Overview of the Recent Transaction

On September 30, 2024, JPMorgan Chase & Co. executed a significant transaction involving the biotechnology firm Regenxbio Inc (RGNX, Financial). The firm reduced its holdings by 536,830 shares, resulting in a new total of 2,475,646 shares. This move reflects a notable shift in JPMorgan Chase & Co.'s investment strategy, with the transaction carried out at a price of $10.49 per share.

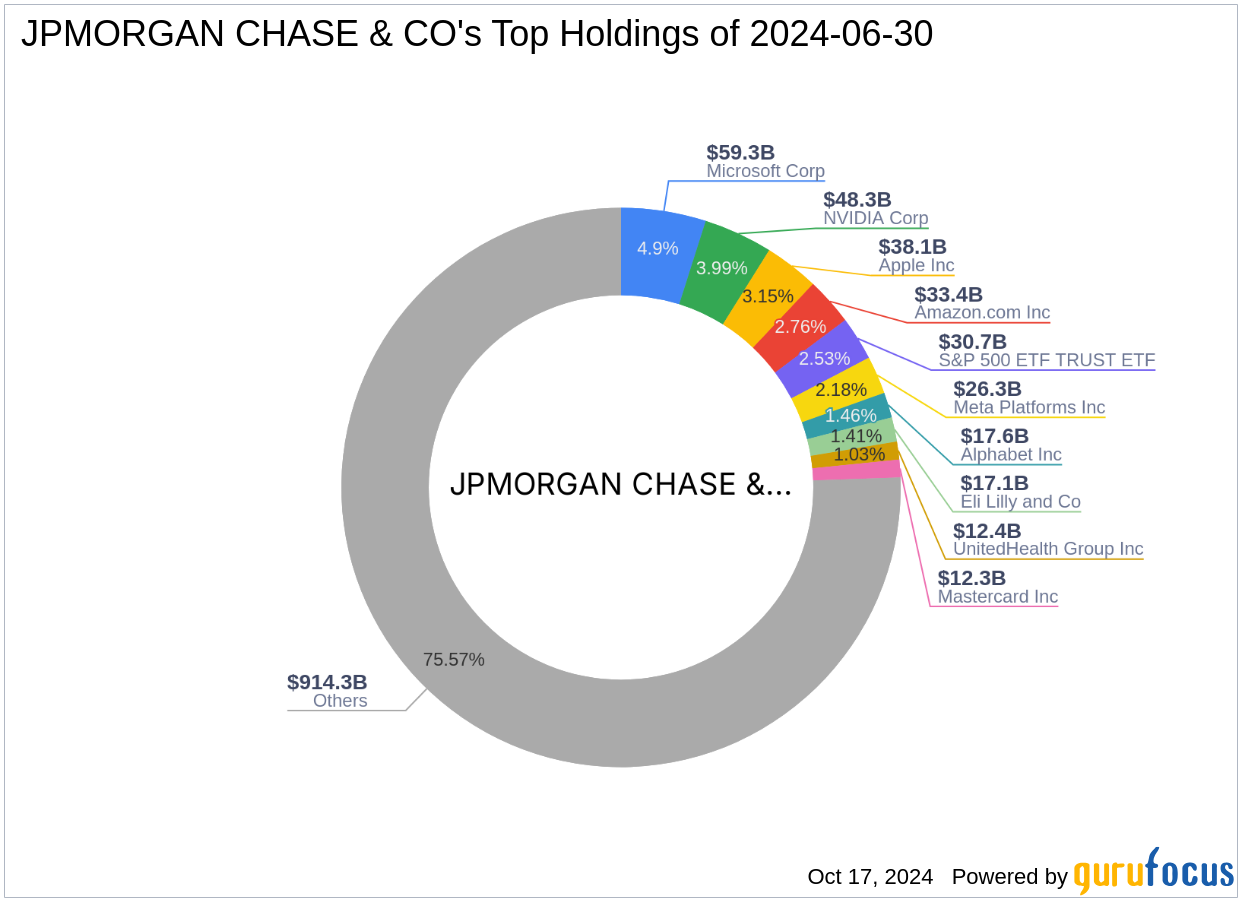

Profile of JPMorgan Chase & Co.

JPMorgan Chase & Co., established in 1799, has evolved into one of the largest and most influential financial institutions globally. With a rich history of mergers and acquisitions, including significant names like Bank One and Bear Stearns, the firm today operates across six major business segments, ranging from investment banking to asset management. Employing nearly 250,000 individuals worldwide, JPMorgan Chase & Co. manages assets totaling approximately $2.6 trillion.

Insight into Regenxbio Inc.

Founded in 2015, Regenxbio Inc is a pioneer in the field of gene therapy, focusing on severe genetic disorders. Despite its innovative platform, the company's financial metrics indicate challenges, with a market capitalization of $531.793 million and a PE ratio of 0, suggesting current unprofitability. The stock is considered modestly undervalued with a GF Value of $13.93, indicating some potential for growth.

Impact on JPMorgan Chase & Co.'s Portfolio

The recent transaction has adjusted Regenxbio Inc's position within JPMorgan Chase & Co.'s portfolio, now accounting for a 5.00% share. This reduction aligns with the firm's broader investment strategy, possibly indicating a strategic realignment or risk management adjustment concerning biotechnology investments.

Market Reaction and Stock Performance

Following the transaction, Regenxbio's stock price saw a slight increase of 2.57%, moving to $10.76. However, the stock's year-to-date performance remains down by 41.33%, reflecting broader market challenges and possibly investor skepticism about the company's near-term prospects.

Strategic Implications of the Trade

JPMorgan Chase & Co.'s decision to reduce its stake in Regenxbio may reflect a strategic shift towards more stable investments or a response to the biotech sector's volatility. This move could be part of a larger risk management strategy, especially considering the firm's significant global presence and diversified investment portfolio.

Future Outlook for Regenxbio Inc.

The future performance of Regenxbio Inc will likely be influenced by its ability to turn pioneering gene therapies into profitable products. The biotechnology sector remains highly competitive and sensitive to regulatory and market changes, which could impact the company's stock performance. Investors should keep an eye on the company's clinical trial outcomes and any strategic partnerships that may enhance its market position.

In conclusion, JPMorgan Chase & Co.'s recent adjustment in its investment in Regenxbio Inc highlights a cautious approach towards the biotechnology sector, reflecting broader market trends and internal portfolio management strategies. This move provides a critical insight into the firm's adaptive investment tactics in response to evolving market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.