Overview of the Recent Transaction

On September 30, 2024, Brandes Investment Partners, LP (Trades, Portfolio) executed a significant transaction by acquiring an additional 56,709 shares of Graham Corporation (GHM, Financial), a key player in the industrial products sector. This purchase increased the firm's total holdings in Graham Corp to 1,133,455 shares, marking a notable expansion of its investment in the company. The shares were acquired at a price of $29.59 each, reflecting a strategic move by the firm to bolster its portfolio with a substantial stake in Graham Corp.

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

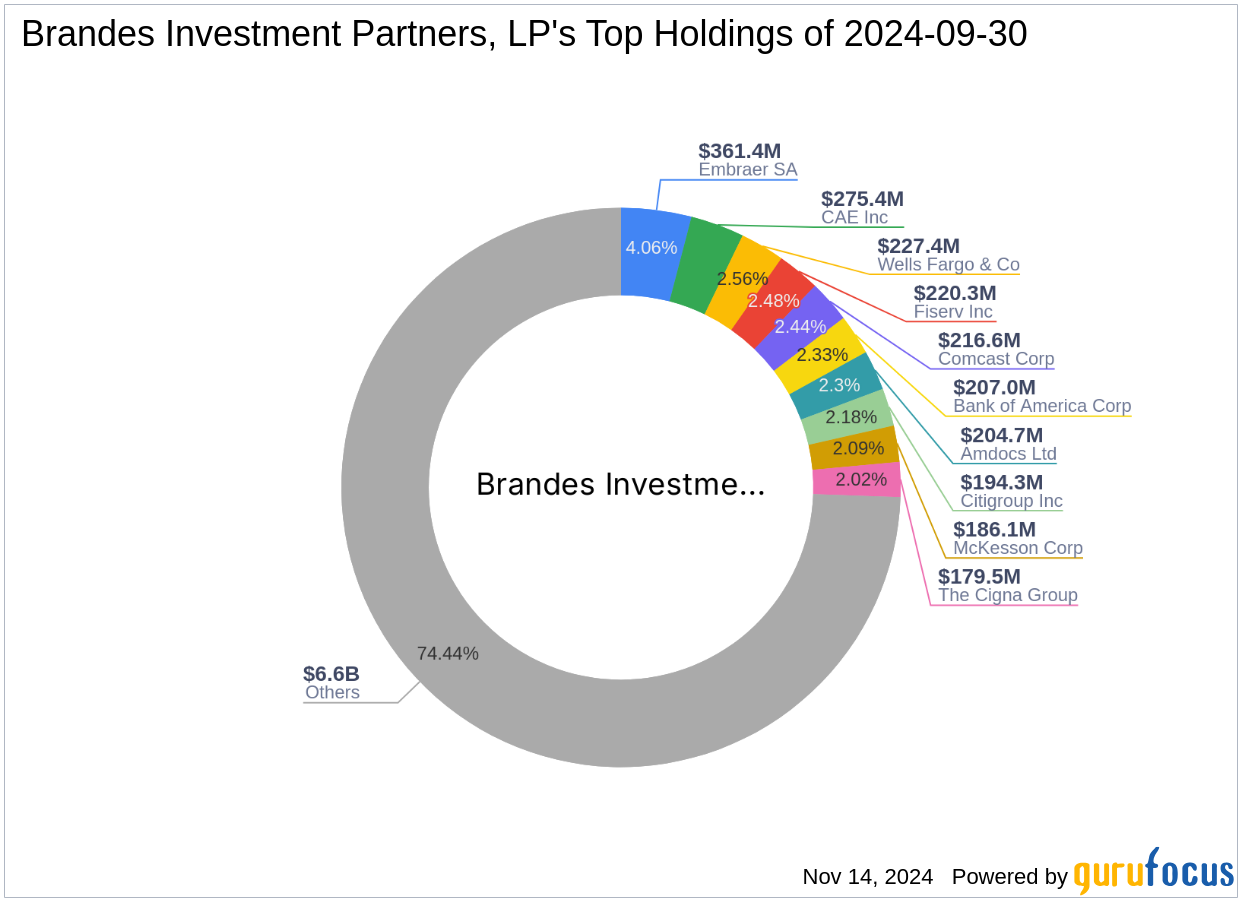

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) has established itself as a prominent investment advisory firm, managing a diverse range of global equity and fixed-income assets. The firm is renowned for its commitment to the value investing principles pioneered by Benjamin Graham. It focuses on acquiring undervalued securities and holds them until their market value aligns with their intrinsic value. Brandes Investment Partners manages several key funds, including the U.S. Equity and Global Equity Funds, and is a major player in sectors such as healthcare and financial services.

Introduction to Graham Corporation

Graham Corporation, listed under the ticker GHM, operates within the industrial products industry in the United States. Since its IPO on March 17, 1992, the company has been instrumental in designing and manufacturing critical technologies for sectors such as defense, energy, and space. With a market capitalization of approximately $447.36 million, Graham Corp specializes in fluid, power, heat transfer, and vacuum technologies, also providing aftermarket services and parts.

Strategic Significance of the Transaction

The recent acquisition by Brandes Investment Partners significantly enhances its portfolio, with Graham Corp now constituting 0.41% of its total investments. This move aligns with the firm's strategy of investing in value-driven stocks, considering Graham Corp's strong market presence and technological expertise in critical industries. The transaction not only diversifies Brandes' holdings but also positions it to benefit from Graham's potential market value realization.

Market Context and Stock Valuation

Currently, Graham Corporation's stock is trading at $41.08, which is significantly higher than the price at which Brandes Investment Partners made its recent purchase. Despite this increase, the stock is considered "Significantly Overvalued" according to the GF Value, with a current GF Value of $17.84. This discrepancy suggests a cautious approach for potential investors, given the high market valuation compared to the intrinsic value.

Performance Metrics and Rankings of Graham Corporation

Graham Corporation holds a GF Score of 71/100, indicating a likelihood of average future performance. The company has a strong Financial Strength with a score of 9/10 and a Profitability Rank of 6/10. Its Growth Rank stands at 8/10, reflecting robust growth metrics over the past three years. However, its GF Value Rank is low at 1/10, underscoring the overvaluation concerns.

Conclusion: Analyzing the Impact

The strategic acquisition of additional shares in Graham Corporation by Brandes Investment Partners, LP (Trades, Portfolio) reflects a calculated enhancement to its portfolio, leveraging the firm's value investing framework. While the current stock price of Graham Corp suggests a significant premium over its GF Value, Brandes' position as a major shareholder could yield substantial returns if the market adjusts to recognize the company's intrinsic value. Investors and market watchers will undoubtedly keep a close eye on how this investment plays out in the evolving landscape of the industrial products sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.