Citigroup Inc - Net Worth and Insider Trading

Citigroup Inc Net Worth

The estimated net worth of Citigroup Inc is at least $6.4 Billion dollars as of 2024-11-05. Citigroup Inc is the 10% Owner of Molson Coors Beverage Co and owns about 99,900,670 shares of Molson Coors Beverage Co (TAP.A) stock worth over $5.9 Billion. Citigroup Inc is the 10% Owner of Nuveen Dividend Advantage Muni Fund 2 and owns about 29,300,000 shares of Nuveen Dividend Advantage Muni Fund 2 (NXZ) stock worth over $438 Million. Citigroup Inc is also the Director of Kemet Corp and owns about 1,761,938 shares of Kemet Corp (KEM) stock worth over $48 Million. Besides these, Citigroup Inc also holds Consumer Portfolio Services Inc (CPSS) , Primerica Inc (PRI) , Sylvamo Corp (SLVM) , PIMCO High Income Fund (PHK) , Jones Energy Inc (JONEQ) , PIMCO Corporate & Income Strategy Fund (PCN) , Gabelli Dividend & Income Trust (GDV) , Western Asset Managed Municipals Fd Inc (MMU) , CBRE Clarion Global Real Estate Income Fund (IGR) , BLACKROCK MUNIYIELD QUALITY FUND III, INC. (MYI) , Nuveen Premium Income Municipal Fund II Inc. (NPM) , Nuveen Municipal Advantage Fund Inc. (NMA) , Gabelli Equity Trust Inc (GAB) , Alliancebernstein National Muni Inc Fd (AFB) , Blackrock Muniyield NY Quality FD, Inc (MYN) , Invesco Senior Income Trust (VVR) , Blackrock Municipal Income Quality Trust (BYM) , BLACKROCK MUNIYIELD CALIFORNIA QUALITY FUND, INC. (MCA) , Nuveen Quality Municipal Fund Common (NQI) , Alliance California Municipal Income Fund Inc (AKP) , Nuveen Credit Strategies Income Fund (JQC) , Blackrock Muni Enhanced Fund Inc (MEN) , Blackrock Muniyield Michigan Quality Fund Inc (MIY) , Kayne Anderson Energy Infrastructure Fund, Inc (KYN) , Nuveen Quality Preferred Income Fund (JTP) , Nuveen Preferred & Income Opportunities Fund (JPC) , Federated Premier Intmd Muni Income Fund (FPT) , Nuveen Maryland Quality Municipal Income Fund (NMY) , Blackrock Municipal Income Trust (BFK) , Invesco Dynamic Credit Opportunities Fund (VTA) , Blackrock Muniyield New Jersey Fund Inc (MYJ) , Blackrock Muniyield California Fund, Inc (MYC) , Nuveen Quality Municipal Income Fund (NAD) , Nuveen Preferred & Income Securities Fund (JPS) , Nuveen Floating Rate Income Fund (JFR) , Nuveen Premier Municipal Opportunity (NIF) , Advent Claymore Convertible Securities & Income Fu (AGC) , BlackRock MuniYield MI Qty II Common (MYM) , Nuveen Diversified Dividend & Income Fund (JDD) , Western Asset Corporate Loan Fund Inc (TLI) , Eaton Vance Floating-rate Income Trust (EFT) , Franklin Limited Duration Income Trust (FTF) , Blackrock Municipal Income Investment Quality Trus (BAF) , Blackrock Credit Allocation Income Trust (BTZ) , Western Asset Intermediate Muni Fd Inc (SBI) , Nuveen New York Quality Income Municipal Fund Inc. (NUN) , Blackrock Municipal Bond Trust (BBK) , Alliance New York Municipal Income Fund Inc. (AYN) , Pacholder High Yield Fund Inc (PHF) , Blackrock Muniyield Invstmt Fd (MYF) , Federated Hermes Premier Municipal Income Fund (FMN) , NIO Inc (NIO) , Blackrock Muniyield Pennsylvania Quality Fund (MPA) , Nuveen Floating Rate Income Opp Fd (JRO) , Saba Capital Income & Opportunities Fund (BRW) , Invesco Trust For Investment Grade New York Municipals (VTN) , Nuveen Quality Preferred Income Fund 3 (JHP) , Nuveen Pennsylvania Quality Municipal Income Fund (NQP) , NUVEEN CONNECTICUT QUALITY MUNICIPAL INCOME FUND (NTC) , EV Floating-Rate Income Plus Fund (EFF) , Nuveen MI Quality Income Muni Fund Inc (NUM) , Blackrock NJ Municipal Income Tr (BNJ) , Blackrock Municipal Inc Invstmt Tr (BBF) , MFS Municipal Income Trust (MFM) , Blackrock Maryland Municipal Bond Trust (BZM) , BlackRock Municipal Bond Inv Common (BIE) , Blackrock CA Muni Income Tr (BFZ) , Nuveen California Dividend Advantage Municipal Fun (NZH) , Mfs Investment Grade Municipal Trust (CXH) , VanEck Brazil Small-Cap ETF (BRF) , BlackRock New York Municipal Income Quality Trust (BSE) , Mfs High Income Municipal Trust (CXE) , Gabelli Multimedia Trust Inc (GGT) , Nuveen New York Premium Income (NNF) , Blackrock Strategic Municipal Trust (BSD) , MFS California Municipal Fund (CCA) , Nuveen CA Dividend Advantage Muni Fund 2 (NVX) , Nuveen Tax Advantaged Total Ret Strat Fd (JTA) , Nuveen Senior Income Fund (NSL) , Blackrock New York Municipal Bond Trust (BQH) , Nuveen New York Quality Municipal Income Fund (NAN) , BlackRock Massachusetts Tax-Exempt Trust (MHE) , Nuveen Ohio Dividend Advantage Municipal Fund (NXI) , NexGen Energy Ltd (NXE) , Mfs High Yield Municipal Trust (CMU) , Nuveen New Jersey Quality Municipal Income Fund (NXJ) , Eaton Vance CA Muni Income Trust (CEV) , Nuveen Arizona Dividend Advantage Municipal Fund (NFZ) , Nuveen Georgia Quality Municipal Income Fund (NKG) , Nuveen Arizona Quality Municipal Income Fund (NAZ) , Blackrock New Jersey Municipal Bond Tr (BLJ) , New Frontier Health Corp (NFH) , Nuveen Arizona Dividend Advantage Municipal Fund 2 (NKR) , Nuveen Ohio Dividend Advantage Municipal Fund 2 (NBJ) , Blackrock Virginia Municipal Bond Trust (BHV) , Eaton Vance Michigan Muni Income Trust (EMI) , PIMCO Municipal Income Fund III (PMX) , Nuveen Ohio Dividend Advantage Municipal Fund 3 (NVJ) , Nuveen California AMT-Free Quality Municipal Income Fund (NKX) , DWS Strategic Municipal Income Trust (KSM) , DWS Municipal Income Trust (KTF) , Invesco Advantage Municipal Income Trust II (VKI) , Intersil Corp (ISIL) , MainStay MacKay DefinedTerm Municipal Opportunities Fund (MMD) , Nuveen AMT-Free Municipal Income Fund (NEA) , Invesco California Value Municipal Income Trust (VCV) , Nuveen New York AMT-Free Quality Municipal Income Fund (NRK) . Details can be seen in Citigroup Inc's Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the final shares held after open market or private purchases and sales of common stock with a transaction code of "P" or "S" on Form 4, assuming that Citigroup Inc has not made any transactions after 2022-09-12 and currently still holds the listed stock(s). Please note that this estimate may not reflect the actual net worth.

