Insights into PRIMECAP's Latest 13F Filing and Its Impact on Key Stock Holdings

Founded in 1983 and based in Pasadena, CA, PRIMECAP Management (Trades, Portfolio) is an independent investment management firm known for its disciplined approach to equity investment. The firm operates with a focus on long-term results, leveraging fundamental research and a multi-counselor investment model. Each portfolio manager independently manages a segment of the portfolio, seeking outperformance over a three to five-year horizon. PRIMECAP often targets undervalued companies that are out of favor, maintaining a patient and long-term approach even in challenging near-term fundamentals.

Summary of New Buys

During the third quarter of 2024, PRIMECAP Management (Trades, Portfolio) expanded its portfolio by adding seven new stocks. Noteworthy new acquisitions include:

- Amentum Holdings Inc (AMTM, Financial), purchasing 5,271,282 shares, which now represent 0.12% of the portfolio, valued at $170 million.

- e.l.f. Beauty Inc (ELF, Financial), with 320,255 shares, making up about 0.03% of the portfolio, valued at approximately $34.92 million.

- Comerica Inc (CMA, Financial), adding 444,500 shares, accounting for 0.02% of the portfolio, with a total value of $26.63 million.

Key Position Increases

PRIMECAP Management (Trades, Portfolio) also significantly increased its stakes in several existing holdings, including:

- ConocoPhillips (COP, Financial), where an additional 1,418,900 shares were purchased, bringing the total to 4,320,905 shares. This increase represents a 48.89% rise in share count and a 0.11% impact on the current portfolio, valued at $454.9 million.

- PayPal Holdings Inc (PYPL, Financial), with an additional 1,069,356 shares, bringing the total to 6,015,816 shares. This adjustment marks a 21.62% increase in share count, valued at $469.41 million.

Summary of Sold Out Positions

In the same quarter, PRIMECAP Management (Trades, Portfolio) exited positions in three companies:

- Lowe's Companies Inc (LOW, Financial), selling all 125,000 shares, impacting the portfolio by -0.02%.

- Omnicell Inc (OMCL, Financial), liquidating all 110,769 shares, with a negligible impact on the portfolio.

Key Position Reductions

Significant reductions were made in several holdings, including:

- Eli Lilly and Co (LLY, Financial), where 1,927,574 shares were sold, resulting in a 9.83% decrease in shares and a -1.26% impact on the portfolio. The stock traded at an average price of $899.05 during the quarter and has seen a return of -1.14% over the past three months and 43.86% year-to-date.

- Wells Fargo & Co (WFC, Financial), reducing by 5,186,907 shares, marking a 13.94% decrease in shares and a -0.22% impact on the portfolio. The stock traded at an average price of $56.56 during the quarter and has returned 34.39% over the past three months and 45.90% year-to-date.

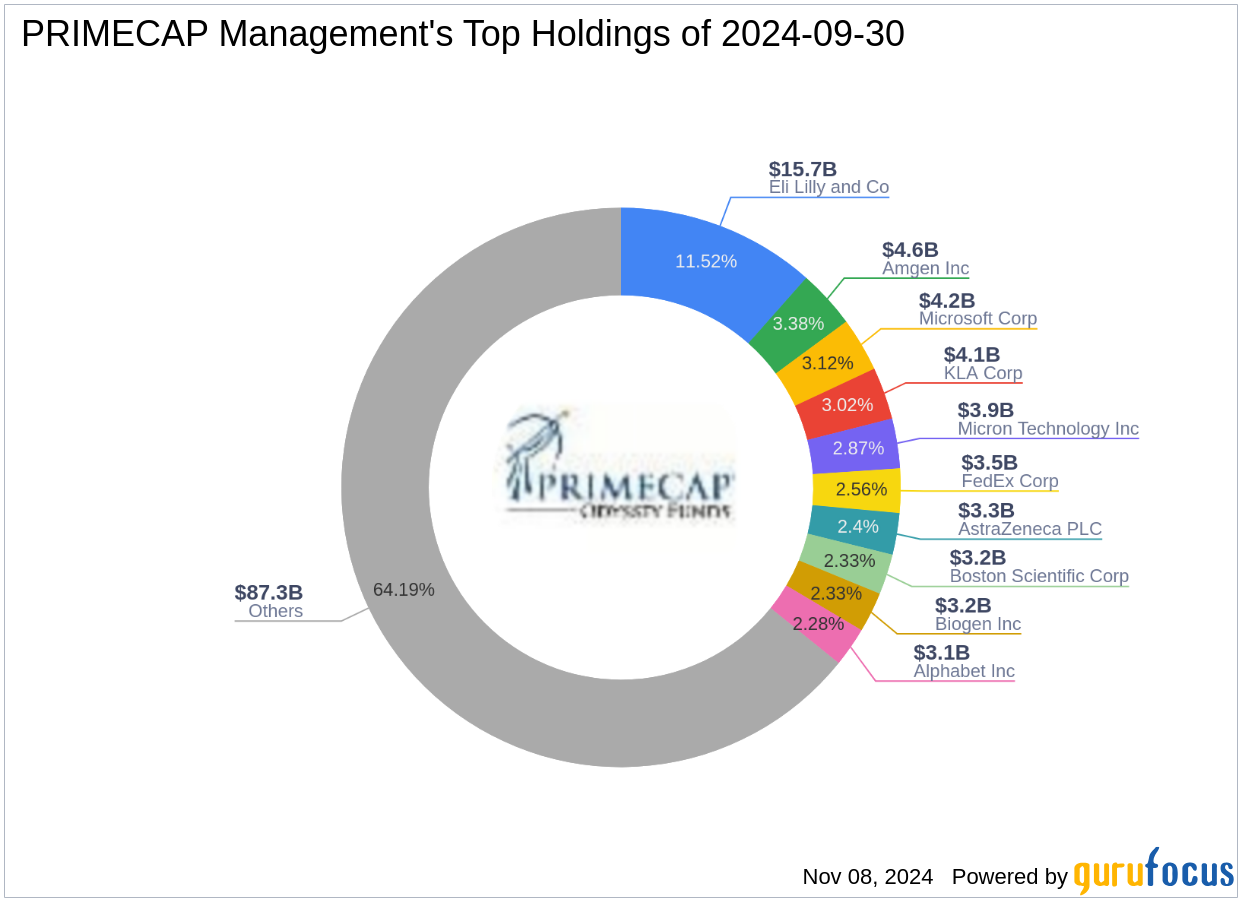

Portfolio Overview

As of the third quarter of 2024, PRIMECAP Management (Trades, Portfolio)'s portfolio included 336 stocks. The top holdings were:

- 11.52% in Eli Lilly and Co (LLY, Financial)

- 3.38% in Amgen Inc (AMGN, Financial)

- 3.12% in Microsoft Corp (MSFT, Financial)

- 3.02% in KLA Corp (KLAC, Financial)

- 2.87% in Micron Technology Inc (MU, Financial)

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.