Overview of the Recent Transaction

On September 30, 2024, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a significant transaction involving the shares of Commercial Vehicle Group Inc (CVGI, Financial). The firm reduced its holdings by 274,302 shares, which represented an 11.27% decrease in its previous stake in the company. This move adjusted the firm's total shares in CVGI to 2,159,806, impacting the portfolio by a mere 0.01%. The shares were traded at a price of $3.25 each. This adjustment brings the firm's position in CVGI to 6.26% of the company's outstanding shares, reflecting a portfolio weight of 0.07%.

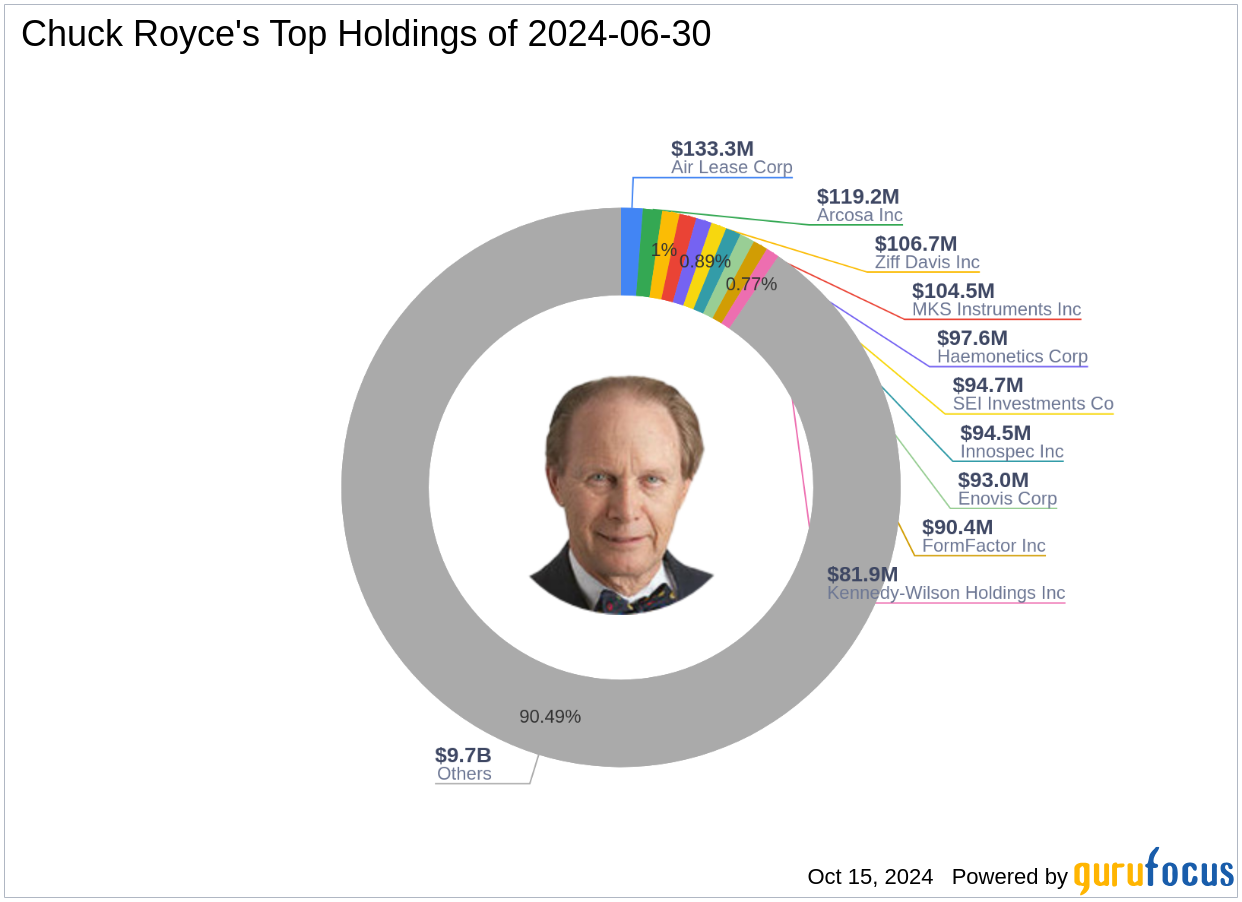

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a notable figure in the investment world, is renowned for pioneering small-cap investing. Leading the Royce Pennsylvania Mutual Fund since 1972, Royce has built a reputation for focusing on companies with market caps up to $10 billion. The firm's investment philosophy centers on identifying undervalued companies with strong balance sheets, successful business histories, and promising futures. Currently, the firm manages an equity portfolio valued at $10.7 billion, with top holdings in diverse sectors such as Industrials and Technology.

Introduction to Commercial Vehicle Group Inc (CVGI, Financial)

Commercial Vehicle Group Inc, based in the USA, operates in the Vehicles & Parts industry. Since its IPO in 2004, CVGI has specialized in supplying cab-related products and systems across multiple segments including Vehicle Solutions and Electrical Systems. Despite a challenging market, CVGI remains significantly undervalued with a GF Value of $6.56, currently trading at $3.15, which is 48% of its intrinsic value. The company's market cap stands at approximately $108.68 million.

Analysis of the Trade Impact

The reduction in CVGI shares by Chuck Royce (Trades, Portfolio)'s firm is subtle yet strategic, reflecting a slight decrease in confidence or a portfolio rebalancing, given the minimal impact on the overall portfolio. Holding 6.26% of CVGI's shares, the firm remains a significant shareholder, suggesting a sustained, albeit reduced, interest in the company's future.

Market Context and Stock Performance

CVGI's market performance has been underwhelming with a year-to-date price decline of 54.22%, and a significant drop of 75.86% since its IPO. The stock's current price-to-GF Value ratio stands at 0.48, indicating it is significantly undervalued. This could represent a potential investment opportunity, assuming the market corrects this undervaluation.

Strategic Implications of the Trade

The decision to reduce holdings in CVGI could be influenced by several factors including the stock's poor performance metrics and market volatility. However, maintaining a notable percentage of ownership indicates an ongoing interest in the stock's potential rebound or long-term value.

Comparative Analysis

Comparing Chuck Royce (Trades, Portfolio)'s firm with other major holders like GAMCO Investors, it's evident that strategic positions are being adjusted frequently in response to market dynamics within the Vehicles & Parts industry. This sector is currently experiencing significant shifts, influencing investment decisions across the board.

Conclusion

Chuck Royce (Trades, Portfolio)'s recent transaction in CVGI shares reflects a nuanced approach to portfolio management in the face of a volatile market. While the reduction is notable, the continued investment suggests a wait-and-see strategy, aligning with the firm's philosophy of investing in undervalued companies with potential for future profitability. Investors should keep a close watch on CVGI's performance and any further adjustments by major stakeholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.