Transaction Summary of Citigroup Inc

Citigroup Inc Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Citigroup Inc owns 113 companies in total, including DWS Municipal Income Trust (KTF) , DWS Strategic Municipal Income Trust (KSM) , and Nuveen Municipal Credit Income Fund (NZF) among others .

Click here to see the complete history of Citigroup Inc’s form 4 insider trades.

Insider Ownership Summary of Citigroup Inc

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| KTF | DWS Municipal Income Trust | 2015-03-10 | 10 percent owner |

| KSM | DWS Strategic Municipal Income Trust | 2015-03-10 | 10 percent owner |

| NZF | Nuveen Municipal Credit Income Fund | 2008-12-31 | 10 percent owner |

| 2016-02-23 | 10 percent owner | ||

| 2012-10-04 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2015-03-19 | 10 percent owner | ||

| 2012-05-15 | 10 percent owner | ||

| 2012-05-15 | 10 percent owner | ||

| 2011-12-22 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2019-06-19 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2019-06-19 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2019-06-19 | 10 percent owner | ||

| 2019-06-19 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2012-06-21 | 10 percent owner | ||

| 2018-07-10 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2011-12-22 | 10 percent owner | ||

| 2017-10-18 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2013-08-29 | 10 percent owner | ||

| 2015-06-25 | 10 percent owner | ||

| 2013-12-30 | 10 percent owner | ||

| 2013-12-30 | 10 percent owner | ||

| 2013-12-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2014-10-22 | 10 percent owner | ||

| 2012-12-18 | 10 percent owner | ||

| 2016-09-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2015-03-03 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2015-12-16 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2015-06-26 | 10 percent owner | ||

| 2015-02-11 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2009-01-30 | 10 percent owner | ||

| 2014-08-04 | 10 percent owner | ||

| 2014-07-25 | 10 percent owner | ||

| 2014-01-06 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2013-07-23 | director & 10 percent owner & See General Remarks. | ||

| 2012-12-24 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2012-01-13 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2012-01-12 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2012-01-10 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2011-12-19 | director & 10 percent owner | ||

| 2011-10-12 | 10 percent owner | ||

| 2011-10-12 | 10 percent owner | ||

| 2011-10-07 | 10 percent owner | ||

| 2011-06-29 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2010-06-08 | 10 percent owner | ||

| 2011-04-06 | 10 percent owner | ||

| 2011-04-05 | 10 percent owner | ||

| 2011-01-18 | other: See Footnote. | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2011-01-05 | 10 percent owner | ||

| 2009-01-30 | 10 percent owner | ||

| 2008-12-31 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2008-11-30 | 10 percent owner | ||

