Overview of the Recent Transaction

On September 30, 2024, Brandes Investment Partners, LP (Trades, Portfolio) executed a significant transaction by adding 14,016 shares to its existing holdings in Netgear Inc (NTGR, Financial). This move increased the firm's total share count in Netgear to 3,910,508, representing a 13.64% ownership in the company. The shares were acquired at a price of $20.06 each, reflecting a strategic addition to the firm’s portfolio.

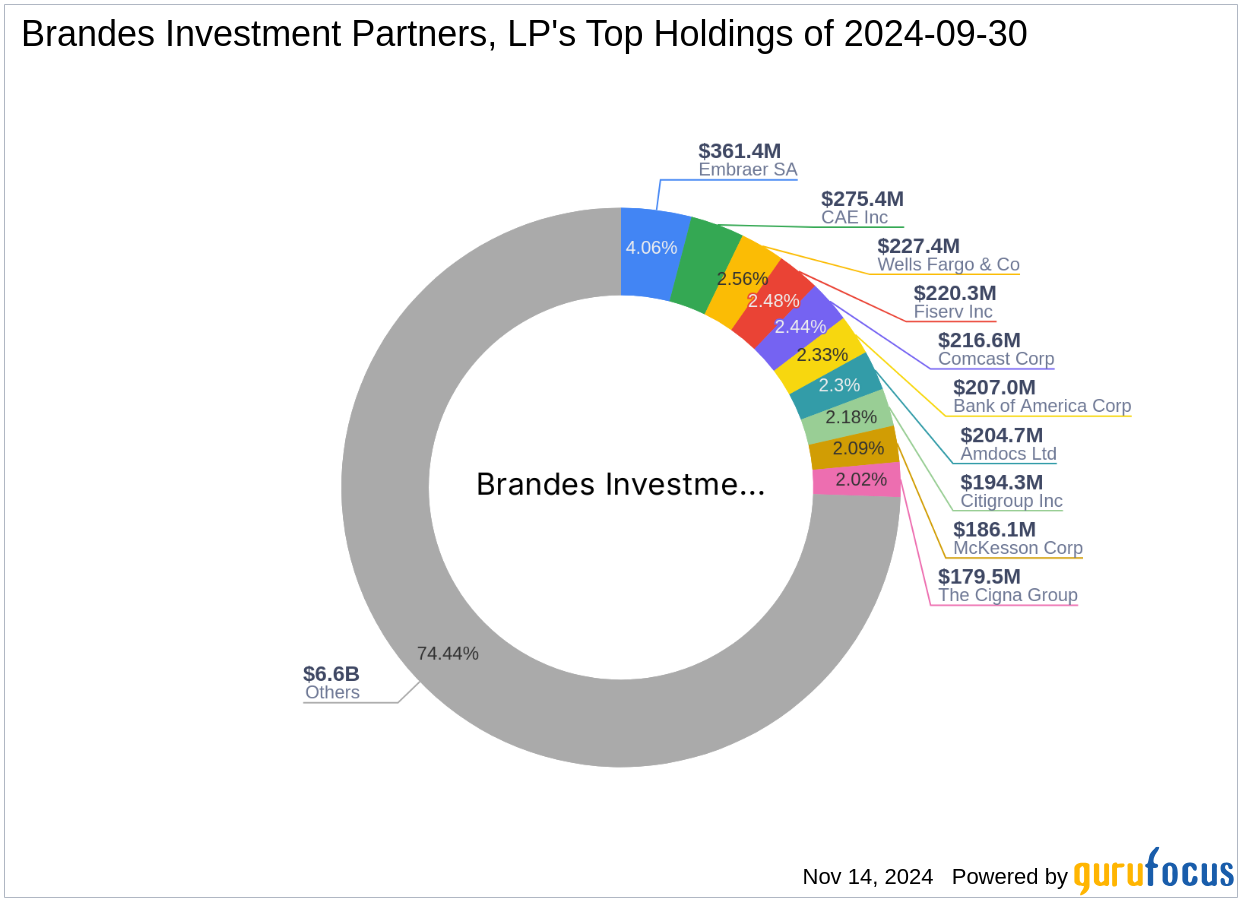

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) is a prominent investment advisory firm known for its global equity and fixed-income asset management. The firm adheres to the value investing principles pioneered by Benjamin Graham, focusing on undervalued securities. Brandes Investment Partners manages several funds, including the U.S. Equity and Global Equity Funds, and holds a diverse portfolio with top holdings in sectors like Healthcare and Financial Services.

Introduction to Netgear Inc

Netgear Inc, based in the USA, specializes in providing innovative networking solutions. Since its IPO on July 31, 2003, the company has developed two main segments: Connected Home and NETGEAR for Business. These segments offer a range of products from high-performance Wi-Fi and mobile networking solutions to smart devices and business-grade networking systems. Despite its innovative offerings, Netgear is currently facing challenges in market performance and growth metrics.

Analysis of the Trade's Impact

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) has bolstered its position in Netgear, making it one of the largest institutional holders with a 0.97% portfolio weight. This strategic move indicates Brandes' confidence in Netgear's value proposition and its alignment with the firm's investment philosophy of targeting undervalued stocks.

Financial and Market Performance of Netgear Inc

Netgear's current stock price stands at $24.08, which is significantly overvalued according to the GF Value of $13.33. The stock has shown a substantial gain of 20.04% since the transaction date, outperforming the industry with a year-to-date increase of 68.51%. However, the company's financial strength and growth metrics, such as a Growth Rank of 2/10 and a GF Value Rank of 1/10, suggest potential concerns.

Sector and Market Analysis

Netgear operates within the competitive hardware industry, where it has struggled to match the growth and profitability standards of its peers. This is reflected in its low profitability and growth ranks. However, its commitment to innovation in networking solutions keeps it relevant in the rapidly evolving tech landscape.

Other Significant Investors

Alongside Brandes Investment Partners, notable firms like Donald Smith & Co and First Eagle Investment (Trades, Portfolio) also hold significant stakes in Netgear. These investments underscore the interest from value-focused investors, drawn by the potential turnaround in Netgear's market performance.

Future Outlook and Analyst Insights

While the short-term outlook for Netgear shows promising market performance, the long-term perspective must be cautious due to its financial metrics and growth challenges. Investors should monitor the company's strategic initiatives and market adaptation closely.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.