Insights from the Latest 13F Filing for Q3 2024

David Abrams (Trades, Portfolio), the founder and CEO of Abrams Capital Management, recently disclosed his investment activities for the third quarter of 2024 through the latest 13F filing. With a background that includes a decade working alongside Seth Klarman (Trades, Portfolio) at Baupost, Abrams has developed a reputation for a fundamental, value-oriented investment strategy. His firm, established in 1999 and based in Boston, focuses on long-term investments in a concentrated portfolio, spanning stocks, debt, and other asset classes.

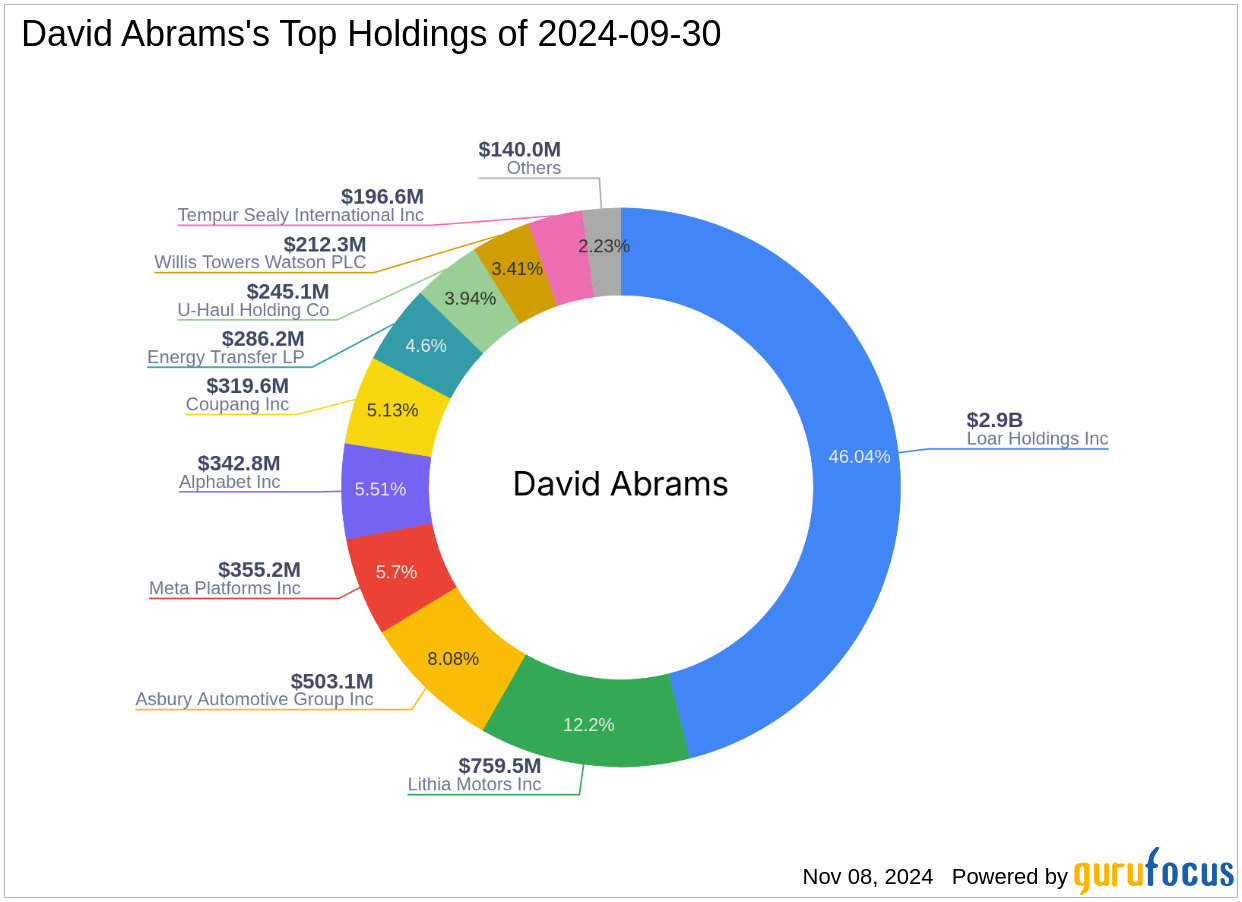

Portfolio Overview

As of the third quarter of 2024, David Abrams (Trades, Portfolio)'s portfolio is composed of 14 stocks. The major holdings include 46.04% in Loar Holdings Inc (LOAR, Financial), 12.2% in Lithia Motors Inc (LAD, Financial), and 8.08% in Asbury Automotive Group Inc (ABG, Financial). Other significant positions are in Meta Platforms Inc (META, Financial) and Alphabet Inc (GOOGL, Financial), making up 5.7% and 5.51% of the portfolio, respectively. The investments are predominantly concentrated in seven industries, with the largest exposures in Industrials, Consumer Cyclical, and Communication Services.

Key Position Reduces

During the quarter, David Abrams (Trades, Portfolio) made notable reductions in several positions:

- Reduced Camping World Holdings Inc (CWH, Financial) by 2,000,000 shares, resulting in a -39.15% decrease in shares and a -0.7% impact on the portfolio. The stock, which traded at an average price of $21.53 during the quarter, has returned 21.32% over the past three months and -7.98% year-to-date.

- Reduced U-Haul Holding Co (UHAL.B, Financial) by 141,484 shares, leading to a -3.99% reduction in shares and a -0.17% impact on the portfolio. The stock's average trading price was $64.99 during the quarter, with a 6.51% return over the past three months and a -4.42% year-to-date performance.

The strategic adjustments in Abrams's portfolio, particularly the significant reduction in Camping World Holdings, reflect his responsive and calculated approach to value investing. As market dynamics evolve, Abrams Capital Management continues to adapt its positions to optimize investment outcomes, maintaining a keen focus on fundamental value across various asset classes.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.