| 2007-10-12 | director | ||

| 2005-11-09 | director | ||

| 2004-10-26 | other: Parent of Advisor | ||

| 2004-04-21 | other: See General Remarks. | ||

| 2004-02-24 | other: Parent of Advisor | ||

| 2003-12-31 | 10 percent owner | ||

| 2003-12-01 | other: Parent of Advisor | ||

| 2003-09-05 | director | ||

| 2003-08-11 | director | ||

| 2003-08-04 | director | ||

| 2003-07-28 | other: Parent of Adviser | ||

| 2008-11-30 | 10 percent owner | ||

| 2013-07-23 | director & 10 percent owner & See General Remarks. | ||

| 2022-09-12 | 10 percent owner |

Citigroup Inc Latest Holdings Summary

Citigroup Inc currently owns a total of 110 stocks. Among these stocks, Citigroup Inc owns 99,900,670 shares of Molson Coors Beverage Co (TAP.A) as of October 21, 2003, with a value of $5.9 Billion and a weighting of 91.94%. Citigroup Inc owns 29,300,000 shares of Nuveen Dividend Advantage Muni Fund 2 (NXZ) as of July 31, 2014, with a value of $438 Million and a weighting of 6.87%. Citigroup Inc also owns 1,761,938 shares of Kemet Corp (KEM) as of August 11, 2003, with a value of $48 Million and a weighting of 0.75%. The other 107 stocks Consumer Portfolio Services Inc (CPSS) , Primerica Inc (PRI) , Sylvamo Corp (SLVM) , PIMCO High Income Fund (PHK) , Jones Energy Inc (JONEQ) , PIMCO Corporate & Income Strategy Fund (PCN) , Gabelli Dividend & Income Trust (GDV) , Western Asset Managed Municipals Fd Inc (MMU) , CBRE Clarion Global Real Estate Income Fund (IGR) , BLACKROCK MUNIYIELD QUALITY FUND III, INC. (MYI) , Nuveen Premium Income Municipal Fund II Inc. (NPM) , Nuveen Municipal Advantage Fund Inc. (NMA) , Gabelli Equity Trust Inc (GAB) , Alliancebernstein National Muni Inc Fd (AFB) , Blackrock Muniyield NY Quality FD, Inc (MYN) , Invesco Senior Income Trust (VVR) , Blackrock Municipal Income Quality Trust (BYM) , BLACKROCK MUNIYIELD CALIFORNIA QUALITY FUND, INC. (MCA) , Nuveen Quality Municipal Fund Common (NQI) , Alliance California Municipal Income Fund Inc (AKP) , Nuveen Credit Strategies Income Fund (JQC) , Blackrock Muni Enhanced Fund Inc (MEN) , Blackrock Muniyield Michigan Quality Fund Inc (MIY) , Kayne Anderson Energy Infrastructure Fund, Inc (KYN) , Nuveen Quality Preferred Income Fund (JTP) , Nuveen Preferred & Income Opportunities Fund (JPC) , Federated Premier Intmd Muni Income Fund (FPT) , Nuveen Maryland Quality Municipal Income Fund (NMY) , Blackrock Municipal Income Trust (BFK) , Invesco Dynamic Credit Opportunities Fund (VTA) , Blackrock Muniyield New Jersey Fund Inc (MYJ) , Blackrock Muniyield California Fund, Inc (MYC) , Nuveen Quality Municipal Income Fund (NAD) , Nuveen Preferred & Income Securities Fund (JPS) , Nuveen Floating Rate Income Fund (JFR) , Nuveen Premier Municipal Opportunity (NIF) , Advent Claymore Convertible Securities & Income Fu (AGC) , BlackRock MuniYield MI Qty II Common (MYM) , Nuveen Diversified Dividend & Income Fund (JDD) , Western Asset Corporate Loan Fund Inc (TLI) , Eaton Vance Floating-rate Income Trust (EFT) , Franklin Limited Duration Income Trust (FTF) , Blackrock Municipal Income