axalta is currently assessed as modestly overvalued with a GF Value of $32.90.

Detailed Transaction Analysis

The recent sale by JPMorgan Chase & Co marks a decrease of 8.88% in their holdings of Axalta shares. Post-transaction, the firm's position in Axalta represents a minor 0.03% of its total portfolio, indicating a slight shift in investment focus. This adjustment aligns with the firm's broader strategy of portfolio optimization and risk management.

Market and Stock Performance Insights

Following the transaction, Axalta's stock price has seen a marginal increase to $36.39, slightly above the trade price. The stock remains modestly overvalued compared to the GF Value, with a price to GF Value ratio of 1.11. Year-to-date, the stock has appreciated by 8.69%, with a significant overall growth of 73.78% since its IPO in 2014.

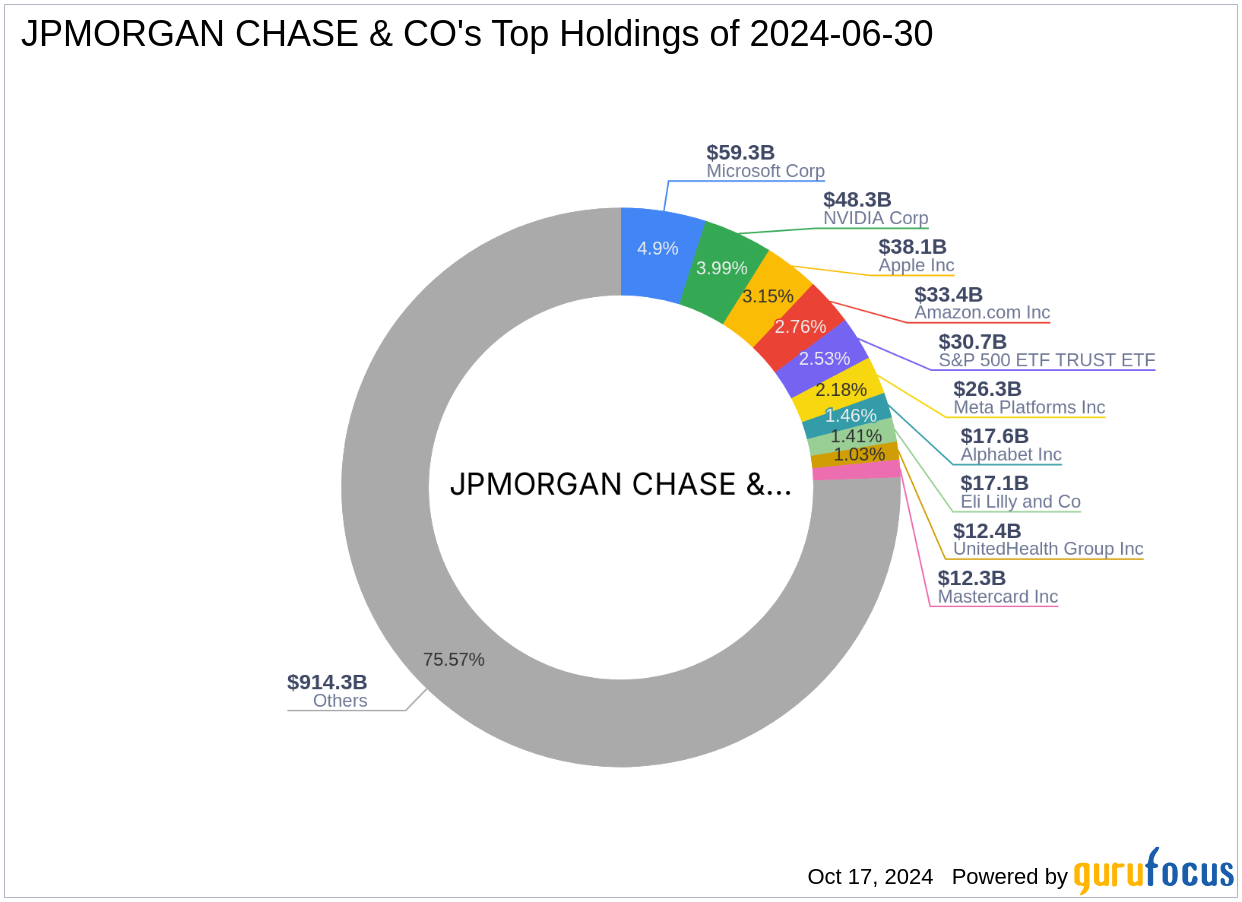

Strategic Investment Focus of JPMorgan Chase & Co

JPMorgan Chase & Co's investment strategy is characterized by a focus on sectors that promise robust growth and stability. The firm's top holdings include major names in technology and healthcare, reflecting a preference for industries with high innovation potential and market demand. This strategic focus is evident in their portfolio adjustments, including the recent transaction involving Axalta.

Broader Investment Landscape

Other notable investors in Axalta include Barrow, Hanley, Mewhinney & Strauss, John Rogers (Trades, Portfolio), Richard Pzena (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio), each holding significant stakes. This collective interest from prominent investors underscores Axalta's strong market position and potential for growth.

Concluding Thoughts on the Transaction

The reduction in Axalta shares by JPMorgan Chase & Co reflects a strategic realignment within its vast portfolio. While the firm maintains a diversified investment approach, this transaction highlights its ongoing adjustments in response to market conditions and portfolio performance objectives. Axalta continues to hold a promising position in the market, supported by its solid financial metrics and strategic industry standing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.