Overview of the Recent Transaction

On October 14, 2024, JCP Investment Management, LLC (Trades, Portfolio) executed a significant transaction by acquiring an additional 227,761 shares of Red Robin Gourmet Burgers Inc (RRGB, Financial), a well-known player in the restaurant industry. This purchase increased the firm's total holdings in the company to 1,014,963 shares, marking a substantial investment move. The shares were bought at a price of $5.59 each, reflecting a strategic addition to JCP's portfolio with a trade impact of 1.4%.Insight into JCP Investment Management, LLC (Trades, Portfolio)

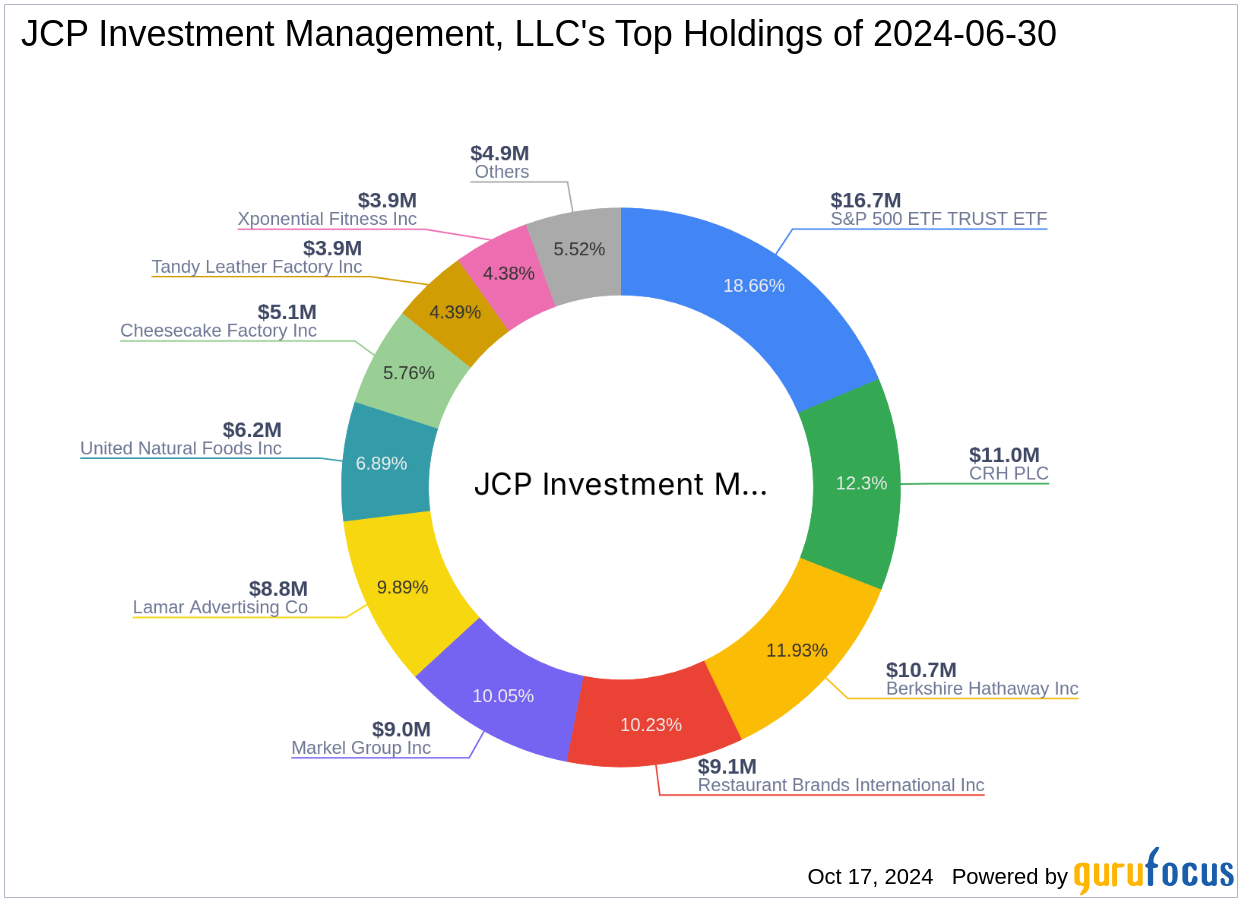

Located in Houston, Texas, JCP Investment Management, LLC (Trades, Portfolio) is a prominent investment firm with a keen focus on value investing. The firm manages a diversified portfolio with significant positions in sectors such as Consumer Cyclical and Financial Services. Among its top holdings are major entities like S&P 500 ETF TRUST ETF (SPY, Financial) and Berkshire Hathaway Inc (BRK.B, Financial). With an equity portfolio valued at approximately $89 million, JCP Investment Management is a notable player in the investment community.

Red Robin Gourmet Burgers Inc at a Glance

Red Robin Gourmet Burgers Inc, trading under the symbol RRGB, operates a chain of casual dining restaurants across North America. Founded on July 19, 2002, the company has expanded its brand to include various concepts like Red Robin Gourmet Burgers and Brews. Despite a challenging market, Red Robin maintains a market capitalization of $91.684 million, with a current stock price of $5.82. The company's financial health has been under scrutiny, reflected in its GF Score of 58/100, indicating potential challenges ahead.

Financial Metrics and Stock Performance

Red Robin's stock performance has been volatile, with a significant decline of 52.53% since its IPO and a 50.8% drop year-to-date. The stock is currently trading at a price to GF Value ratio of 0.58, suggesting it might be undervalued. However, the GF Value warns of a possible value trap, advising investors to think twice. The company's financial metrics such as a PE Ratio of 0.00 and a low Cash to Debt ratio of 0.04 further complicate its investment appeal.Strategic Implications of JCP's Investment

JCP Investment Management's decision to increase its stake in Red Robin could be seen as a contrarian move, given the company's current financial challenges and market performance. This acquisition increases JCP's exposure to the restaurant industry, which could be a strategic play betting on a turnaround or specific operational improvements within Red Robin. The sizeable addition to their holdings, now accounting for 6.40% of their portfolio, underscores the firm's commitment to this investment.Future Outlook and Industry Trends

The restaurant industry faces numerous challenges, including changing consumer preferences and economic pressures. However, Red Robin's focus on innovation and customer engagement could position it for recovery. Industry trends such as the increasing demand for quality dining experiences and efficient service models might benefit Red Robin if effectively capitalized. Investors and stakeholders in JCP Investment Management, LLC (Trades, Portfolio) will be watching closely to see how this investment plays out in the evolving market landscape.In conclusion, JCP Investment Management, LLC (Trades, Portfolio)'s recent acquisition of additional shares in Red Robin Gourmet Burgers Inc represents a notable development in their investment strategy. This move not only increases their influence within the company but also reflects a broader bet on the potential recovery and growth of the casual dining sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.