Investment Quality Trus (BAF) , Blackrock Credit Allocation Income Trust (BTZ) , Western Asset Intermediate Muni Fd Inc (SBI) , Nuveen New York Quality Income Municipal Fund Inc. (NUN) , Blackrock Municipal Bond Trust (BBK) , Alliance New York Municipal Income Fund Inc. (AYN) , Pacholder High Yield Fund Inc (PHF) , Blackrock Muniyield Invstmt Fd (MYF) , Federated Hermes Premier Municipal Income Fund (FMN) , NIO Inc (NIO) , Blackrock Muniyield Pennsylvania Quality Fund (MPA) , Nuveen Floating Rate Income Opp Fd (JRO) , Saba Capital Income & Opportunities Fund (BRW) , Invesco Trust For Investment Grade New York Municipals (VTN) , Nuveen Quality Preferred Income Fund 3 (JHP) , Nuveen Pennsylvania Quality Municipal Income Fund (NQP) , NUVEEN CONNECTICUT QUALITY MUNICIPAL INCOME FUND (NTC) , EV Floating-Rate Income Plus Fund (EFF) , Nuveen MI Quality Income Muni Fund Inc (NUM) , Blackrock NJ Municipal Income Tr (BNJ) , Blackrock Municipal Inc Invstmt Tr (BBF) , MFS Municipal Income Trust (MFM) , Blackrock Maryland Municipal Bond Trust (BZM) , BlackRock Municipal Bond Inv Common (BIE) , Blackrock CA Muni Income Tr (BFZ) , Nuveen California Dividend Advantage Municipal Fun (NZH) , Mfs Investment Grade Municipal Trust (CXH) , VanEck Brazil Small-Cap ETF (BRF) , BlackRock New York Municipal Income Quality Trust (BSE) , Mfs High Income Municipal Trust (CXE) , Gabelli Multimedia Trust Inc (GGT) , Nuveen New York Premium Income (NNF) , Blackrock Strategic Municipal Trust (BSD) , MFS California Municipal Fund (CCA) , Nuveen CA Dividend Advantage Muni Fund 2 (NVX) , Nuveen Tax Advantaged Total Ret Strat Fd (JTA) , Nuveen Senior Income Fund (NSL) , Blackrock New York Municipal Bond Trust (BQH) , Nuveen New York Quality Municipal Income Fund (NAN) , BlackRock Massachusetts Tax-Exempt Trust (MHE) , Nuveen Ohio Dividend Advantage Municipal Fund (NXI) , NexGen Energy Ltd (NXE) , Mfs High Yield Municipal Trust (CMU) , Nuveen New Jersey Quality Municipal Income Fund (NXJ) , Eaton Vance CA Muni Income Trust (CEV) , Nuveen Arizona Dividend Advantage Municipal Fund (NFZ) , Nuveen Georgia Quality Municipal Income Fund (NKG) , Nuveen Arizona Quality Municipal Income Fund (NAZ) , Blackrock New Jersey Municipal Bond Tr (BLJ) , New Frontier Health Corp (NFH) , Nuveen Arizona Dividend Advantage Municipal Fund 2 (NKR) , Nuveen Ohio Dividend Advantage Municipal Fund 2 (NBJ) , Blackrock Virginia Municipal Bond Trust (BHV) , Eaton Vance Michigan Muni Income Trust (EMI) , PIMCO Municipal Income Fund III (PMX) , Nuveen Ohio Dividend Advantage Municipal Fund 3 (NVJ) , Nuveen California AMT-Free Quality Municipal Income Fund (NKX) , DWS Strategic Municipal Income Trust (KSM) , DWS Municipal Income Trust (KTF) , Invesco Advantage Municipal Income Trust II (VKI) , Intersil Corp (ISIL) , MainStay MacKay DefinedTerm Municipal Opportunities Fund (MMD) , Nuveen AMT-Free Municipal Income Fund (NEA) , Invesco California Value Municipal Income Trust (VCV) , Nuveen New York AMT-Free Quality Municipal Income Fund (NRK) have a combined weighting of 0.44% among all his current holdings.

