Overview of the Recent Transaction

On October 17, 2024, Suvretta Capital Management, LLC executed a significant transaction involving the shares of 89bio Inc (ETNB, Financial). The firm reduced its holdings by 40,201 shares, priced at $8.61 each. Following this transaction, Suvretta Capital Management holds a total of 7,991,644 shares in 89bio Inc, making up 7.50% of the company's outstanding shares and 2.53% of the firm's portfolio.

Profile of Suvretta Capital Management, LLC

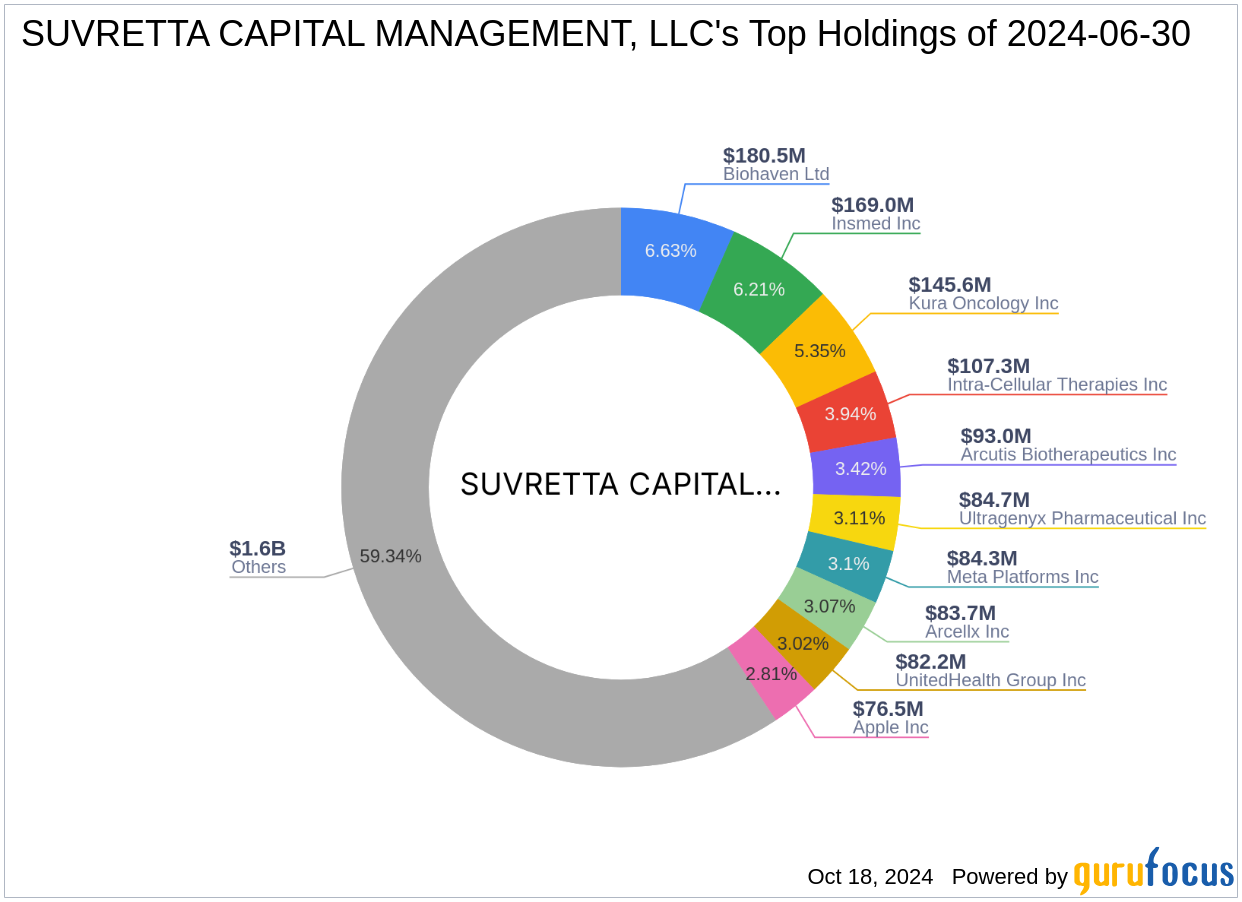

Suvretta Capital Management, LLC, based at 950 Third Avenue, New York, NY, is a prominent investment firm with a portfolio heavily skewed towards the healthcare and technology sectors. The firm manages an equity portfolio valued at approximately $2.72 billion, with top holdings including Insmed Inc (INSM, Financial), Intra-Cellular Therapies Inc (ITCI, Financial), and others. Suvretta's investment approach focuses on leveraging market dynamics and sector-specific trends to optimize investment returns.

Introduction to 89bio Inc

89bio Inc, a clinical-stage biopharmaceutical company based in the USA, specializes in developing therapies for liver and cardio-metabolic diseases. Its flagship product candidate, pegozafermin, is in development for conditions such as nonalcoholic steatohepatitis (NASH) and severe hypertriglyceridemia (SHTG). Since its IPO on November 11, 2019, 89bio has been focused on addressing significant unmet medical needs in the biotechnology sector.

Financial and Market Analysis of 89bio Inc

As of the latest data, 89bio Inc holds a market capitalization of approximately $869.517 million, with a current stock price of $8.21. The company's financial performance shows a GF Score of 40/100, indicating potential challenges in future performance. The stock has experienced a year-to-date price decline of 27.28%, with a significant drop of 58.95% since its IPO. These metrics suggest a cautious outlook for the stock in the near term.

Impact of the Trade on Suvretta Capital Management’s Portfolio

The recent reduction in 89bio Inc shares by Suvretta Capital Management has a minimal immediate impact on the firm's portfolio, decreasing its stake by just 0.01%. However, this move could signify a strategic shift or risk mitigation given the stock's recent performance and market volatility within the biotechnology sector.

Sector and Market Considerations

The biotechnology sector, where 89bio operates, is known for its high volatility and substantial investment risks, balanced by the potential for significant returns. Suvretta Capital Management's adjustment in its 89bio Inc holdings may reflect broader market reactions or internal strategy shifts towards more stable investments or those with different risk profiles.

Comparative and Future Outlook

Comparatively, other major investors like Leucadia National have also engaged with 89bio Inc, each applying their unique strategies based on market analysis and future projections. For Suvretta Capital Management, the future engagement with 89bio Inc will likely depend on forthcoming clinical trial results of pegozafermin and overall market conditions influencing the biotech sector.

This transaction underscores the dynamic nature of investment strategies in high-stakes sectors like biotechnology, where firms like Suvretta Capital Management must continuously adapt to new information and market trends to optimize their investment portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.