Stanley Morgan - Net Worth and Insider Trading

Stanley Morgan Net Worth

The estimated net worth of Stanley Morgan is at least $3.5 Billion dollars as of 2024-11-05. Stanley Morgan is the 10% Owner of Intercontinental Exchange Inc and owns about 20,773,610 shares of Intercontinental Exchange Inc (ICE) stock worth over $3.2 Billion. Stanley Morgan is the 10% Owner of DigitalGlobe Inc and owns about 7,273,576 shares of DigitalGlobe Inc (DGI) stock worth over $250 Million. Stanley Morgan is also the 10% Owner of Mondee Holdings Inc and owns about 8,465,479 shares of Mondee Holdings Inc (MOND) stock worth over $11 Million. Besides these, Stanley Morgan also holds Constant Contact Inc (CTCT) , Cadiz Inc (CDZI) , Alimera Sciences Inc (ALIM) , Cross Country Healthcare Inc (CCRN) , Discover Financial Services (DFS) , Blackrock Muniyield Quality Fund Inc (MQY) , Bloom Energy Corp (BE) , Saba Capital Income & Opportunities Fund (BRW) , Eastern Light Capital Inc (ELCI) , Cyclacel Pharmaceuticals Inc (CYCC) , Nuveen Short Duration Credit Opps (JSD) , Mfs Investment Grade Municipal Trust (CXH) . Details can be seen in Stanley Morgan's Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the final shares held after open market or private purchases and sales of common stock with a transaction code of "P" or "S" on Form 4, assuming that Stanley Morgan has not made any transactions after 2023-06-09 and currently still holds the listed stock(s). Please note that this estimate may not reflect the actual net worth.

Transaction Summary of Stanley Morgan

Stanley Morgan Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Stanley Morgan owns 49 companies in total, including Leisure Acquisition Corp (LACQU) , China XD Plastics Co Ltd (CXDC) , and Bloom Energy Corp (BE) among others .

Click here to see the complete history of Stanley Morgan’s form 4 insider trades.

Insider Ownership Summary of Stanley Morgan

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| LACQU | Leisure Acquisition Corp | 2020-06-19 | 10 percent owner |

| CXDC | China XD Plastics Co Ltd | 2019-09-30 | 10 percent owner & other: See Explanation of Responses |

| BE | Bloom Energy Corp | 2019-04-11 | 10 percent owner |

| 2008-12-31 | 10 percent owner | ||

| 2009-12-31 | 10 percent owner | ||

| 2017-08-30 | other: See Remarks Below | ||

| 2017-07-24 | 10 percent owner | ||

| 2016-04-13 | 10 percent owner | ||

| 2016-02-24 | 10 percent owner | ||

| 2016-03-11 | 10 percent owner | ||

| 2023-10-05 | 10 percent owner | ||

| 2014-07-01 | director & 10 percent owner & other: See Note (1) | ||

| 2008-12-31 | 10 percent owner | ||

| 2013-02-27 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2010-08-06 | 10 percent owner | ||

| 2012-08-21 | 10 percent owner | ||

| 2012-07-06 | 10 percent owner | ||

| 2012-06-28 | 10 percent owner | ||

| 2012-02-17 | 10 percent owner | ||

| 2012-03-23 | 10 percent owner | ||

| 2012-02-29 | 10 percent owner | ||

| 2012-01-03 | 10 percent owner | ||

| 2011-01-18 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2009-11-10 | 10 percent owner | ||

| 2007-11-14 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-09-18 | 10 percent owner | ||

| 2008-05-28 | 10 percent owner | ||

| 2008-03-17 | 10 percent owner | ||

| 2008-03-11 | 10 percent owner | ||

| 2007-06-01 | 10 percent owner | ||

| 2006-10-04 | 10 percent owner | ||

| 2006-02-02 | 10 percent owner | ||

| 2005-04-14 | 10 percent owner | ||

| 2003-12-19 | 10 percent owner | ||

| 2021-10-08 | 10 percent owner | ||

| 2022-02-08 | 10 percent owner | ||

| 2020-03-29 | 10 percent owner | ||

| 2022-07-18 | 10 percent owner | ||

| 2022-07-18 | 10 percent owner | ||

| 2021-06-21 | 10 percent owner | ||

| 2023-06-09 | 10 percent owner |

Stanley Morgan Latest Holdings Summary

Stanley Morgan currently owns a total of 15 stocks. Among these stocks, Stanley Morgan owns 20,773,610 shares of Intercontinental Exchange Inc (ICE) as of July 21, 2006, with a value of $3.2 Billion and a weighting of 92.04%. Stanley Morgan owns 7,273,576 shares of DigitalGlobe Inc (DGI) as of February 27, 2013, with a value of $250 Million and a weighting of 7.18%. Stanley Morgan also owns 8,465,479 shares of Mondee Holdings Inc (MOND) as of June 9, 2023, with a value of $11 Million and a weighting of 0.31%. The other 12 stocks Constant Contact Inc (CTCT) , Cadiz Inc (CDZI) , Alimera Sciences Inc (ALIM) , Cross Country Healthcare Inc (CCRN) , Discover Financial Services (DFS) , Blackrock Muniyield Quality Fund Inc (MQY) , Bloom Energy Corp (BE) , Saba Capital Income & Opportunities Fund (BRW) , Eastern Light Capital Inc (ELCI) , Cyclacel Pharmaceuticals Inc (CYCC) , Nuveen Short Duration Credit Opps (JSD) , Mfs Investment Grade Municipal Trust (CXH) have a combined weighting of 0.48% among all his current holdings.