Latest Holdings of Citigroup Inc

Holding Weightings of Citigroup Inc

Citigroup Inc Form 4 Trading Tracker

According to the SEC Form 4 filings, Citigroup Inc has made a total of 0 transactions in Molson Coors Beverage Co (TAP.A) over the past 5 years. The most-recent trade in Molson Coors Beverage Co is the sale of 12,000 shares on October 21, 2003, which brought Citigroup Inc around $97,500.

According to the SEC Form 4 filings, Citigroup Inc has made a total of 0 transactions in Nuveen Dividend Advantage Muni Fund 2 (NXZ) over the past 5 years. The most-recent trade in Nuveen Dividend Advantage Muni Fund 2 is the sale of 0 shares on July 31, 2014, which brought Citigroup Inc around $0.

According to the SEC Form 4 filings, Citigroup Inc has made a total of 0 transactions in Kemet Corp (KEM) over the past 5 years. The most-recent trade in Kemet Corp is the sale of 11,667 shares on August 11, 2003, which brought Citigroup Inc around $355,250.

More details on Citigroup Inc's insider transactions can be found in the Insider Trading History of Citigroup Inc table.Insider Trading History of Citigroup Inc

- 1

Citigroup Inc Trading Performance

GuruFocus tracks the stock performance after each of Citigroup Inc's buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Citigroup Inc is -0.57%. GuruFocus also compares Citigroup Inc's trading performance to market benchmark return within the same time period. The performance of stocks bought by Citigroup Inc within 3 months outperforms 0 times out of 1 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Citigroup Inc's insider trading performs compared to the benchmark.

Performance of Citigroup Inc

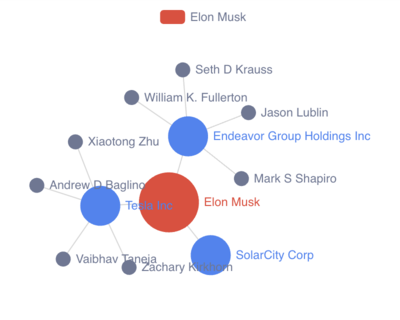

Citigroup Inc Ownership Network

Ownership Network List of Citigroup Inc

Ownership Network Relation of Citigroup Inc

Citigroup Inc Owned Company Details

What does DWS Municipal Income Trust do?

Who are the key executives at DWS Municipal Income Trust?

Citigroup Inc is the 10 percent owner of DWS Municipal Income Trust. Other key executives at DWS Municipal Income Trust include 10 percent owner Jpmorgan Chase Bank, National Association , other: Director of Investment Adviser George Catrambone , and AML Compliance Officer Christian Rijs .

DWS Municipal Income Trust (KTF) Insider Trades Summary

In summary, during the past 3 months, insiders sold 0 shares of DWS Municipal Income Trust (KTF) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of DWS Municipal Income Trust (KTF) were sold and 0 shares were bought by its insiders, resulting in a net sale of 0 shares.

DWS Municipal Income Trust (KTF)'s detailed insider trading history can be found in Insider Trading Tracker table.

DWS Municipal Income Trust Insider Transactions

Citigroup Inc Mailing Address

Above is the net worth, insider trading, and ownership report for Citigroup Inc. You might contact Citigroup Inc via mailing address: 388 Greenwich Street, New York Ny 10013.