On December 31, 2024, FMR LLC (Trades, Portfolio), a prominent investment firm, executed a significant transaction involving American Eagle Outfitters Inc (AEO, Financial). The firm reduced its holdings in AEO by 12,518,976 shares, marking a substantial change of -81.32%. This strategic move reflects a notable shift in FMR LLC (Trades, Portfolio)'s investment strategy concerning this specialty retailer. The transaction was executed at a price of $16.67 per share, leaving FMR LLC (Trades, Portfolio) with a total of 2,875,725 shares in AEO. Despite the large reduction, the impact on FMR LLC (Trades, Portfolio)'s overall portfolio was minimal, with a trade impact of -0.01.

FMR LLC (Trades, Portfolio): A Profile of the Investment Firm

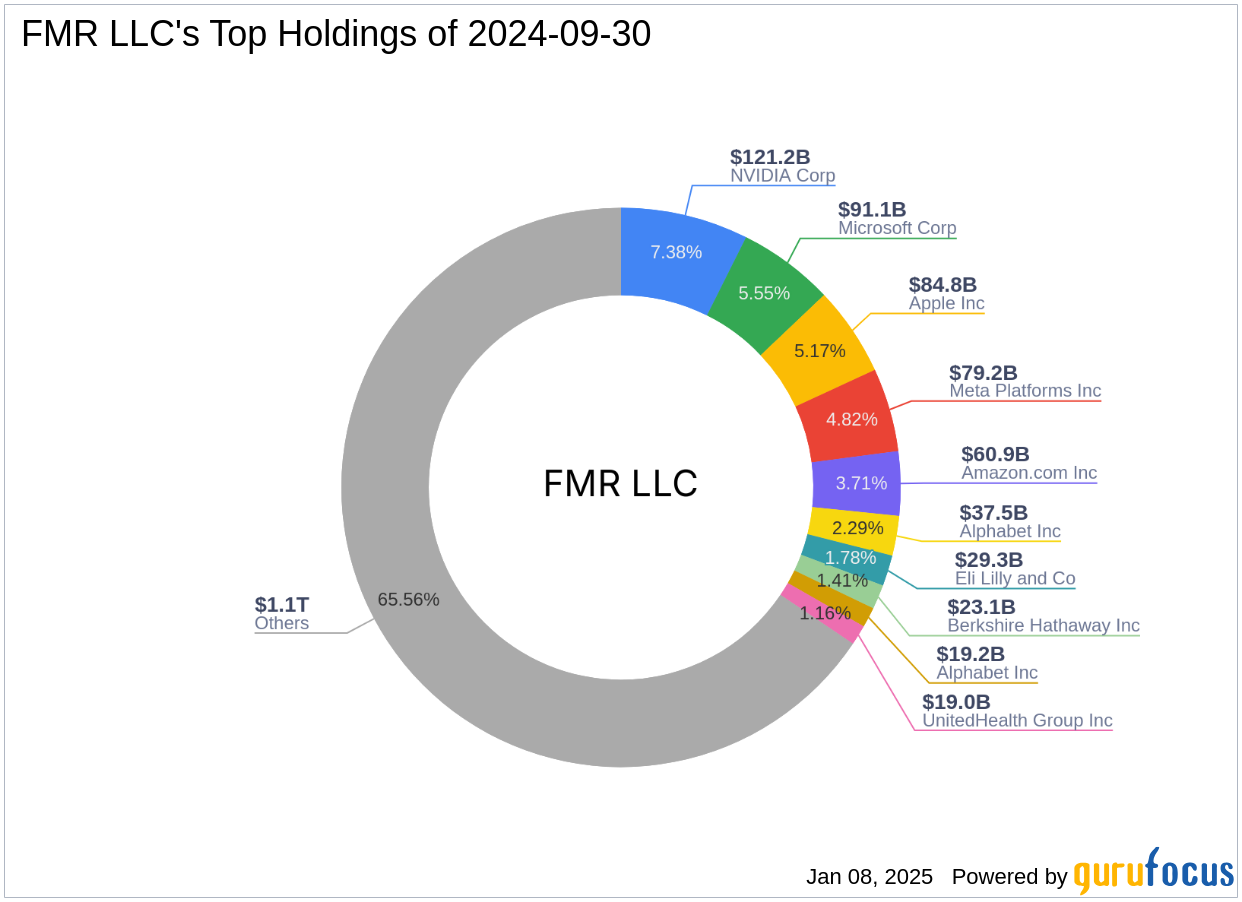

FMR LLC (Trades, Portfolio), widely recognized as Fidelity, was founded in 1946 by Edward C. Johnson II. The firm is renowned for its growth-oriented investment strategy, focusing on stocks with significant growth potential. Over the years, Fidelity has built a diverse portfolio, with top holdings in major technology companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). Fidelity's investment philosophy emphasizes innovation and research, which has allowed it to maintain a strong presence in the financial industry. The firm has a substantial equity base of $1,640.7 trillion, with a primary focus on the technology and healthcare sectors.

American Eagle Outfitters Inc: Company Overview

American Eagle Outfitters Inc is a specialty retailer primarily engaged in the sale of apparel and accessories. The company operates through two main segments: American Eagle and Aerie. The majority of its revenue is generated from the American Eagle brand, which offers a wide range of specialty apparel, accessories, and personal care products for both women and men. With a market capitalization of $3.14 billion, American Eagle Outfitters has established a strong presence in the United States, Canada, Mexico, and Hong Kong. The company also operates an online business, further expanding its reach in the retail market.

Financial Metrics and Valuation of AEO

American Eagle Outfitters Inc is currently fairly valued with a GF Value of $17.91. The stock has a price-to-earnings (PE) ratio of 13.95 and a GF Score of 74/100, indicating likely average performance. The company's Profitability Rank stands at 7/10, reflecting a solid financial foundation. However, the stock's year-to-date price change is -4.7%, and it has a cash to debt ratio of 0.12, suggesting some financial challenges. The Altman Z score of 3.73 indicates a relatively stable financial position.

Performance and Growth Indicators

Over the past three years, American Eagle Outfitters has experienced a revenue growth of 5.80%. The company's Growth Rank is 3/10, indicating moderate growth potential. The stock's Momentum Rank is 5/10, reflecting a balanced momentum in the market. Despite these indicators, the company's Operating Margin growth is 6.20%, showcasing its ability to manage operational efficiency effectively.

Other Notable Holders of AEO

Fisher Asset Management, LLC is the largest holder of AEO shares, indicating a strong belief in the company's potential. Other investment firms, such as Keeley-Teton Advisors, LLC (Trades, Portfolio), also hold positions in AEO, reflecting a diverse interest in the stock among institutional investors. This broad interest suggests confidence in American Eagle Outfitters' market position and future prospects.

Conclusion: Strategic Portfolio Management

The reduction in FMR LLC (Trades, Portfolio)'s holdings in American Eagle Outfitters Inc reflects a strategic decision within its portfolio management. While the firm has significantly decreased its stake, the minimal impact on its overall portfolio suggests a calculated move to optimize its investment strategy. Investors considering AEO should evaluate the company's financial health, market position, and growth potential to make informed investment decisions. The transaction highlights the dynamic nature of portfolio management and the importance of adapting to market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.