Overview of the Recent Transaction

On September 30, 2024, State Street Corp executed a significant transaction involving the sale of 1,437,667 shares of Compass Minerals International Inc (CMP, Financial), a notable player in the metals and mining sector. This move reduced their holding to 794,645 shares, reflecting a strategic adjustment in their investment portfolio. The shares were traded at a price of $12.02 each, marking a pivotal shift in State Street Corp's investment strategy.

Profile of State Street Corp

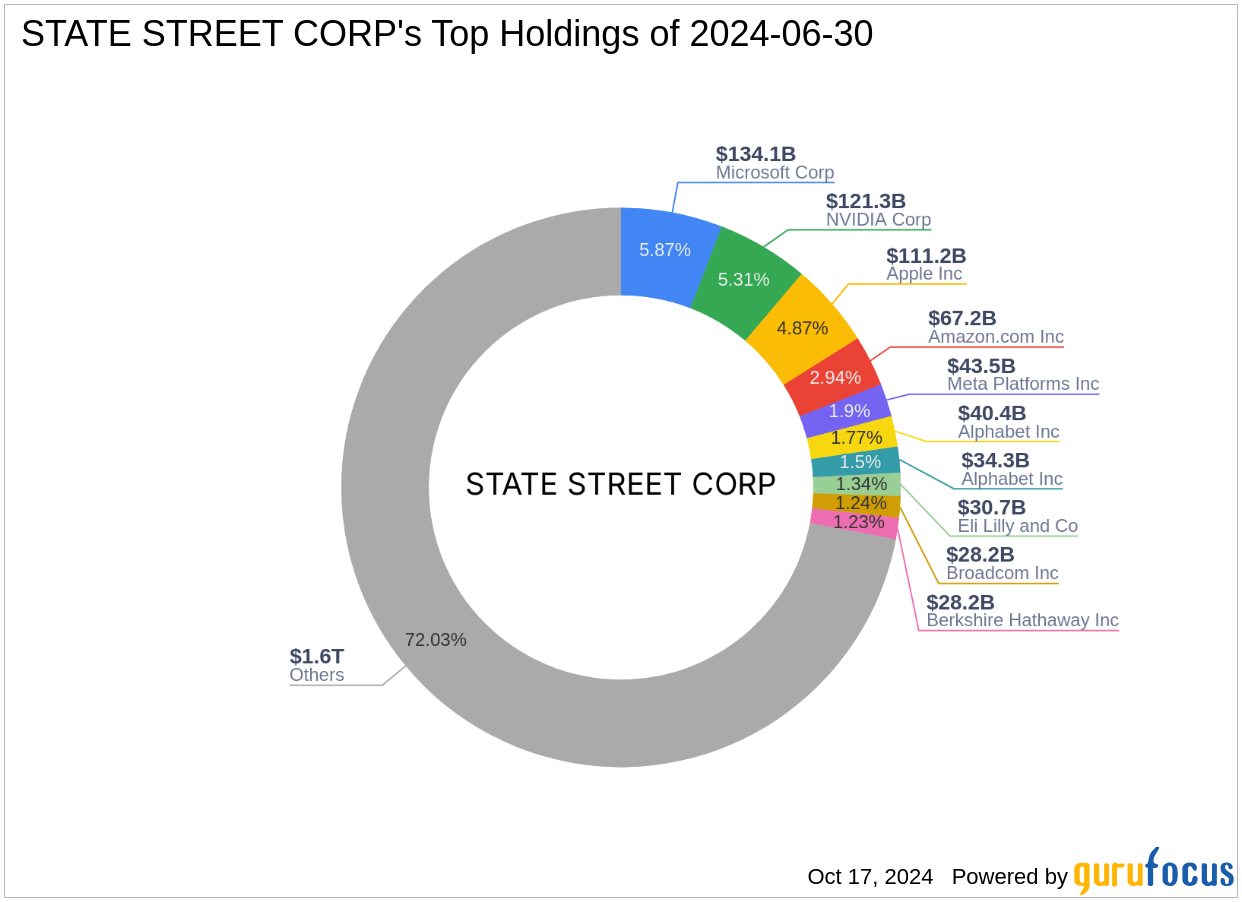

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent investment firm known for its robust portfolio management and strategic investment decisions. With a vast equity holding of $2,285.63 trillion, the firm has a significant influence in the financial markets, particularly in the technology and financial services sectors. Their top holdings include major corporations like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial).

Introduction to Compass Minerals International Inc

Compass Minerals International Inc, trading under the symbol CMP, is primarily involved in the production of salt and specialty potash fertilizers. With key assets across North America and the United Kingdom, the company serves a diverse range of sectors from deicing to agriculture. The firm's strategic operations in potash and salt extraction have positioned it as a key player in the industry.

Financial and Market Analysis of Compass Minerals International Inc

As of the latest data, Compass Minerals holds a market capitalization of $565.031 million with a current stock price of $13.67. Despite a challenging market environment indicated by a year-to-date price decline of 45.12%, the stock has seen a recent upturn with a 13.73% gain since the transaction date. The company's valuation metrics suggest caution, with a GF Value of $30.47 and a price to GF Value ratio of 0.45, signaling a potential value trap scenario.

Impact of the Trade on State Street Corp's Portfolio

The recent transaction has notably decreased Compass Minerals' position in State Street Corp's extensive portfolio, now constituting only 1.90% of their holdings. This reduction aligns with the firm's strategic realignment, possibly due to the stock's underwhelming financial performance and market valuation concerns.

Sector and Market Considerations

State Street Corp primarily invests in technology and financial services, sectors that generally promise high growth and stability. The decision to reduce exposure to the metals and mining sector, represented by Compass Minerals, may reflect a strategic shift towards more lucrative and stable investments, considering the volatile nature of commodity-based industries.

Future Outlook and Analyst Insights

Compass Minerals, with a GF Score of 55, indicates a potential for poor future performance. Analysts are cautious, given the company's financial struggles, including a significant debt load and negative profitability metrics. The future performance of CMP will likely hinge on its ability to improve operational efficiency and market conditions in the metals and mining sector.

Conclusion

State Street Corp's recent reduction in Compass Minerals International Inc reflects a strategic pivot within its investment portfolio, possibly due to the challenging financial metrics and uncertain future of the metals and mining sector. For value investors, this move highlights the importance of continuous portfolio assessment and realignment in response to changing market conditions and company fundamentals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.