Latest Holdings of Stanley Morgan

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| ICE | Intercontinental Exchange Inc | 2006-07-21 | 20,773,610 | 154.49 | 3,209,315,009 |

| DGI | DigitalGlobe Inc | 2013-02-27 | 7,273,576 | 34.40 | 250,211,014 |

| MOND | Mondee Holdings Inc | 2023-06-09 | 8,465,479 | 1.26 | 10,666,504 |

| CTCT | Constant Contact Inc | 2007-10-02 | 223,637 | 32.01 | 7,158,620 |

| CDZI | Cadiz Inc | 2006-02-02 | 1,102,481 | 3.46 | 3,814,584 |

| ALIM | Alimera Sciences Inc | 2022-02-08 | 557,551 | 5.54 | 3,088,833 |

| CCRN | Cross Country Healthcare Inc | 2005-04-14 | 217,605 | 11.22 | 2,441,528 |

| DFS | Discover Financial Services | 2007-06-01 | 1,000 | 149.14 | 149,140 |

| MQY | Blackrock Muniyield Quality Fund Inc | 2012-02-17 | 8,127 | 12.47 | 101,344 |

| BE | Bloom Energy Corp | 2018-11-26 | 1,638 | 10.82 | 17,723 |

| BRW | Saba Capital Income & Opportunities Fund | 2011-01-18 | 396 | 7.53 | 2,982 |

| ELCI | Eastern Light Capital Inc | 2004-03-19 | 25,068 | 0.10 | 2,507 |

| CYCC | Cyclacel Pharmaceuticals Inc | 2009-11-10 | 90 | 0.51 | 46 |

| JSD | Nuveen Short Duration Credit Opps | 2016-03-11 | 0 | 13.33 | 0 |

| CXH | Mfs Investment Grade Municipal Trust | 2010-08-06 | 0 | 8.15 | 0 |

Holding Weightings of Stanley Morgan

Stanley Morgan Form 4 Trading Tracker

According to the SEC Form 4 filings, Stanley Morgan has made a total of 0 transactions in Intercontinental Exchange Inc (ICE) over the past 5 years. The most-recent trade in Intercontinental Exchange Inc is the sale of 9,939,670 shares on July 21, 2006, which brought Stanley Morgan around $111 Million.

According to the SEC Form 4 filings, Stanley Morgan has made a total of 0 transactions in DigitalGlobe Inc (DGI) over the past 5 years. The most-recent trade in DigitalGlobe Inc is the sale of 190,000 shares on February 27, 2013, which brought Stanley Morgan around $5 Million.

According to the SEC Form 4 filings, Stanley Morgan has made a total of 2 transactions in Mondee Holdings Inc (MOND) over the past 5 years, including 1 buys and 1 sells. The most-recent trade in Mondee Holdings Inc is the sale of 1,049,889 shares on June 9, 2023, which brought Stanley Morgan around $10 Million.

More details on Stanley Morgan's insider transactions can be found in the Insider Trading History of Stanley Morgan table.Insider Trading History of Stanley Morgan

- 1

Stanley Morgan Trading Performance

GuruFocus tracks the stock performance after each of Stanley Morgan's buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Stanley Morgan is -2.24%. GuruFocus also compares Stanley Morgan's trading performance to market benchmark return within the same time period. The performance of stocks bought by Stanley Morgan within 3 months outperforms 3 times out of 13 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Stanley Morgan's insider trading performs compared to the benchmark.

Performance of Stanley Morgan

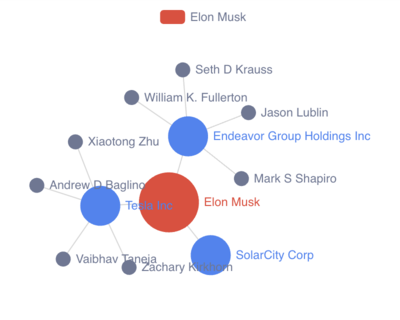

Stanley Morgan Ownership Network

Ownership Network List of Stanley Morgan

Ownership Network Relation of Stanley Morgan

Stanley Morgan Owned Company Details

What does Leisure Acquisition Corp do?

Who are the key executives at Leisure Acquisition Corp?

Stanley Morgan is the 10 percent owner of Leisure Acquisition Corp. Other key executives at Leisure Acquisition Corp include director & Chief Executive Officer Daniel B. Silvers , director & Executive Chairman A Lorne Weil , and Chief Financial Officer George Peng .

Leisure Acquisition Corp (LACQU) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of Leisure Acquisition Corp (LACQU) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Leisure Acquisition Corp (LACQU) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

Leisure Acquisition Corp (LACQU)'s detailed insider trading history can be found in Insider Trading Tracker table.

Leisure Acquisition Corp Insider Transactions

Stanley Morgan Mailing Address

Above is the net worth, insider trading, and ownership report for Stanley Morgan. You might contact Stanley Morgan via mailing address: 1585 Broadway, New York Ny 10036.